PHOTO

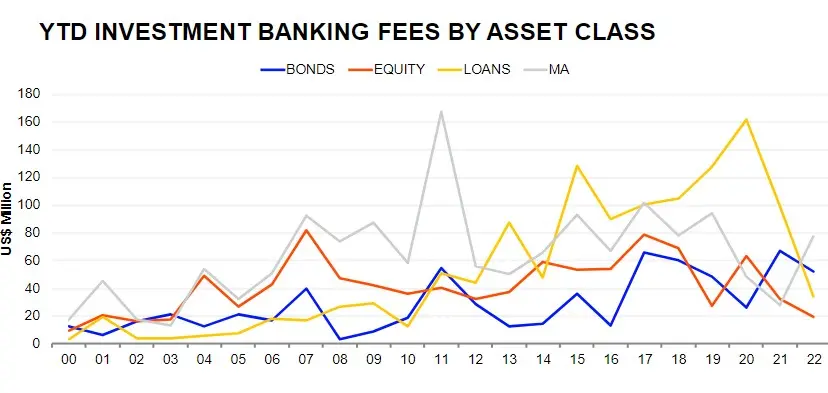

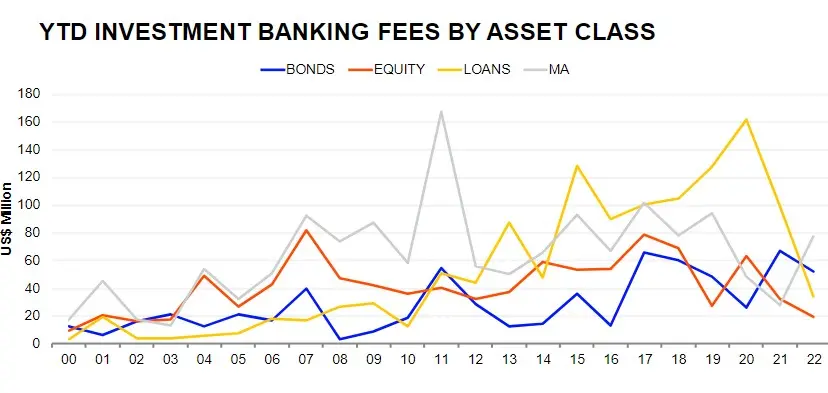

Investment banking fees worth an estimated $182.8 million were generated in sub-Saharan Africa during the first half of 2022, down 19% from the same period in 2021 and the lowest first half total since 2014, according to global data provider Refinitiv.

Equity capital markets underwriting fees declined 40% to $19.2 million, the lowest first half total in nineteen years. Also, debt capital markets fees declined 23% from last year’s record start to $52.0 million, while syndicated lending fees declined 66% to $33.9 million.

Advisory fees earned in the region from completed M&A transactions reached a three-year high of $77.7 million, an increase of 180% compared to the first six months of 2021.

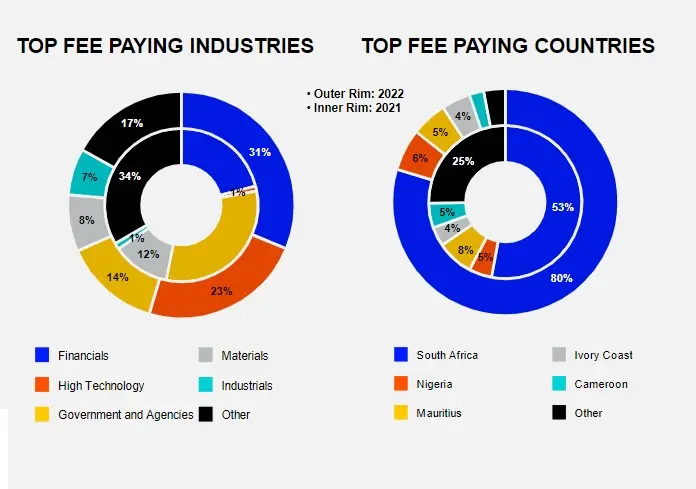

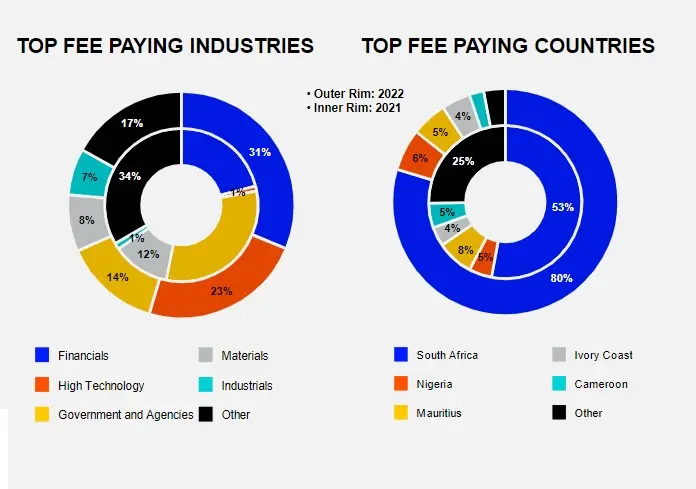

Eighty percent of all sub-Saharan African fees were generated in South Africa during the first half of 2022, and 31% were earned from deals in the financial sector.

Citi earned the most investment banking fees in the region during the first half of 2022, a total of $20.0 million or a 10.9% share of the total fee pool.

Mergers and acquisitions

The value of announced M&A transactions with any sub-Saharan African involvement reached $25.1 billion during H1 2022, 60% less than the value recorded during the same period in 2021, although higher than the value recorded during each of the previous 10 years, Refinitiv said.

Deals worth $14.6 billion involved a Sub-Saharan African target, 73% less than the value recorded during the first six months of 2021.

While domestic deals declined 83% from last year, inbound deals involving a non-sub-Saharan African acquirer increased 83% to $5.8 billion, the highest first half total in three years, the global data provider said.

Sub-Saharan African outbound M&A totalled $8.7 billion, 73% more than last year despite a 1% fall in the number of deals.

Healthcare was the most targeted sector by value in Sub-Saharan Africa during the first half of 2022, while the materials sector saw the highest number of deals in the region.

South Africa was the most targeted nation, with $9.2 billion in M&A announcements, equivalent to 63% of total activity recorded in the region.

With advisory work on deals worth a combined $9.2 billion, Scotiabank held the top spot in the financial advisor ranking for deals with any sub-Saharan African involvement during H1 2022.

(Writing by Seban Scaria; editing by Daniel Luiz)