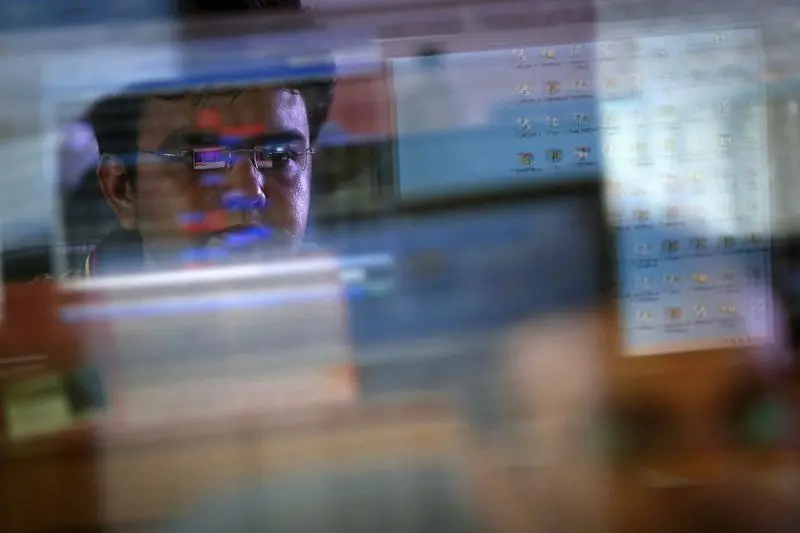

PHOTO

BENGALURU: Indian shares fell on Wednesday after hitting five-month highs for three sessions in a row, as caution set in ahead of the U.S. Congress's approval of the debt deal and fresh concerns about China's stuttering economic recovery weighed on the sentiment.

The blue-chip Nifty 50 index was down 0.45% at 18,550.75 as of 9:57 a.m. IST, while the benchmark S&P BSE Sensex lost 0.49% to 62,662.08.

Nine of the 13 major sectoral indexes logged losses, with the high-weightage financials falling 0.8%. India's largest state-owned lender State Bank of India Ltd lost over 2% on its record date for dividend.

Metal stocks lost over 1% after data showed contraction in China's manufacturing activity, raising concerns over recovery in the world's second-largest economy. China is the world's largest producer and consumer of metals.

"Investors are awaiting the U.S. debt agreement deal on Wednesday, as its outcome would determine the market direction in the near to medium term," said Shrikant Chouhan, head of equity research (retail) at Kotak Securities.

While the deal is expected to pass, uncertainty prevailed about whether the U.S. Congress will approve the deal after some Republican lawmakers vowed to stall it.

Investors also await India's gross domestic product (GDP) data for the quarter ending March 31. A Reuters poll of economists estimated the economy to have grown by 5%, accelerating from 4.5% in the previous quarter, aided by steady urban demand and government spending.

Among individual stocks, Tega Industries Ltd, Mazagon Dock Shipbuilders Ltd, Welspun Corp Ltd , Lemon Tree Hotels Ltd gained between 2.5% and 8% after reporting strong results in the fourth quarter.

($1 = 82.7159 Indian rupees) (Reporting by Bharath Rajeswaran in Bengaluru; Editing by Nivedita Bhattacharjee, Dhanya Ann Thoppil, and Janane Venkatraman)