PHOTO

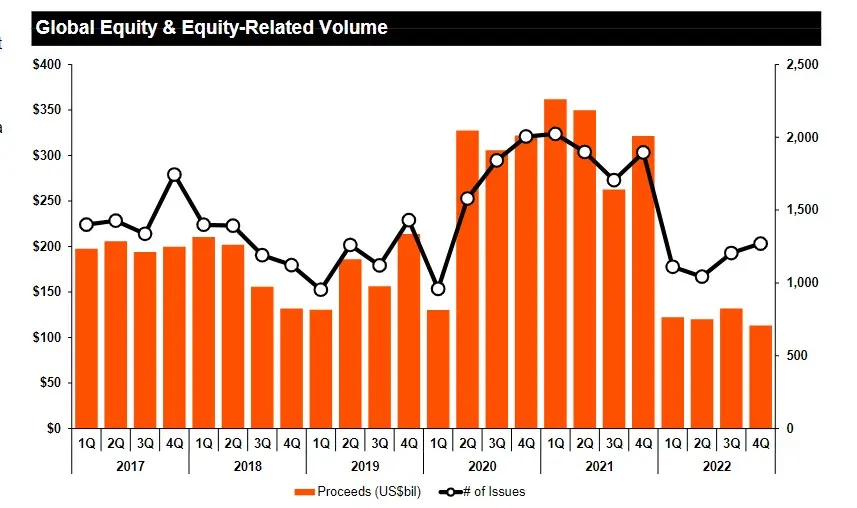

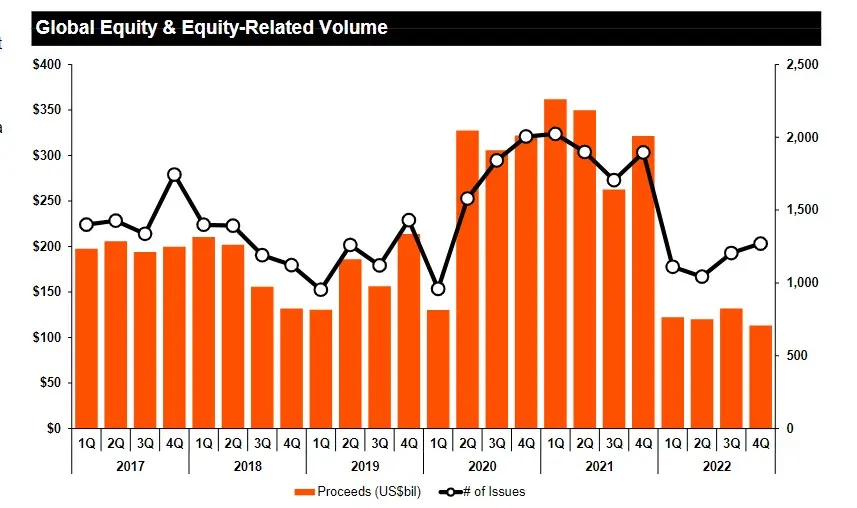

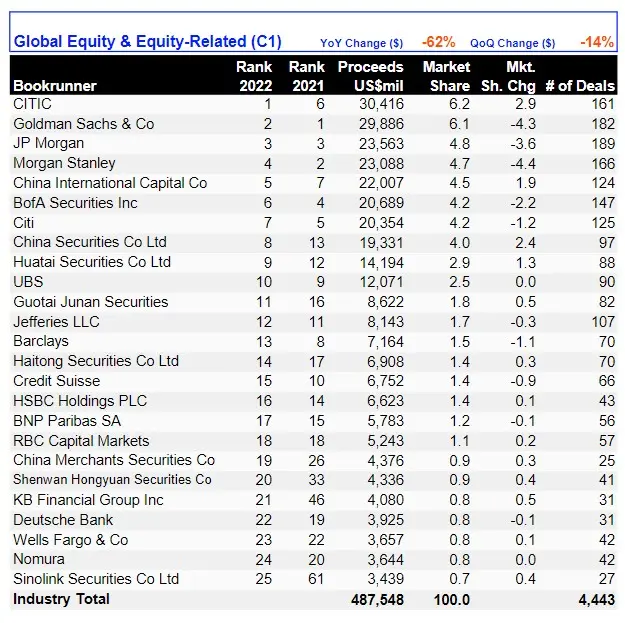

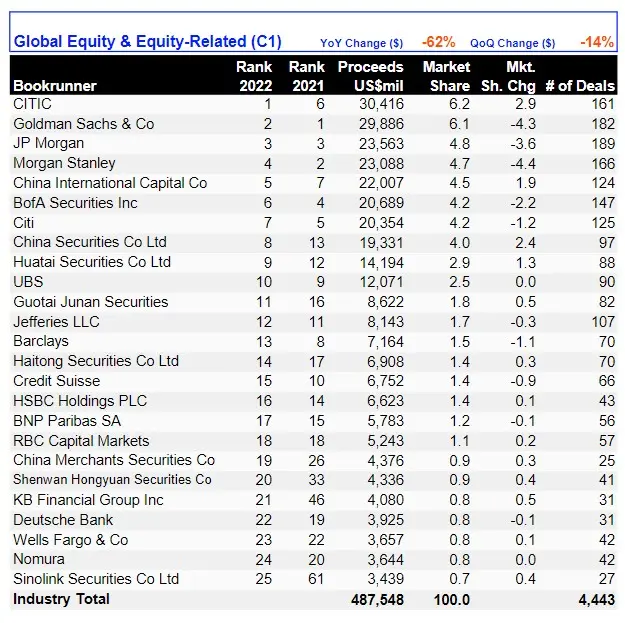

Global Equity Capital Market (ECM) activity totaled $487.5 billion during 2022, a 62% decrease compared to 2021 and the slowest annual period for global ECM activity since 2003, data from Refinitiv showed.

By number of issues, nearly 4,450 ECM offerings were brought to market during 2022, a 39% decrease compared to a year ago and a ten-year low.

Global capital raising during the fourth quarter of 2022 decreased 14% compared to the third quarter of this year, marking the slowest quarter for global ECM issuance since the fourth quarter of 2011, the global data platform revealed in its 2022 Q4 ECM review.

Top issuers

Issuers from China raised $186.7 billion in the global equity capital markets during 2022, a decrease of 43% compared with levels seen a year ago, but the largest percentage of global ECM during an annual period on record.

As a percentage of global ECM, the US accounted for 17% of overall issuance, with proceeds down 78% compared to full year 2021, Refinitiv said.

ECM offerings from issuers in Asia Pacific totaled $253.0 billion during full year 2022, a 46% decrease compared to 2021 levels.

ECM offerings from European issuers registered a 73% decrease compared to a year ago, reaching a 29-year low.

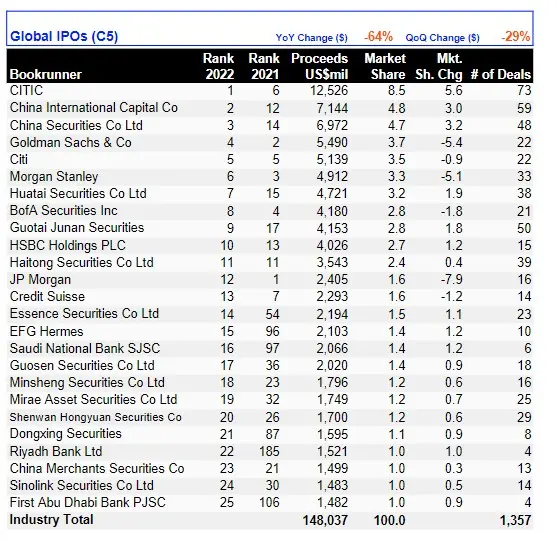

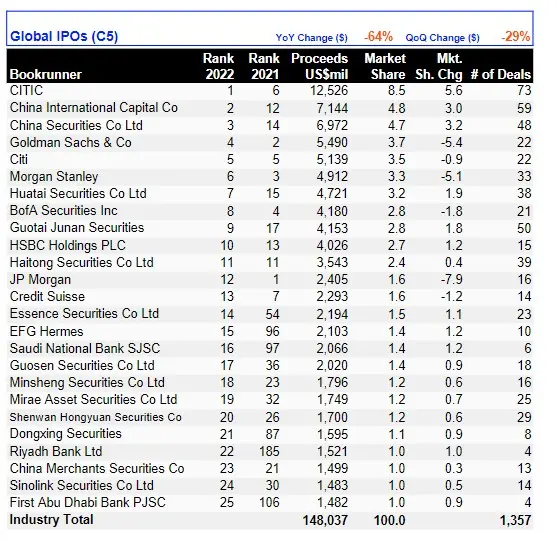

IPOs down 64%

Global IPOs, excluding SPACs, totaled $148.0 billion during full year 2022, a decrease of 64% compared to year ago levels and the slowest annual period for global IPOs since 2016.

Total proceeds for IPOs on US exchanges totaled $8 billion during 2022, a 95% decline compared to a year ago and the slowest full year period for new US listing since 1990.

China-domiciled IPOs totaled $71.1 billion during full year 2022, down 34% compared to 2021 levels, Refinitiv data showed.

(Writing by Seban Scaria seban.scaria@lseg.com; editing by Daniel Luiz)