PHOTO

Oil prices are surging due to the war in Ukraine and sanctions on Russia, but the 1970s energy crisis is not likely to happen again because the world now relies less on oil, according to the International Monetary Fund (IMF).

The Washington-based lender said that lower oil reliance can insulate the global economy from the major price breakouts that happened several decades ago. Between 1973 and 1974, crude prices rose nearly 300 percent due to geopolitical tensions, causing inflation to soar and economic growth to slow down.

“Memories of the high inflation and slow growth that followed – known as stagflation – have fuelled concerns about a possible repeat. [But] times have changed,” the IMF said in its latest blog.

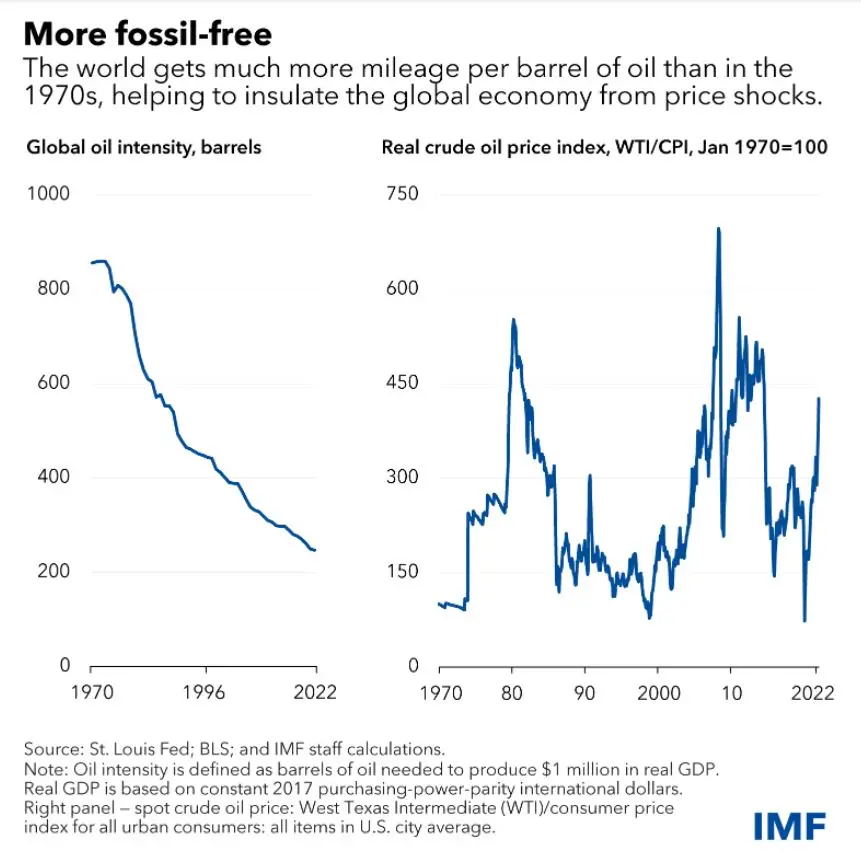

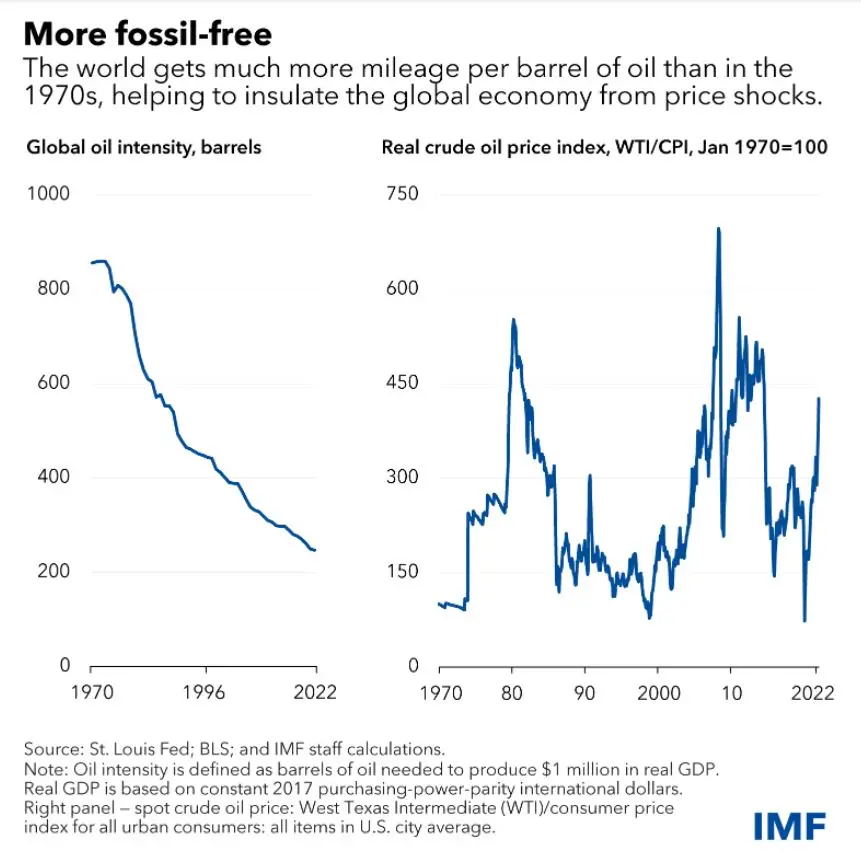

“The world [now] relies less on oil, easing any potential shocks. Economists track oil intensity by comparing how many barrels are needed to produce $1 million in gross domestic product, and this measure was about 3.5 times higher than current levels when crude prices almost tripled between August 1973 and January 1974,” the IMF said.

Brent crude climbed to $130 after Russia’s invasion of Ukraine, but the price has pared its gains following COVID-19 lockdowns in China, the biggest importer of oil in the world.

Other factors

Another factor that can help ease potential shocks, the IMF said, is the prevalence of wage-setting mechanisms that enable inflation-based automatic adjustments in workers’ salaries.

“Central banks, too, have changed since the 1970s. More are independent today, and the credibility of monetary policy has broadly strengthened over the intervening decades,” the IMF said.

(Reporting by Cleofe Maceda; editing by Seban Scaria)