PHOTO

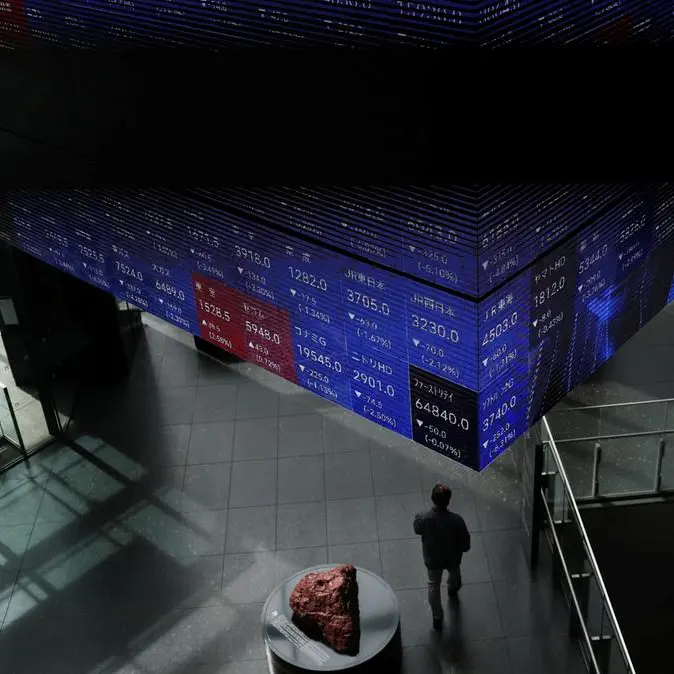

Stock markets in the United Arab Emirates closed lower on Friday in line with oil prices on signs the U.S. may engage in dialogue with Iran over its nuclear programme, reducing concerns of supply disruptions from a U.S. attack.

President Donald Trump said on Thursday he planned to speak with Iran, even as the U.S. dispatched another warship to the Middle East and Pentagon chief Pete Hegseth said the military would be ready to carry out whatever the president decided. Oil prices - a key contributor to the Gulf's financial market - declined 1% to $70.04 a barrel by 1107 GMT.

Abu Dhabi's benchmark index declined 0.8%, dragged down by a 5.5% slide in UAE's third largest lender Abu Dhabi Commercial Bank and a 1.6% fall in real estate giant Aldar Properties. Abu Dhabi Commercial Bank reported fourth-quarter net profit of AED 3.34 billion ($909.56 million) that fell short of market estimates of AED 3.55 billion with Q4 operating income falling 5% sequentially.

Separately, Abu Dhabi's newest sovereign wealth fund L'imad Holding is taking control of peer ADQ, the government media office said on Friday, a major consolidation that creates a new investment heavyweight in the wealthy emirate under its crown prince.

Dubai's main market settled 0.7% lower, with blue-chip developer Emaar Properties slipping 2% and Dubai Islamic Bank decreasing 2.3%. Dubai recorded 6.4% gains, its strongest monthly advance since July last year, while Abu Dhabi jumped 2.9% over the month, according to LSEG data.

- ABU DHABI fell 0.8% to 10,282 points

- DUBAI down 0.7% to 6,435 points

($1 = 3.6721 UAE dirham)

(Reporting by Mohd Edrees in Bengaluru; Editing by Shailesh Kuber)