PHOTO

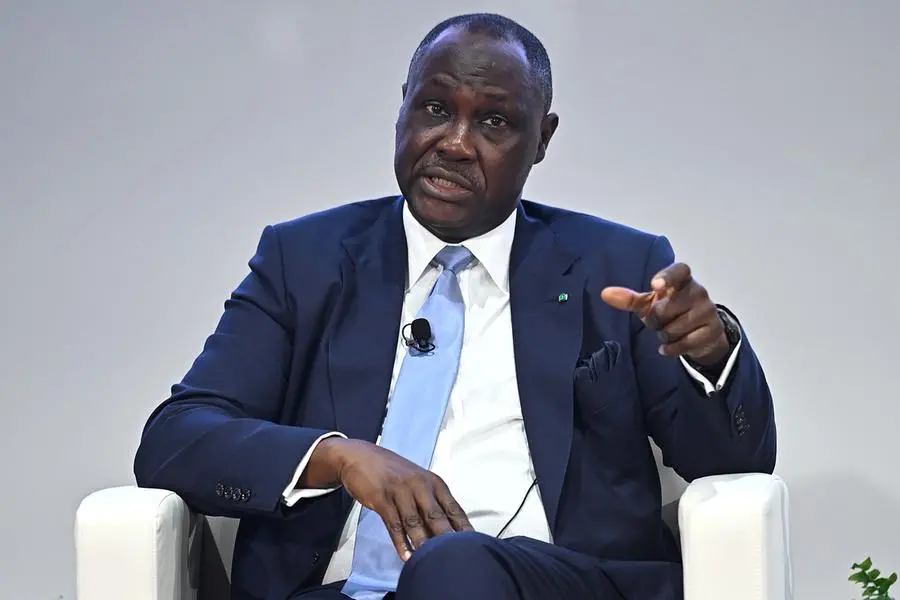

LONDON: The chief executive of Africa Finance Corp said its first credit rating from S&P Global would help it achieve lower borrowing costs and expand lending across the continent. Samaila Zubairu told Reuters that the 'A' rating assigned by S&P late on Wednesday to the multilateral development lender's long-term debt could support its push to boost homegrown financing across Africa as concessional lending and Western aid decline.

"This for us is validation of who we are that should translate into better market access," Zubairu said, adding that the rating puts the lender "firmly in the investment-grade pocket" for most investors.

"That should, over time reduce cost of funding for us and for our clients on the continent."

S&P cited the lender's "strong asset quality" and "very strong liquidity coverage". It also assigned an A-1 short-term credit rating and a positive outlook, suggesting upgrades are possible.

The infrastructure-focused lender already has an A3 rating from Moody's, an AAAspc rating from S&P Ratings (China) and an A+ rating from the Japan Credit Rating Agency.

Nigeria's Central Bank and Nigerian financial institutions represent roughly 75% of AFC's total shareholding. S&P said its positive outlook reflected expectations the lender would expand its sovereign shareholders. In contrast, fellow African lender Afreximbank was downgraded to "junk" by Fitch on Wednesday, shortly after it severed ties with the agency.

Zubairu said gold mining, critical minerals, renewable energy and fertiliser were the most in-demand projects and his bank was focused on being efficient and prudent. The closely watched Lobito Corridor, a U.S.-backed railway project funded by the AFC that will link copper fields in Zambia and cobalt mines in the Democratic Republic of the Congo to Angola's Atlantic Ocean Lobito port, was driving more interest in mining and agriculture in those countries, Zubairu said.

The AFC would continue to seek funding via international bond sales as well as by issuing sukuk, panda and samurai bonds, but Zubairu declined to comment further on fundraising plans.

The bank invested roughly $4 billion in projects last year and a "stronger pipeline" this year will see investments at or above 2025 levels. The AFC is also in talks for its first funding involving private credit lenders, who are increasingly seeking opportunities in developing nations as shrinking returns and defaults stalk developing world borrowers.

"We're looking at these opportunities, and hopefully there will be an announcement soon," Zubairu said.

(Reporting by Libby George; Editing by Kirsten Donovan)