PHOTO

• 71% of UAE residents will receive a company bonus during 2015

• 44% of expats relocated to the UAE to earn more money and a tax-free salary

• But only 44% of expats will fulfil their financial goals when they leave the UAE

Dubai - Those lucky enough to receive a company bonus may get excited at the prospect of a bumper pay packet during the 'bonus season' in March and April, but the reality is that the majority of people in the United Arab Emirates are using this extra cash to settle debt or pay bills.

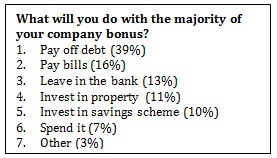

According to a survey for Zurich International Life by YouGov, 71% of UAE residents will receive a company bonus during 2015. However for 39% of bonus recipients, the primary use of their payment will be to settle debt with a further 16% using the bonus to pay bills, such as rent or school fees. Another 13% of respondents said they will leave their bonus in the bank, 11% will invest in property, 10% will invest in a savings scheme, while only 7% will spend the majority of their bonus.

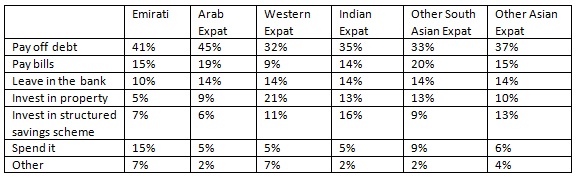

The survey of 1,000 UAE residents also found Arab expats are the most likely to use their bonus to settle debt (45%) or pay bills (19%), with Western expats the least likely to settle debt (32%) or pay bills (9%).

Emiratis are the most likely to spend their bonus (15%), while Indian expats are the most likely to invest it in a savings scheme (16%).

"The tendency to live a lavish lifestyle in the UAE means many residents need their bonus to pay off financial liabilities. This leads to a greater strain on their long-term savings," said Paul Dawson, Head of Retail Distribution at Zurich International Life. "Many expats look forward to tax-free bonuses when they move to the UAE with the intention to save and secure their financial future. They probably don't expect needing to use their bonus to clear debt accumulated during their stay."

He added: "Another concerning trend is the number of people leaving their bonus in the bank. With UAE inflation running at 4% and low bank deposit interest rates, the net effect of this investment strategy could be a loss in real terms. Try to maximize the returns from your hard-earned bonus."

Expats come to the UAE to earn more money, but many end up accumulating debt

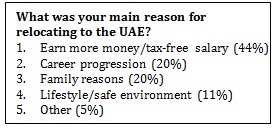

Zurich's survey also asked expat respondents for the main reason they moved to the UAE. It found 44% of expats relocated to earn more money and a tax-free salary; 20% came for career progression; and another 20% for family reasons, in most cases to stay with their spouse. Only 11% relocated to the UAE for its lifestyle and safe environment.

Despite money being a motivating factor for moving to the UAE, Zurich's survey found only 44% of expats believe they will fulfil their financial goals when they leave the country. In fact, 26% of expats do not set any financial goals for the duration of their stay.

"The majority of expats move to the UAE for better earning potential through increased salary, tax free income and career progression opportunities," explained Dawson.

"This represents a great opportunity to increase your savings and build a nest egg to secure your financial future when you return to your home country. Sadly, many expats are missing this opportunity by not setting or realizing their financial goals and return home with little more than a good sun tan."

Dawson added: "Sound financial management should go hand-in-hand with expat life. At Zurich we recommend expats regularly revisit their financial goals, budget carefully and speak to a financial adviser to understand the best way to save and invest their tax-free salaries and bonuses to help them achieve their financial objectives and life ambitions."

Bonuses are growing; most equate to one month's salary or less

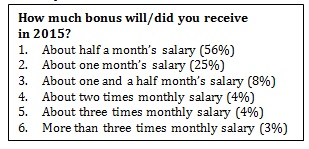

Zurich's survey also found the majority of company bonuses (81%) equated to one month's salary or less; while a lucky 7% received a bonus worth three times or more their monthly salary.

For 45% of respondents, the bonus in 2015 is higher than the payment in 2014; while 30% are receiving a lower bonus this year than previous.

-Ends-

Appendix

What will you do with the majority of your company bonus? (by nationality)

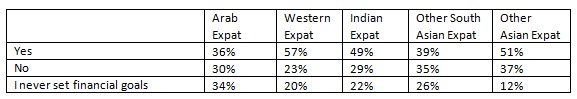

For Expats: When you leave the UAE, do you believe you will have met your financial goals?

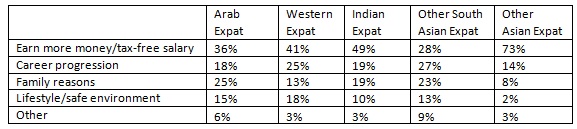

For expats: What was your main reason for relocating to the UAE?

About the Zurich Company Bonus and Savings survey:

Between March 15 - 22, 2015, 992 residents living in all seven Emirates of the UAE were surveyed online by YouGov. Respondents were asked about their company bonus and attitudes towards savings.

About Zurich Insurance Group:

Zurich Insurance Group (Zurich) is a leading multi-line insurer that serves its customers in global and local markets. With more than 55,000 employees, it provides a wide range of general insurance and life insurance products and services. Zurich's customers include individuals, small businesses, and mid-sized and large companies, including multinational corporations, in more than 170 countries. The Group is headquartered in Zurich, Switzerland, where it was founded in 1872. The holding company, Zurich Insurance Group Ltd (ZURN), is listed on the SIX Swiss Exchange and has a level I American Depositary Receipt (ZURVY) program, which is traded over-the-counter on OTCQX.

Further information about Zurich is available at www.zurich.com.

For further information, please contact:

Sean McAllister

Head of Communications, Middle East

Zurich Insurance Group

Direct: +971 4 455 7552

Mobile: +971 56 175 3640

Email: sean.mcallister@zurich.com

© Press Release 2015