PHOTO

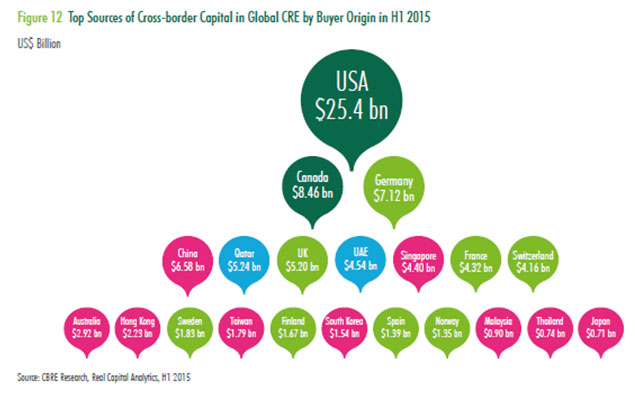

- Qatar takes 5th position globally as a top source of cross-border capital

-UAE stands at 7th position globally

Dubai: Global commercial real estate (CRE) investment reached US$407 billion in H1 2015, the strongest first half of a year since 2007, and up 14 per centyear-over-year, according to the latest research from global property advisor CBRE Group, Inc.

Although rapid growth has been maintained for several years, the rate of growth slowed in H1 2015and was vastly different at a regional and country level.The Americas experienced growth of 31 per cent year-over-year, while a strong dollar impacted activityin EMEA (Europe, Middle East & Africa) and Asia Pacific (APAC). In dollar terms, EMEA was up just 5 per cent from H1 2014, withAPAC down 19 per cent year-over-year. When measured in local currencyEMEA grew by 25%, while a decline in APAC was more muted at 9 per cent year-on-year.

Despite the low oil prices Middle Eastern purchasers remain very active, collectively investing US$ 11.5 billion outside their home markets in H1 2015.

US$ 5.24 billion and US$ 4.54 billion flowed out of Qatar and UAE respectively into direct real estate globally in H1 2015.While recent activity was boosted by a few large sovereign wealth fund deals, the investor base is growing and so is their investment strategy towards greater geographic and sector diversification, with activity spreading beyond gateway markets to second-tier locations in Europe and the Americas, and more recently towards core Asia Pacific.

"Data from H1 2015 shows a continuing acceleration in the flow of capital out of Middle East region by private offices and high-net-worth-individuals. This, to some extent, is compensating for a decline in sovereign wealth capital going overseas, naturally perhaps as a consequence of reduced revenue allocations because of recent oil repricing. The interest in overseas investments, particularly from the UAE, is also being influenced by some uncertainties in the local real estate markets," said Nick Maclean, Managing Director, CBRE Middle East.

"Capital flows into real estate are well supported. Even ignoring rental value growth, real estate offers a 'spread' over bond rates of between 200 to 300 bps across global markets and capital will continue to be attracted to the sector," said IrynaPylypchuk, Director, Global Research, CBRE. "The influx of new sources of capital targeting real estate as part of long-term liability-matching allocation strategies is helping to extend the investment cycle. At the same time, this pushes the 'old capital' into niche sectors, prompting expansion of the investment universe,"Pylypchukconcluded.

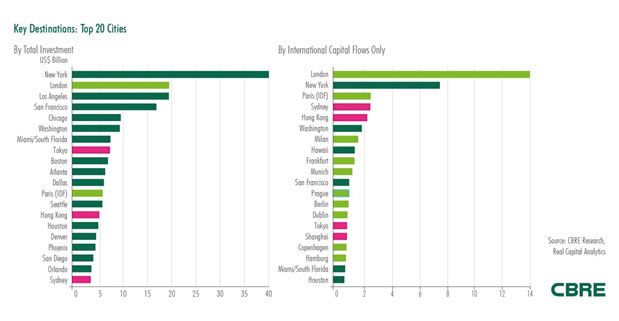

Cross-border investors have grown in influence to become an important driver of CRE investment globally, particularly in the last 24 months, and are changing the shape of the market. The world's leading destinations, in terms of global capital flows, is a balanced mix of cities across all main regions--London was the most targeted city by cross-border investors in H1 2015, followed by New York and Paris. This contrasts with the top destinations for overall investment where the bias is strongly on the U.S.--New York was the leading city overall, followed by London and Los Angeles.

At a regional level, the influence of global investors varies from as little as 10 per cent in the Americas,to almost 50 per cent of the market in EMEA. The largest contributor to these flows during H1 2015 was the U.S., accounting for a stand-out US$25.4 billion of investment outside its home market. The next three largest sources were Canada (US$ 8.5 billion), Germany (US$7.1 billion) and China (US$6.6 billion), with their combinedvolume still considerably less than the U.S.

"The influence of global capital is growing to the point that these investors are becoming the "market-maker" in setting the price in the most desired and liquid markets across the globe. Within this growing wave of cross-border capital, there are elements of old and new," said Chris Ludeman, Global President, Capital Markets, CBRE.

-Ends-

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world's largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 70,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 400 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.ae

Press Release 2015