JLL Issues Report at Cityscape Abu Dhabi

Abu Dhabi, 21 April 2015, JLL, the world's leading real estate investment and advisory firm, today has released its first quarter (Q1 2015) Abu Dhabi Real Estate Overview report that assesses the latest trends in the office, residential, retail and hospitality sectors. The report was released today at Cityscape Abu Dhabi, which is taking place from 21-23 April 2015. JLL is once again leading the Market Overview presentation and panel discussion on the opening day of Cityscape Abu Dhabi.

The first quarter of 2015 recorded further growth in the residential rental and hospitality sectors while the residential sales, retail and office sectors remained stable. Following the decline in oil prices, JLL expects there to be a reduction in government spending this year which will slow down the pace of demand growth - growth is expected to continue, but at a lower rate. On the other hand, the short-term supply picture is also relatively under control leading to generally stable market conditions.

David Dudley, Regional Director and Head of Abu Dhabi Office at JLL MENA, commented: "In the first quarter of 2015, the Abu Dhabi real estate market experienced strong growth in the hospitality sector and further growth of residential rents balanced by further stabilization in the office, residential sales and retail sectors. In contrast to the downward pressure we saw for the hospitality market in Dubai during the quarter, the Abu Dhabi hotel sector saw an increase in hotel ADRs for the first time since 2010 as demand outpaced supply expansion. The growth in hospitality demand is largely driven by a range of ongoing government initiatives to grow tourism demand - including the expansion of Etihad Airways and the Airport, further enhancement of Abu Dhabi's leisure offering, and campaigns by the Abu Dhabi Tourism & Culture Authority to promote Abu Dhabi regionally and globally."

He continued: "Residential demand remains dominated by residents who are interested in renting, rather than buying property. Rental growth for prime residential units continued at 4% during Q1, following 11% growth in 2014 and 17% in 2013, primarily due to limited quality supply across all price points and the removal of the rent cap. While average prime rents increased, the residential sales market remained stable this quarter, following 25% annual growth of prime residential prices over the past two years. The office market remained stable this past quarter, with demand remaining relatively flat and limited new supply entering the market. Overall vacancy rates for office space are expected to remain at this level throughout the year, given the significant proportion of near-term completions that are pre-committed."

He concluded: "Following a two year bull-run, we are currently going through a period of mid-cycle stabilization."

SECTOR SUMMARY HIGHLIGHTS - ABU DHABI:

Office: Total stock reached approximately 3.2 million sq m GLA in Q1, with the Finance House HQ at Capital Centre adding approximately 25,000 sq m GLA. An additional 359,000 sq m of office GLA is expected to be delivered throughout the year including Addax Tower on Reem Island, ADIB HQ on Airport Road and Al Hilal Bank HQ on Al Maryah Island. Average Grade A and B office rents remained stable this quarter at AED 1,730 per sq m and AED 1,180 per sq m respectively. With limited completions during Q1, the market-wide vacancy rate remained at 25%. The Minister of Economy announced that the UAE is at an advanced stage of drafting a foreign investment law allowing 100% foreign ownership of companies operating outside free zones. Mr. Dudley commented: "The new law is intended to support innovation and technology transfer through foreign direct investment in selected sectors. The extent to which the law will impact Abu Dhabi in the short term is yet to be determined."

Residential: Although no major deliveries took place during the first quarter of 2015, approximately 5,000 residential units are expected to enter the market by the end of 2015, dominated by the delivery of The Views (Saraya), Hydra Avenue and The Wave (Al Reem Island), C59 (Rawdhat) and Amwaj 2 (Al Raha Beach). Abu Dhabi's sales prices for residential units (apartments and villas) have remained stable during Q1 at approximately AED16,000 per sq m. Rents for prime 2 bedroom apartments continued to increase this quarter given the limited supply in the market registering a 4% increase to reach approximately AED 163,000 p.a. Mr. Dudley commented: "We expect there to be a reduction in government spending this year due to the recent decline in oil prices - which will slow down the annual demand growth rate. We expect this to be a slowdown in annual growth rather than the government putting the brakes on - employment creation and residential demand growth will continue to be sustained from projects commenced while oil prices were high. Given a current shortage of quality housing, we expect rental growth to continue, but at single-digit growth rates, rather than the double-digit rates we saw from 2013 to 2014. While the residential rental market is linked to the overall supply-demand balance, the sales market is driven more by sentiment and consequently is more sensitive to the recent decline in oil prices and equities markets. After two years of 25% annual growth, average prime residential prices have remained flat since Q4 2014 - principally due to the recent decline in oil prices, equities markets and investor sentiment."

Retail: Abu Dhabi's retail market remained largely stable during Q1. No major deliveries took place, keeping the total retail supply at 2.6 million sq m of retail GLA. About 87,000 sq m of retail GLA is expected to enter the market by the end of 2015, largely as non-mall retail within mixed-use developments. Average line store rents within well-located malls have remained stable at AED 3,000 per sq m p.a. (Abu Dhabi Island) and AED 1,860 per sq m p.a. (off Island). Vacancies remain minimal within established regional and super regional malls.

Mr. Dudley commented: "Retail growth has also remained stable, with no major supply completions in Q1 and limited completions scheduled for the rest of 2015 and 2016. Yas Mall, which has been well received by consumers and retailers, has completed its first full quarter of trading. A number of super regional malls are scheduled to enter the market from 2018 which will substantially increase Abu Dhabi's retail supply in the medium term. The future outlook for retail is positive as consumer demand continues to increase from population, employment and tourism growth."

Hotels: Despite the heavy competition in the market, ADR levels increased for the first time since 2010 to reach approximately USD 169, reflecting an increase of 12% in YT February 2015. Occupancy rates witnessed a far lower rate of growth, reaching 77% in the first two months of 2015, just one percentage point higher than 2014. The combined growth of improved ADR levels and occupancy rates pushed the RevPAR up by 14%, to reach approximately USD 132. Two major openings occurred during Q1 - Tryp by Wyndham (146 keys) and the Swiss-Belhotel Corniche (189 keys). Additionally, 500 keys were added to the serviced apartments sector with the opening of the Meera Time Residence in Saraya and Danat Residences in Danet Abu Dhabi. Mr. Dudley commented: "Over recent years, while there has been a steady increase in tourism arrivals, the positive increase in demand was largely offset by new supply coming through, impacting on performance. While we expect an additional 3,000 rooms to enter the market by the end of 2015, the pace of supply additions is now slowing down the extensive government initiatives to boost tourism numbers continue strongly. Occupancy rates have been increasing over recent years, now reaching 77%. This quarter, we also saw a positive increase to Average Daily Rates for the first time since 2010."

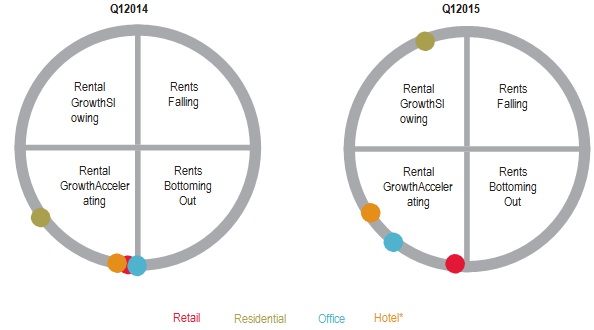

Abu Dhabi Prime Rental Clock

This diagram illustrates where JLL estimates each prime market is within its individual rental cycle at the end of the relevant quarter.

*Hotel clock reflects the movement of RevPAR.

Source: JLL

Contact:

David Dudley / Kathryn Athreya

Erica Pettit / Vadia Rai

Phone:+971 2 443 7772 /+971 4 426 6999

+971 4 437 2105 /+971 4 437 2110

Email:david.dudley@jll.com / Kathryn.athreya@jll.com

erica.pettit@fticonsulting.com / vadia.rai@fticonsulting.com

About JLL

JLL (NYSE: JLL) is a professional services and investment management firm offering specialized real estate services to clients seeking increased value by owning, occupying and investing in real estate. With annual fee revenue of $4.7 billion and gross revenue of $5.4 billion, JLL has more than 230 corporate offices, operates in 80 countries and has a global workforce of approximately 58,000. On behalf of its clients, the firm provides management and real estate outsourcing services for a property portfolio of 3.4 billion square feet, or 316 million square meters, and completed $118 billion in sales, acquisitions and finance transactions in 2014. Its investment management business, LaSalle Investment Management, has $53.6 billion of real estate assets under management. JLL is the brand name, and a registered trademark, of Jones Lang LaSalle Incorporated. For further information, visit www.jll.com.

About JLL MENA

Across the Middle East, North and Sub-Saharan Africa, JLL is a leading player in the real estate market and hospitality services market. The firm has worked in 40 Middle Eastern and African countries and has advised clients on more than US$ 1 trillion worth of real estate, hospitality and infrastructure developments. JLL employs over 200 internationally qualified professionals embracing 30 different nationalities across its offices in Dubai, Abu Dhabi, Riyadh, Jeddah and Cairo. Combined with the neighbouring offices in Casablanca, Istanbul and Johannesburg, the firm employs more than 550 professionals and provides comprehensive services in the wider Middle East and African (MEA) region. For information, please visit our website: www.jll-mena.com

Office No. 3, 7th Floor, Abu Dhabi Trade Centre Building│ PO Box 36788, Tourist Club Area │ Abu Dhabi UAE │ tel +971 2 443 7772

© Press Release 2015