PHOTO

- Occupancy costs in EMEA increased by 2.1% year-over-year

- Hong Kong (Central) climbed to the top of CBRE's semi-annual ranking of the world's most expensive office markets

- London-Central (West End), now ranked in second place

- Globally, prime office occupancy costs increased 2.4% in the year ending Q1 2016

Dubai - Dubai leads the office space market in the Middle East and is ranked 23rd globally according to CBRE Global Research and Consulting's Global Prime Office Occupancy Costs survey. The Dubai office occupancy ranking has dropped by 4 when compared to last year, translating to more affordable office rental space. Dubai's current prime office occupancy costs in Q1, 2016 AED is 280.00 sq. ft. p.a.

The study found that Abu Dhabi was ranked as one of the most expensive markets globally in Q3 2015 and has now dropped by 4 ranks according to the global report. Abu Dhabi's current prime office occupancy costs in Q1, 2016 is AED 1,800 sq. m. p.a.

Nick Maclean, Managing Director, CBRE Middle East, said, "We continue to see strong demand from international companies primarily seeking to improve the quality of accommodation and/or its efficiency. The latter point is particularly important for organisations whos staff are spread across several buildings.

Dubai's position as first choice for regional new entrants is very important. In addition to direct real estate considerations, the relative depth of the labor pool and the quality of the aviation transport sector are cited as important in corporate decision making.

Overall the market fundamentals in the commercial sector remains positive particularly for well-located buildings of good quality. Poorly located offices with indifferent facilities, particularly those which are badly managed, will struggle against more competitive new stock."

According to the CBRE research, Hong Kong (Central) scored the world's highest-priced office market and Asia continued to dominate the world's most expensive office locations. Shanghai (Pudong), China in 10th place and New York moved up to 9th place as the most expensive office market in the Americas, with a prime office occupancy cost of US$ 136.7 per sq ft.

Hong Kong's (Central) overall occupancy costs of US$290.21 per sq. ft. per year topped the "most expensive" list. London-Central (West End), United Kingdom followed with total occupancy costs of US$262.29 per sq. ft. Beijing (Finance Street) (US$188.07 per sq. ft.), Beijing (Central Business District (CBD)) (US$181.60per sq. ft.) and Hong Kong (West Kowloon) (US$179.49 per sq. ft.) rounded out the top five.

Global prime office occupancy costs increased 2.4% in the year ending Q1 2016 reflecting the same rate of growth stated in the previous survey. At the beginning of the year, the global stock markets were unstable, however the service sector was not adversely impacted. The study implies that the economic growth is expected to pick up in the coming quarters which will then translate into further occupancy cost increases.

22 markets have moved more than three ranks upwards and EMEA markets account for 36%. CBRE tracks occupancy costs for prime office space in 126 markets around the globe.

Europe Middle East & Africa (EMEA)

The study also found that occupancy costs in EMEA increased 2.1% year-over-year on an annual basis, on par with the 2.2% gain seen in Q3 2015. Dublin, Stockholm and Barcelona were the fastest- growing markets in the region. Most Central and Eastern European markets were down year-over-year, including Moscow, which is still in the midst of a recession. Costs accelerated quickly in South Africa, with Johannesburg, Cape Town and Durban all seeing increases of at least 6.9% from year-ago levels.

Office occupancy costs rose 2.7% year-over-year, up from 1.9% in Q3 2015. EMEA's 2.1% year-over-year growth rate in Q1 2016 was about the same as the 2.2% pace seen in Q3 2015.

These rates of occupancy cost growth may seem low compared to the higher pace of growth in some of the individual markets where demand for space is very high. However, it is important to keep in mind that inflation is low, so 2.4% represents real growth in office occupancy costs, and is significant for both office users and investors.

Asia Pacific

According to the CBRE research, Hong Kong (Central) climbed to the top of CBRE's semi-annual ranking of the world's most expensive office markets, displacing London-Central (West End), which dropped to second place.

In Asia Pacific, prime office occupancy costs, which reflect the highest-quality properties (typically the top 10% of Grade A stock) are growing at a faster pace than average Grade A rents, up 2.7% year-over-year compared to only 1.6% annual growth for Grade A rents.

Americas

Costs in the Americas rose 2.3% on an annual basis, with four markets--Monterrey, Atlanta (Downtown), Seattle (Downtown) and Atlanta (Suburban)--logging double-digit percentage gains year-over-year.

Globally, prime office occupancy costs increased 2.4% in the year ending Q1 2016, the same rate of growth reported in our prior survey. While the opening weeks of 2016 were turbulent times for global stock markets, the service sector, the principal occupier of prime office space, was not adversely impacted.

Top 10

Most Expensive Markets

(In US$ per sq. ft. per annum as of Q1 2016)

Largest Annual Changes

Occupancy Costs

(In local currency and measure - Prime office space occupancy costs in local currency and measure, ranked by 12-month % change increase as of Q1 2016)

Top 5 Increases

Top 5 Decreases

Fall in rank from Q3 2015

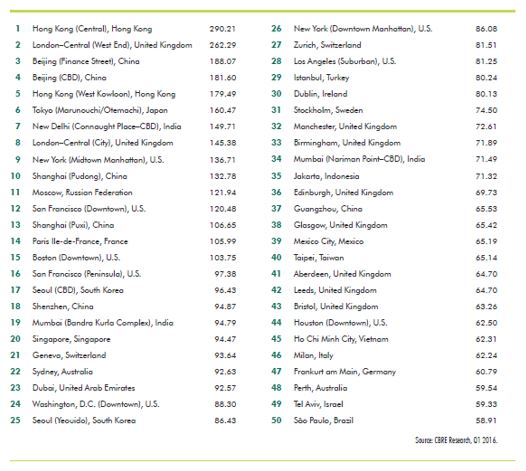

Note: The full Top 50 Most Expensive Markets chart is located at the end of this press release.

Top 50 Most Expensive Office Markets

(In US$ per sq. ft. per annum)

Source: CBRE Research, Q1 2016.

-Ends-

About CBRE Group, Inc.

CBRE Group, Inc. (NYSE:CBG), a Fortune 500 and S&P 500 company headquartered in Los Angeles, is the world's largest commercial real estate services and investment firm (in terms of 2014 revenue). The Company has more than 70,000 employees (excluding affiliates), and serves real estate owners, investors and occupiers through more than 400 offices (excluding affiliates) worldwide. CBRE offers strategic advice and execution for property sales and leasing; corporate services; property, facilities and project management; mortgage banking; appraisal and valuation; development services; investment management; and research and consulting. Please visit our website at www.cbre.ae

© Press Release 2016