PHOTO

The war with Islamic State is costing Arab economies around USD 1 trillion.

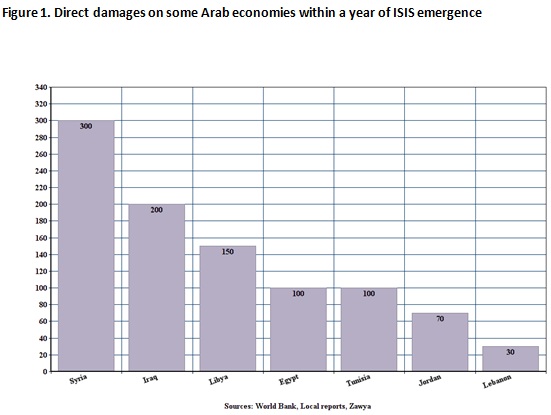

Arab economies have lost more than USD 1 trillion since Islamic State declared its caliphate in Iraq and Syria a year ago, with the Sunni Muslim militant group managing in that time to take control of a third of Iraq and more than half of all Syrian territory, according to figures compiled by TR Zawya.

Iraq and Syria have borne the brunt of direct war costs, but Islamic State fighters and supporters have also carried out attacks in Tunisia, Kuwait, Saudi Arabia, Egypt, Libya and Yemen, dampening investor confidence and undermining economic activity in several countries.

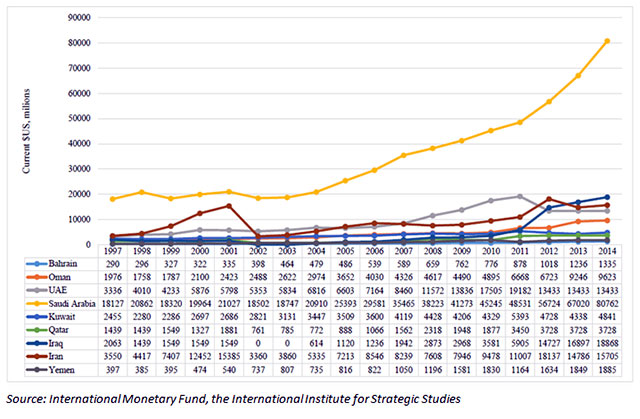

In addition, cross-border trade and investment in the region has been stifled, the influx of refugees has strained resources in several countries and military spending in several Gulf Arab states, including Saudi Arabia, Qatar and the United Arab Emirates, has surged at a time when state revenues have been hit by weaker crude oil prices.

Saudi Arabia and the UAE led military expenditures in the Middle East in 2014, according to a report by the International Institute for Strategic Studies issued in April. It said Saudi Arabia, the UAE, Oman and Qatar imported arms worth an estimated USD 109 billion last year, a 44% increase from 2012.

Saudi Arabia, which is also leading Arab airstrikes against Shi'ite Muslim rebels in neighboring Yemen, ranked fourth globally at USD 80 billion in expenditure

Volume of expenditure on military systems by Gulf Arab states (in USD billions)

IRAQ STRUGGLING

The rapid spread of Islamic State across Iraq and the large military expenditures to battle the Sunni Muslim militant group have hit the Iraqi economy hard.

The Economist Intelligence Unit (EIU) estimated that the rise of Islamic State led to a 3.2% contraction in Iraq's non-oil sector in 2014, offsetting 4.4% growth in oil production and resulting in zero growth overall. EIU forecasts growth of 1.8% in 2015.

Some Iraqi government reports put the country's direct losses from the battle against Islamic State militants at more than USD 200 billion in just one year.

Dhirgham Muhammad Ali, director of the Economic Media Center in Baghdad, said losses were incurred from attacks on infrastructure, energy facilities and the military. He said the oil sector has lost about USD 18 billion as a result of the decline in exports and damages to installations and facilities such as pipelines, especially in the Baiji refinery, and at oilfields.

A spokesman at the Ministry of Planning, Abdul-Zahra Al-Hindawi, said that while the government had allocated IQD 500 billion (USD 420 million) to repair war damages, the amount was not sufficient. He said Iraq would require around USD 25 billion to reconstruct Saladin, Diyala and Anbar.

"Projects completely stopped in 2015 because of ISIS control, in addition to the destruction of infrastructure, which incurred heavy losses on Iraq," he said.

Military spending has increased substantially and the cost of supporting around 3 million people who have been displaced is also a major burden to government finances at a time of low oil prices.

FOREIGN INVESTORS SHY AWAY

A report published by the World Bank last year said that cost of the Syrian war and spread of the Islamic State alone have been estimated at USD 35 billion in terms of lost output between mid-2011 and mid-2014. It said these conflicts had hurt the standard of living of living in neighboring countries dealing with the influx of refugees, with average-per-capita income in Lebanon declining 11% and in Jordan by 1.5%.

Izzat Abdullah, a professor of economics at Teeba Academy, said attacks by Islamic State fighters and other militant groups were scaring away foreign investment in the region, resulting in low production and high unemployment rates. He said economies directly exposed to militant attacks such as Egypt, Iraq, Syria, Yemen and Tunisia are suffering most.

Tunisia has said it expects to lose at least USD 515 million this year, or about a quarter of its estimated annual tourism earnings, after the attack by a gunman on a beach hotel last month that killed 39 people. The tourism sector makes up 7% of Tunisia's gross domestic product and is a major source of foreign currency and employment, according to a Reuters report.

In Egypt, militant attacks last year led to losses of around USD 100 billion due mainly to a decline in tourism and in the volume of foreign investments, said Alaa Rizq, president of the Strategic Forum for Development and Peace. Islamic State's Egypt affiliate, Sinai Province, has killed hundreds of soldiers and police since 2013, and the insurgency has spread out of the North Sinai area.

The regional conflicts, a sharp drop in oil prices and the slow pace of reform have all taken a toll on economic growth in the wider Middle East and North Africa region, which is expected to slow down in 2015 and range between 3.1-3.3% according to a recent World Bank report on the outlook for MENA

The report said unemployment in the region stands at 12% and that rising fiscal deficits would leave the region with a deficit of 8% of gross domestic product in 2015, after four years of surpluses.

Figure 1. Direct damages on some Arab economies within a year of ISIS emergence

(Additional reporting by Mohamed El Agamy in Egypt and Majda Mohsen in Iraq)

Mohamed Abdulzaher is Arabic editor at Zawya-Thomson Reuters. He can be reached by email at Mohamed.Abdulzaher@thomsonreuters.com.

Zawya 2015