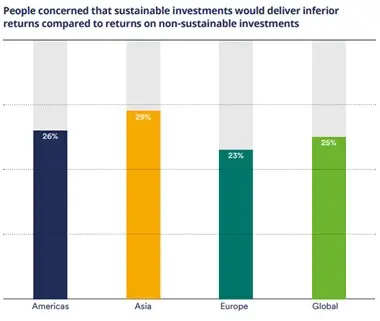

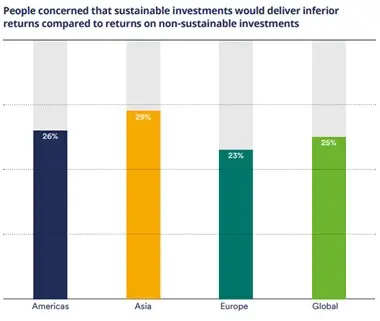

Only a quarter of people globally are concerned that investing sustainably would hinder investment outcomes, an indication that investors are increasingly convinced robust returns and a positive impact are not mutually exclusive.

The second part of Schroders Global Investor Study 2018 - which surveyed over 22,000 investors from 30 countries*, including the UAE - has identified that people who have reservations investing sustainably could be detrimental to long-term returns, are in the minority.

European and UAE investors are the least concerned globally with just 23% (in each region) worried investing sustainably would harm returns, with the greatest concern being among investors in Asia (29%). In particular, investors in China (39%), Indonesia (38%) and Thailand (34%) identified it as a barrier to investing sustainably.

The least concerned were investors in Japan (13%), Denmark (18%), France (19%), Belgium (19%), Germany (20%), Netherlands (21%), Austria (21%), Sweden (22%) and the UAE (22%).

The study confirmed that investing sustainably is a trend that continues to grow globally, with 64% of investors having increased their allocations over the past five years and 77% of UAE investors having done so.

This reflects the 76% of investors globally stating that investing sustainably has increased in importance to them over the same timeframe. In the UAE this trend is even higher with 86% reporting an increase in importance.

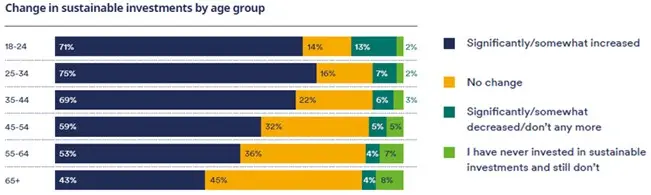

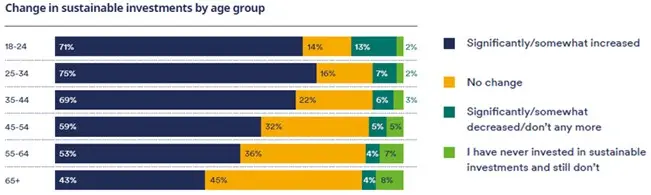

Specifically younger people – particularly the demographics which largely comprise of ‘Millennials’ – are more likely to have increased their exposures to sustainable investments over the last five years, with 71% of 18-24 year-olds and 75% of 25-34 year-olds having increased them.

This proportion consistently drops for older age groups, culminating in 43% of investors aged 65+ having done so.

Younger people also said they allocate a larger proportion of their portfolios towards sustainable investment funds with 18-24 year-olds investing 43% of their funds in this manner, compared with 33% for the portfolios of 45-54 year-olds.

Crucially, investors who consider themselves to have a higher investment knowledge are more likely to invest sustainably.

Globally, those that considered themselves to have ‘expert’ levels of knowledge said they invest 54% of their investment portfolio sustainably.

This compares with 33% for investors who class themselves as ‘beginners’, signalling that investor education could be key to creating a more sustainable financial system – a growing focus of policymakers globally.

More than half (57%) of investors globally said that a lack of information, advice or understanding prevented them from investing sustainably. This number is even higher in the UAE at 72%, more than any of the other countries

Jessica Ground, Global Head of Stewardship at Schroders, said:

“This survey underlines the rapid growth of interest in sustainable investing. The fact that 64% of investors have increased their allocation to sustainable investments in the past five years tells you how important this is for so many people.

“Specifically, it’s encouraging to see that investors no longer appear to be held back from investing sustainably by concerns that this approach may hamper returns.

“While the demographic differences were interesting, it was particularly interesting that knowledgeable investors were more likely to invest sustainably. This emphasises the work the industry still needs to do to educate all investors about the potential benefits of investing sustainably.

“Clearly, barriers still remain preventing investors from embracing this approach, highlighting that the availability, transparency and advice around these funds requires improving.”

Schroders strengthens Middle East business

Schroders today announces the appointment of Douglas Bourne as Client Director in the Middle East Sales team. In this newly created role, Douglas, who is based in Dubai and joined at the end of August, will be responsible for growing our institutional business in the region. His focus will primarily be on sovereign wealth funds and pension funds. He will report to Patrick Grant, Head of Middle East at Schroders.

Douglas brings a wealth of knowledge and experience to the role, having worked at BlackRock for ten years in a variety of Sales roles in the UK and Middle East across the intermediary and institutional spaces. Most recently he worked in their Middle East Institutional Sales team and was responsible for developing and maintaining institutional relationships in the region.

Patrick Grant, Head of Middle East at Schroders, said:

“I am delighted to announce that Douglas Bourne has recently joined the Middle East team to support me in the further growth of our institutional business in the region. He will be an important addition to the Dubai office and will work alongside Nisarg Trivedi, Sales Director, who oversees our intermediary business. Douglas joins the team at an exciting time of growth potential in the Middle East and his arrival significantly increases our distribution presence in the region.”

-Ends-

For further information, please contact:

Sophia Lerche-Thomsen

Tel: +971 50 384 2005

sophia.lerche-thomsen@schroders.com

For trade press only. To view the latest press releases from Schroders visit: http://ir.schroders.com/media

Schroders plc

As a global investment manager, we help institutions, intermediaries and individuals meet their goals, fulfil their ambitions, and prepare for the future. But as the world changes, so do our clients’ needs. That’s why we have a long history of adapting to suit the times and keeping our focus on what matters most to our clients.

Doing this takes experience and expertise. We bring together people and data to spot the trends that will shape the future. This provides a unique perspective which allows us to always invest with conviction. We are responsible for £449.4 billion (€508.2 billion/$593.3 billion)* of assets for our clients who trust us to deliver sustainable returns. We remain determined to build future prosperity for them, and for all of society. Today, we have 4,600 people across six continents who focus on doing just this.

We are a global business that’s managed locally. This allows us to always keep our clients’ needs at the heart of everything we do. For over 200 years and more than seven generations we’ve grown and developed our expertise in tandem with our clients’ needs and interests.

Further information about Schroders can be found at www.schroders.com .

Issued by Schroder Investment Management Limited. Registration No 1893220 England. Authorised and regulated by the Financial Conduct Authority. For regular updates by e-mail please register online at www.schroders.com for our alerting service.

*as at 30 June 2018

For the Schroders Global Investor Study 2018 full report ‘Is information the key to increasing sustainable investments?’ please visit www.schroders.com/gis

The first section of Schroders Global Investor Study, released in July, found that people globally were significantly underestimating the cost of living in retirement. It can be found here.

* In April 2018, Schroders commissioned Research Plus Ltd to conduct an independent online survey of over 22,000 people who invest from 30 countries around the globe. The countries included Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, the Netherlands, Spain, the UK and the US. This research defines “people” as those who will be investing at least €10,000 (or the equivalent) in the next 12 months and who have made changes to their investments within the last ten years

For further information, please contact:

Schroders

Andy Pearce, Institutional PR Manager:

Tel: 0207 658 2203/ andy.pearce@schroders.com

Sarah Deutscher, Senior International PR Manager:

Tel: 0207 658 6139/ sarah.deutscher@schroders.com

Estelle Bibby, Senior PR Manager:

Tel: 0207 658 3431/ estelle.bibby@schroders.com

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.