PHOTO

As oil prices surge to four-year highs, levels will still not be high enough for all six members of the Gulf Cooperation Council (GCC) as the fiscal breakeven point need varying widely from $47.10 to $113.

Fears of supply tightening as a result of sanctions set to be imposed on Iran by the United States from November has pushed prices to levels not seen since 2014, with Brent Crude hovering near $81.5 on Tuesday.

As a result, JP Morgan raised its Brent Crude forecast to $85 over the next six months in its latest note, up from a previous forecast in the low $60s. According to the bank, a spike of Brent to $90 is likely, the analysts said in a note.

The U.S. Energy Information Administration (EIA) increased the forecast price for the Brent spot price to $73 in 2018 and $74 in 2019 in the September 2018 update of its Short-Term Energy Outlook (STEO).

While governments in the region will welcome oil’s upward trajectory, it will still not be enough for all of them to adequately balance their budgets.

In its May regional outlook for the region the International Monetary Fund (IMF) calculated the breakeven point for each of the GCC countries, with Bahrain, Saudi Arabia, and Oman needing to hit $113, $87.9 and $77.1 respectively to stay in surplus, while the United Arab Emirates, Kuwait and Qatar only need $71.5, $48.1 and $47.1, respectively, to stay in the black.

“Oil prices are obviously an important ingredient for the regional macro and market landscape, particularly by providing governments with the ammunition to increase spending, which is the ultimate driver of economic activity in the GCC,” Jean-Paul Pigat, Head of Research at Lighthouse Research told Zawya by email on Tuesday.

“But as prices have risen this year thanks in large part to supply constraints, it could be argued that the traditional link between oil prices and business confidence has broken down a bit, since the job growth that has historically accompanied a bullish commodity cycle doesn’t seem to have materialised,” Pigat added.

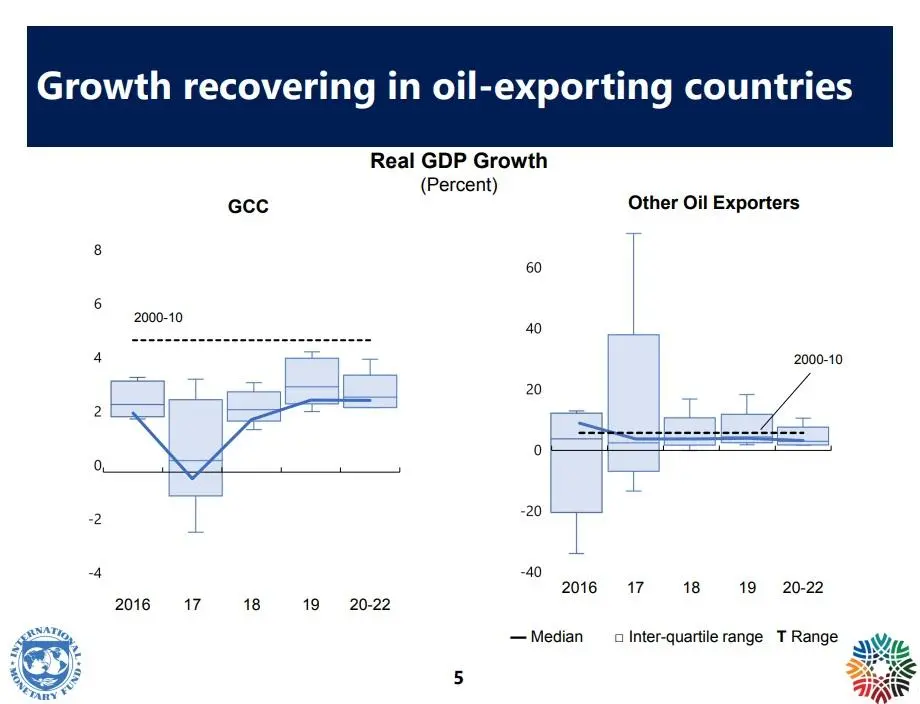

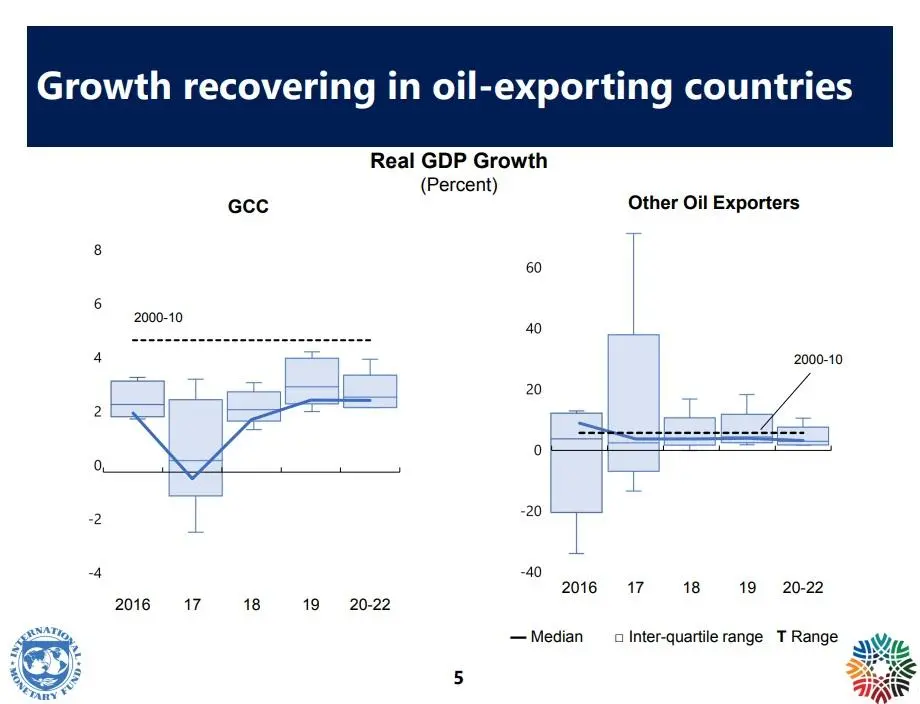

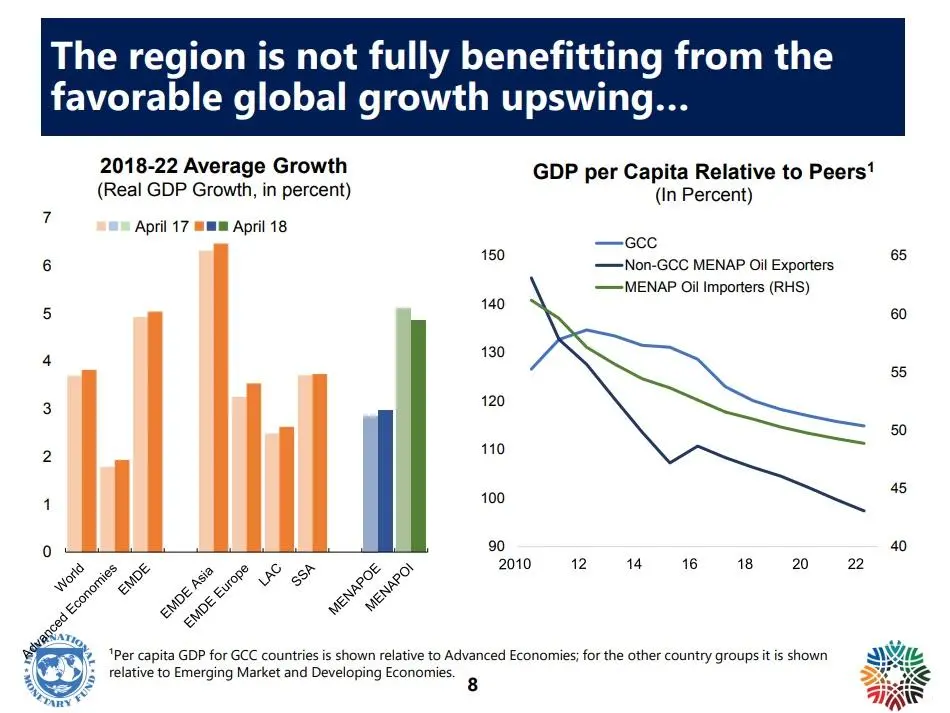

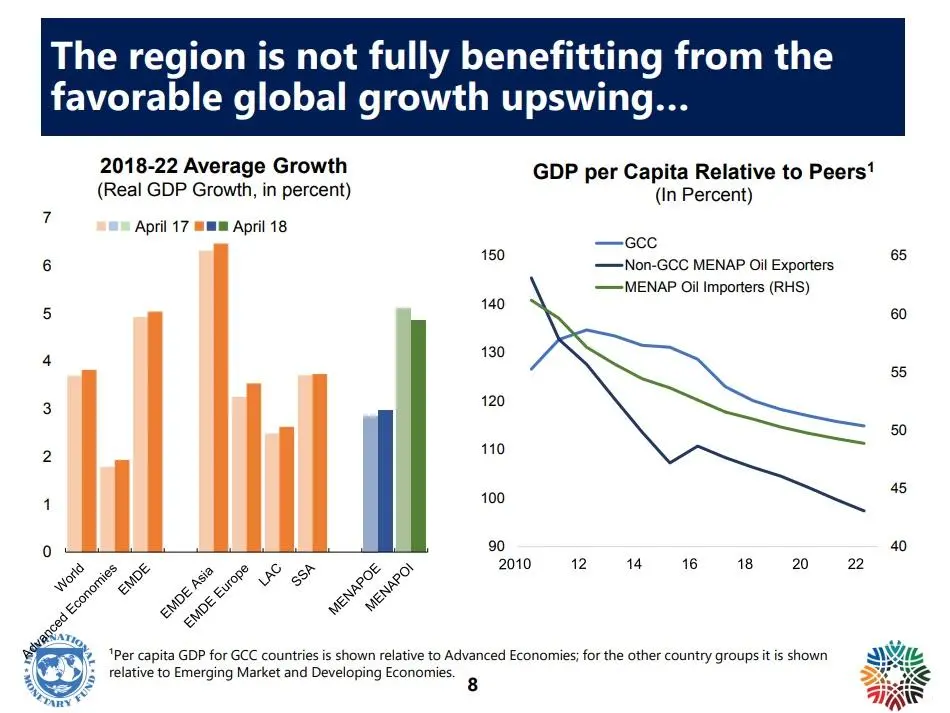

Real gross domestic product (GDP) growth in the Middle East and North Africa (MENA) is projected to strengthen further over the next few years, reaching levels of 3.2 percent in 2018 and 3.6 percent in 2019, according to the IMF’s May report.

In the GCC, overall GDP fell by 0.2 percent last year, with Saudi Arabia seeing its first economic contraction since 2009, according to the IMF report.

For 2018, the IMF projects real GDP growth for the UAE to be 2 percent, with Saudi Arabia at 1.7 percent, Bahrain at 3 percent, Kuwait at 1.3 percent, Qatar at 2.6 percent and Oman at 2.1 percent.

“The regional business cycle has troughed, and we’re starting to see an acceleration thanks largely to higher government spending. Growth in many markets in 2019 will, however, remain well below historical trend,” Pigat’s Lighthouse Research said.

“Looking ahead, I’m a bit more optimistic on the outlooks for Saudi Arabia and the UAE, but still quite cautious on Oman and Bahrain, as I think the latter will eventually be forced to rein in spending. Qatar’s non-oil economy has been outperforming in recent years, but a slowdown is likely ahead as the pipeline of construction projects related to the World Cup gradually dries up,” Pigat said.

For Egypt, the IMF projects real GDP growth at 5.2 percent for 2018, while Lebanon, Morocco and Tunisia are set to see 1.5 percent, 3.1 percent and 2.4 percent, respectively.

“Outside of the GCC it is unfortunately ‘more of the same’, in terms of weak growth and difficulties implementing reforms. Morocco is still a standout, while the outlook for Tunisia and Lebanon are more concerning,” Pigat added.

All graphs are taken from the IMF presentation

(Reporting by Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018