PHOTO

Dubai:

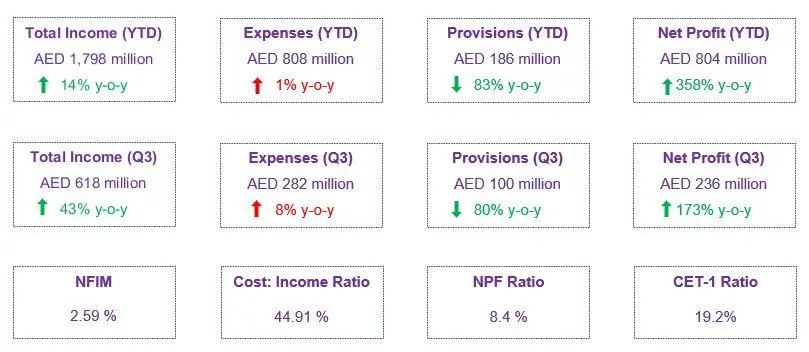

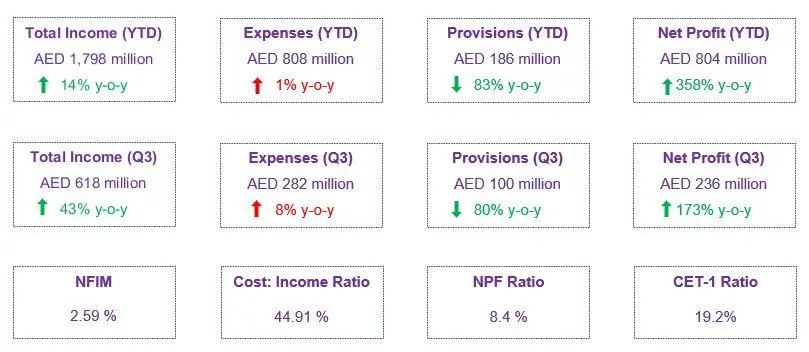

Emirates Islamic’s net profit jumped to AED 804 million for the first nine months of 2021 on higher non-funded income and a significant reduction in the cost of risk reflecting improved business sentiment.

Key Highlights – Q3 2021

- Strong operating performance on higher non-funded income coupled with reduction in cost of risk

- Total income up 14% y-o-y and 43% on Q3-20 driven by higher non funded income

- Expenses increased 1% y-o-y and 8% on Q3-20

- Impairment Allowances reduced 83% y-o-y with a lower cost of risk at 73 bps

- Operating profit improved 28% y-o-y and 94% on Q3-20

- Net profit increased to AED 804 million on the back of higher non-funded income and lower impairment allowances

- Net profit margin at 2.59% following stable profit rates in the first nine months of 2021

- Strong capital and liquidity combined with a healthy deposit mix enable the Bank to support customers

- Total assets remained robust at AED 66 billion maintaining a strong asset base

- Customer financing at AED 42.4 billion, increased 4% from 2020

- Customer deposits at AED 48.9 billion, increased 4% from 2020 with CASA balances at 76% of deposits

- Credit Quality: Non-performing financing ratio improved to 8.4% with strong coverage ratio at 108%

- Capital: Tier 1 ratio at 19.2% and Capital adequacy ratio at 20.3% reflect the strong capital position of the Bank

- Headline Financing to Deposit ratio at 87% remained within the management’s target range

Hesham Abdulla Al Qassim, Chairman said:

- “We are pleased to announce a strong set of financial results for the first nine months of 2021underlying the growing importance of Islamic banking.

- We aim to set new milestones in Islamic banking and support the Government's goal of making Dubai the global capital of the Islamic economy.

- As the UAE opens its doors to the world for Expo 2020 Dubai, we are proud to support the event as official Islamic Banking Partner. As the Islamic bank of choice in the UAE, Emirates Islamic sees this landmark event as an opportunity to accelerate the transformation of the world’s oldest and most relevant banking system and gain far greater reach for our industry's ethical values through digital innovation.”

Salah Mohammed Amin, Chief Executive Officer said:

- “Emirates Islamic’s net profits rebounded in the first nine months of 2021 at AED 804 million, driven by higher non-funded income coupled with lower impairment allowances.

- As a key contributor to the development of the overall Islamic finance sector, Emirates Islamic has asserted its position as a leading financial institution in the UAE, and this is reflected in our financial performance.

- In order to enhance the Expo 2020 Dubai experience, we are offering UAE residents an exclusive, limited-edition free-for-life co-branded Mastercard World Credit Card that rewards them with exclusive privileges during the iconic event. It offers exceptional value with a wide range of benefits across key Expo partners.

- Providing a superior banking experience to customers remains a key focus for us and we continue to strengthen our value proposition through best-in-class innovative digital-led offerings and investment in the latest technology.

- Time and again we have been recognized for our product and service innovations in the Islamic banking sector. As we remain committed to raising the profile of Islamic banking in the UAE, our strategic focus will remain on digital banking, driving a service culture and customer engagement.

Key Highlights

- Launch of Emirates Islamic branch at Expo 2020 Dubai

- Launch of Emirates Islamic Expo 2020 Dubai Mastercard Credit Card

- The Bank was proud to win the following global awards at the Wold Finance Islamic Finance Awards 2021:

- ‘Best Islamic Bank in Customer Experience, UAE’

- 'Best Credit Card in the UAE' award for Skywards Black Credit Card

About Emirates Islamic:

Emirates Islamic (DFM: EIB), part of Emirates NBD Group, is one of the fastest growing banks in the UAE. Established in 2004 as Emirates Islamic Bank, the bank has established itself as a major player in the highly competitive financial services sector in the UAE.

Emirates Islamic offers a comprehensive range of Shari’a-compliant products and services across the Personal, Business and Corporate banking spectrum with a network of 41 branches and 193 ATMs/CDMs across the UAE. In the fast-growing area of online and mobile banking, the bank is an innovator, being the first Islamic bank in the UAE to launch a mobile banking app and offer Apple Pay, as well as being the first Islamic bank in the world to launch Chat Banking services for customers via WhatsApp.

Emirates Islamic has consistently received local and international awards, in recognition of its strong record of performance and innovation in banking. The bank was named ‘Best Islamic Bank in Customer Experience, UAE, 2020’ at the World Finance Islamic Finance Awards 2021 and received the ‘Best Digital Innovation in Islamic Banking’ award at MEA Finance Banking Technology Summit & Awards, in recognition of its commitment to service excellence and digitisation.It was awarded 'Best Credit Card in the UAE' for its Skywards Black Credit Card and also received the 'Best Credit Card' award for its Emarati Visa Signature credit card at the 2021 International Finance Awards.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions. Emirates Islamic is the Official Banking Partner to Expo 2020 Dubai.

As part of its commitment to the UAE community, the Emirates Islamic Charity Fund provides financial aid to those in need, with a focus on food, shelter, health, education and social welfare contributions.

For further information please visit www.emiratesislamic.ae

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.