PHOTO

LONDON- World stocks tumbled for the fifth straight day on Wednesday, while safe-haven gold rose back towards seven-year highs and U.S. bond yields held near record lows after governments and health authorities warned of a possible coronavirus pandemic.

U.S. Treasury yields teetered near record lows hit the previous day, when Wall Street equity indexes slid more than 3% on news the coronavirus was continuing to spread and dozens of countries, from South Korea to Italy, had accelerated emergency measures.

Adding to alarm, the World Health Organization said the epidemic had peaked in China, but urged other countries to prepare for virus outbreaks. The U.S. Centers for Disease Control and Prevention also, in a change of tone, advised Americans to be ready for community spread of the virus.

The virus has claimed almost 3,000 lives in mainland China where drastic travel restrictions slammed the brakes on China's manufacturing and consumer spending, and there are worries other countries will face similar disruptions.

"China's template to contain the virus was to restrict economic activity and that's hitting home. Markets are fearing there will be sequential shutdowns of economic systems to stop the spread," Salman Ahmed, chief strategist at Lombard Odier, said.

Those fears of severe economic damage, even a recession, have sent MSCI's all-country equity index to 2-1/2-month lows, wiping almost $3 trillion off its value this week alone. chart

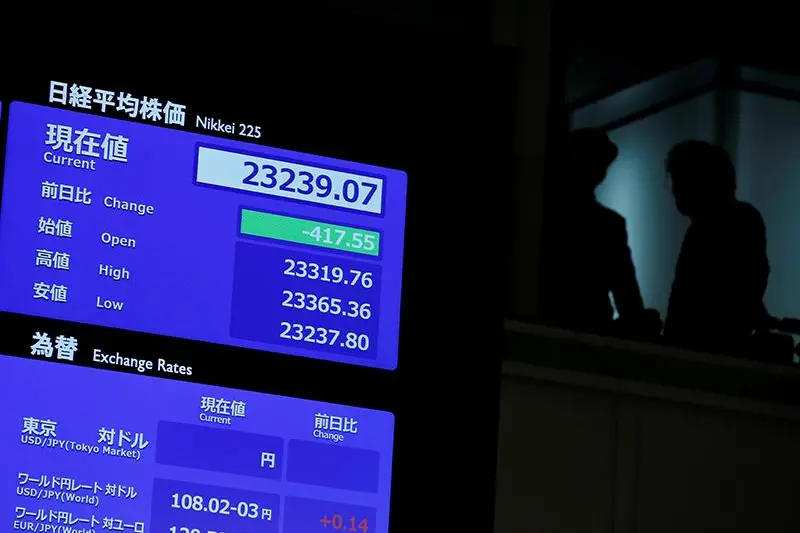

Asian shares excluding Japan fell 1% while Tokyo lost 0.8% on concerns the virus could force the cancellation of the Olympics scheduled for July. That weighed heavily on shares in companies such as Dentsu 4324.T that are heavily involved in the Games.

A pan-European equity index lost 1% and equity futures for Wall Street were down around 0.8% .

The economic growth worries are reflected in steep drop in bond yields - with 10-year U.S. yields down 60 basis points since the start of the year.

Ten- and 30-year U.S. Treasury yields teetered just off record lows and another safe-haven, German bonds also saw 10-year yields tumble to four-month lows below -0.5% .

Analysts note growing bets on interest rate cuts - expectations that monetary policy would be deployed yet again to head off any downturn.

Money markets now price roughly two 25-basis-point rate cuts by the Federal Reserve and expect a 10 bps cut by the European Central Bank by December. A Bank of England rate cut is also fully priced for September.

"Part of this selloff is a cry for help," Ahmed said but he said Fed cuts were unlikely in the early part of the year unless "we get an Italy-like situation in the United States."

The rate cut expectations weighed on the dollar while continued to pullback against the yen from recent 10-month high of 112.23 yen. It traded around 110 yen.

The greenback also came off an almost three-year high against the euro, reached on Feb. 20 while it remained flat to a basket of .

But some reckon the greenback slump may not last, given the Fed's warines of rushing into rate cuts.

"The significant dovish tilt being priced in by markets from the Fed may not materalise and that might cause the next leg of the dollar rally," said Peter Chatwell, head of multi-asset strategy at Mizuho.

The dash for safety also boosted gold 1% to around $1,650 per ounce, heading back towards seven-year highs of 1,688.66 hit on Monday.

Brent crude futures fell 1% to $53.95 per barrel.

(Additional reporting by Stanley White in Tokyo and Saikat Chatterjee in London) ((sujata.rao@tr.com; +44 207 542 6176))

((To read Reuters Markets and Finance news, click on https://www.reuters.com/finance/markets))