PHOTO

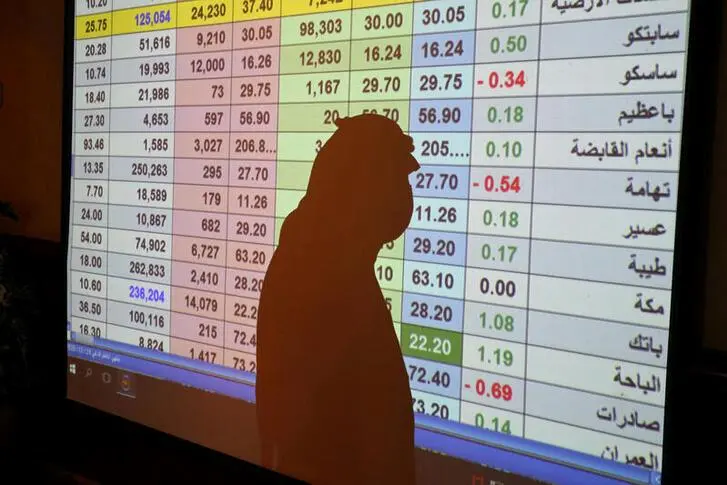

Most major Gulf markets rose in early trade on Sunday, with Saudi shares leading gains as material and financial stocks offered a boost against a background of rising oil prices.

Oil prices rose for a third week in a row to a near three-year high on Friday as global output disruptions force energy companies to pull large amounts of crude out of inventories.

Brent futures settled at $78.09 a barrel on Friday.

Saudi Arabia's benchmark index was trading 0.7% higher after four consecutive days of declines.

Market Heavyweight Al Rajhi Bank was up 0.7% while chemical makers Sahara International Petrochemical and Saudi Basic Industries advanced 3.6% and 0.8% respectively.

The Dubai index was up 0.3% with financial stocks giving the most support as Dubai Islamic Bank gained 0.6%.

Amanat Holdings jumped as much as 4.6% before steadying around 2.8% higher. The integrated healthcare and education investment company said it's Saudi fund sold a minority stake in International Medical Centre, resulting in a net gain of about 40 million dirhams.

Abu Dhabi's index edged down 0.1%. First Abu Dhabi Bank eased 0.5% and Emirates Telecommunications Group lost 0.2%.

Losses were offset by Alphadhabi Holding and Dana Gas, which gained 0.6% and 2.8% respectively.

The United Arab Emirates central bank (CBUAE) said on Thursday it was starting to gradually withdraw stimulus measures introduced last year to mitigate the economic impact of the COVID-19 pandemic.

The central bank, however, said it will leave unchanged temporarily lowered reserve requirements for banks.

The Qatari index was up 0.4%. Industrial and financial shares supported the index the most with Industries Qatar up 2.3% and Commercial Bank adding 0.5%.

(Reporting by Maqsood Alam in Bengaluru; Editing by Kirsten Donovan) ((Maqsood.Alam@thomsonreuters.com;))