PHOTO

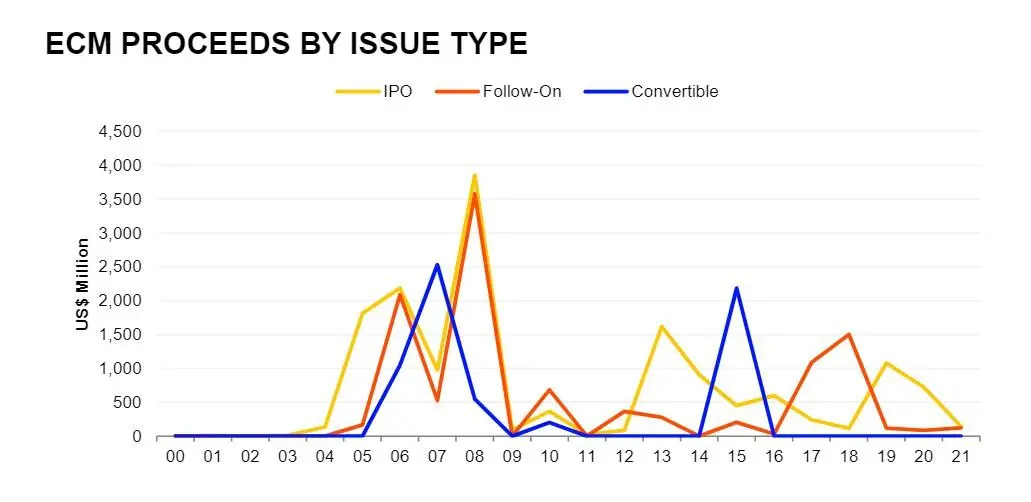

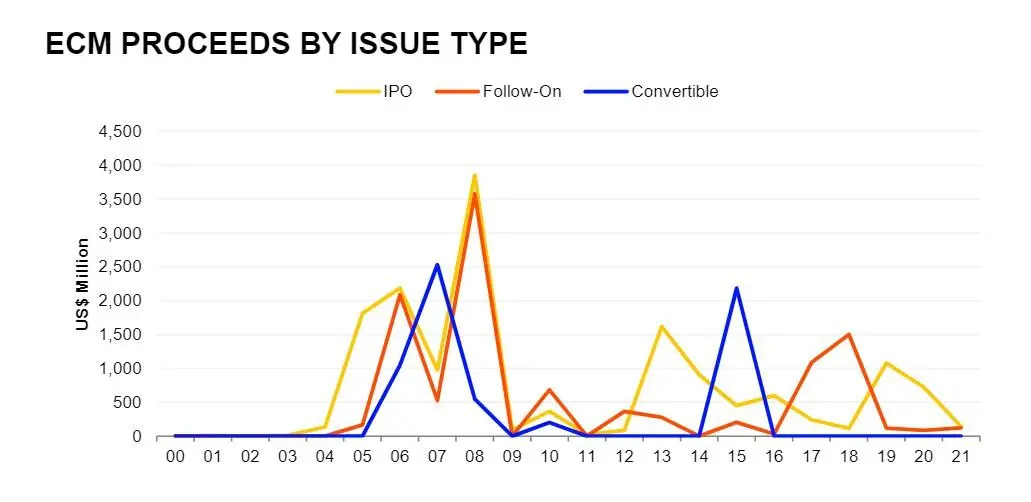

Equity and equity-related issuance in the MENA region totaled $267.7 million during the first quarter of 2021, a 67 percent decline in proceeds from 2020 and the lowest start to the year since 2011, according to global data provider Refinitiv.

Equity capital markets underwriting fees fell by more than half compared to 2020, to $7 million, the lowest total since 2011.

Of the equity issuance in 2021 so far, $124.7 million was raised through follow-on offerings, which equate to 46 percent of equity issuance in 2021 so far.

Alkhorayef Water & Power Tech’s offering in early March on Saudi Tadawul raised $144 million and that was the only IPO recorded in Q1.

According to Junaid Ansari, Senior Vice President of Investment Strategy and Research, the market is treading cautiously as the enthusiasm surrounding FY-2020 earnings and dividends is already factored in the prices.

“Now all eyes are on Q1 earnings that would set expectations for the rest of the year and would determine investor’s appetite for new offerings,” he told Zawya.

There was expectation that the scene would perk up in the second quarter, when logistics firm Tristar announced plans for an IPO, one that would have been the biggest on the Dubai bourse since Emaar Development offering in 2017.

MENA equity capital market activity plunges in Q1

However, Tristar dropped those plans early in April saying its board and shareholders believed greater returns could be realised without an IPO. A Reuters report cited sources as saying that deal did not attract enough investor demand.

Nevertheless, Ansari is optimistic.

“We see Tristar as an exception and believe that the year should be broadly positive y-o-y for IPOs given the pending issuances of last year as well as the ones that are eyeing opportunities in specific sectors in the near term,” he said.

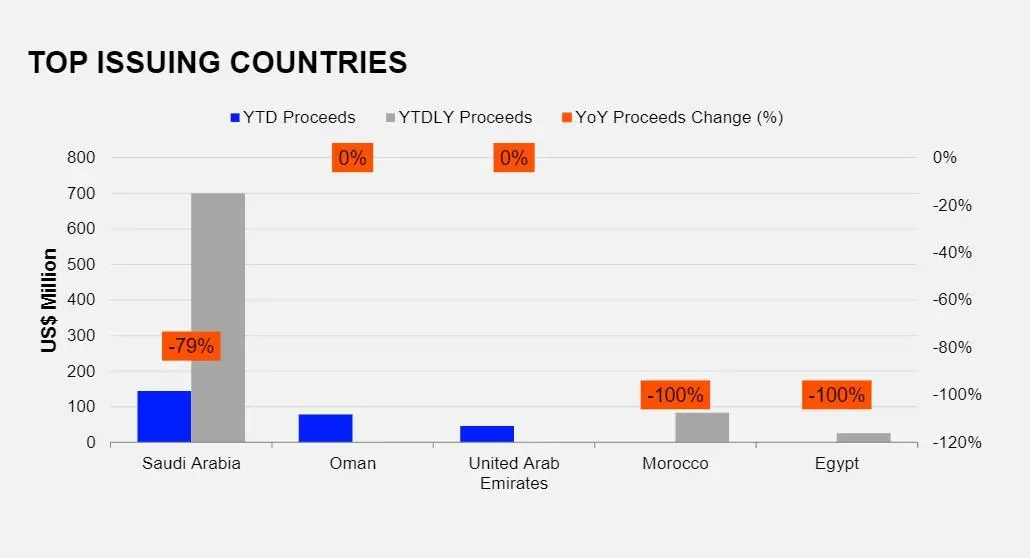

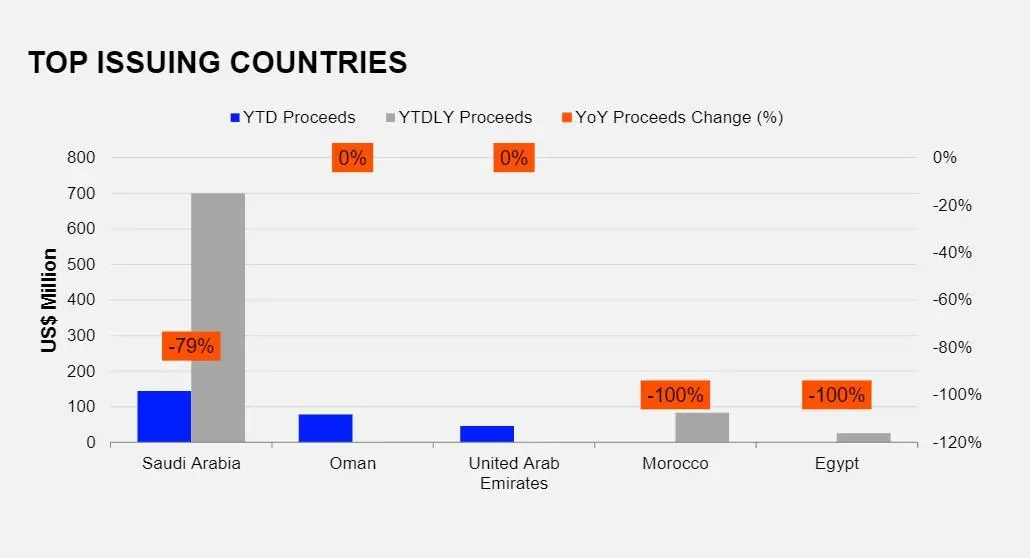

According to Refinitiv, Saudi Arabia was the top issuing country in the region followed by Oman and the UAE.

Meanwhile on the earnings front, Oman-based investment firm, Ubhar Capital, took first place in the MENA Equity Capital Market (ECM) league table during the first quarter of 2021, with proceeds of $78.7 million.

Egypt’s EFG Hermes and Saudi Arabia’s Banque Saudi Fransi, which were the bookrunner and manager of the Alkhorayef IPO, were in joint second place with $72 million each.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021