PHOTO

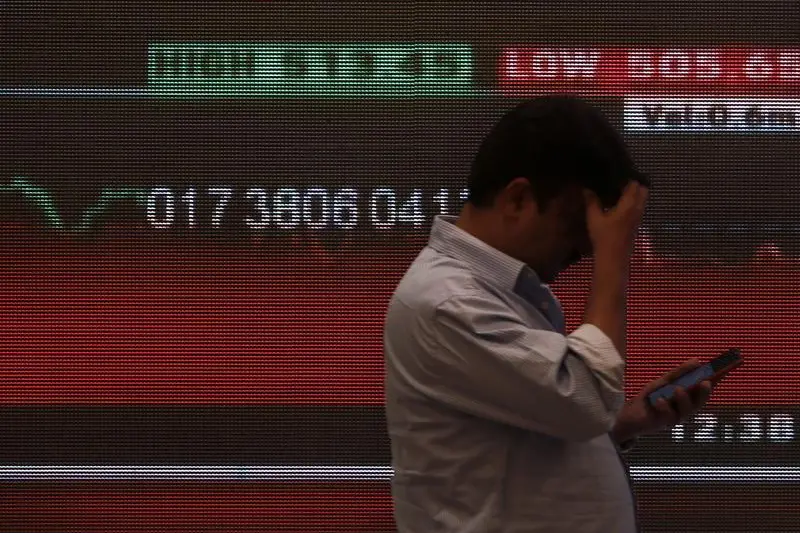

BENGALURU/MUMBAI - Indian bond yields rose sharply on Tuesday, while shares were little changed as hopes of a rate cut in February dimmed after data showed a higher-than-expected surge in inflation.

India's annual retail inflation rose to 7.35% in December, its highest level in more than five years and well above the Reuters poll of a 6.2% rise.

The benchmark 10-year bond yield was up 7 basis points at 6.68% by 0430 GMT, after rising to 6.7% earlier and compared with its Monday's close of 6.60%.

"Market expects that we have seen the top on inflation and it will come off from these levels. RBI too is likely to wait for 2-3 prints to see how it is panning," the head of debt trading at a private bank said.

The 10-year yield is expected to be capped at 6.75% levels in the near term, the banker added.

The rise in inflation in December was mainly driven by food prices and market participants expect the central bank to look through these temporary blips and remain accommodative in its stance but rate cuts bets for February are not off the table.

However, investors remain hopeful of a possible rate cut in April after the union budget on Feb. 1 and as inflation starts to moderate as per the central bank's projections.

The NSE Nifty 50 index climbed 0.060%% to 12,336.90 by 0414 GMT, while the benchmark S&P BSE Sensex was flat at 41,856.55.

The partially convertible rupee was at 70.86 per dollar, compared with its previous close of 70.96.

The rate cut expectations from central bank has come down, said Vinod Nair, head of research at Geojit Financial Services.

Vedanta Ltd rose 2.8% and was the biggest gainer on the Nifty, while Yes Bank Ltd was the top loser, falling 4.75%.

IndusInd Bank Ltd and Wipro Ltd shares rose 0.09% and 0.73% ahead of their quarterly results due later in the day.

China would no longer be designated as a currency manipulator, the U.S. Treasury Department said on Monday ahead of Wednesday's signing of the Phase 1 trade agreement, a development closely tracked by markets worldwide.

MSCI's world shares gauge hit a fresh all time high, while MSCI's broadest index of Asia-Pacific shares outside Japan drifted higher.

(Reporting by Philip George in Bengaluru and Swati Bhat in Mumbai) ((P.George@thomsonreuters.com; within U.S. +1 646 223 8780, outside U.S. +91 80 6749 1609; Reuters Messaging: p.george@thomsonreuters.net))