The COVID-19 pandemic has set in motion the largest decline in global energy investment in history, with spending expected to plunge in every major sector this year, the International Energy Agency (IEA) said in a report on Wednesday.

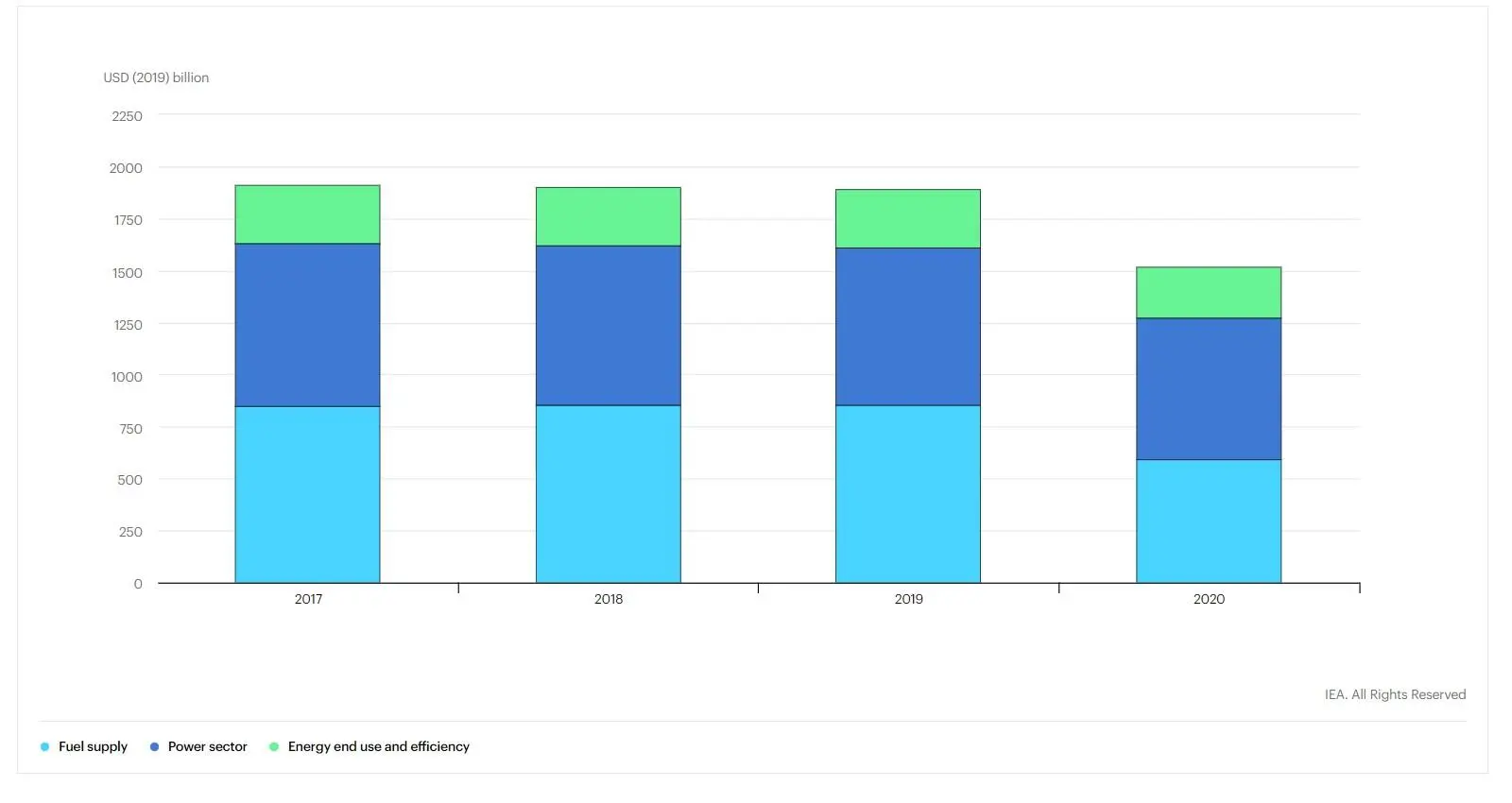

At the start of 2020, global energy investment was on track for growth of around 2 percent, which would have been the largest annual rise in spending in six years. But after the COVID-19 crisis brought large swathes of the world economy to a standstill in a matter of months, global investment is now expected to plummet by 20 percent, or almost $400 billion, compared with last year, according to the IEA’s World Energy Investment 2020 report.

"The historic plunge in global energy investment is deeply troubling for many reasons," said Dr Fatih Birol, the IEA’s Executive Director. "It means lost jobs and economic opportunities today, as well as lost energy supply that we might well need tomorrow once the economy recovers. The slowdown in spending on key clean energy technologies also risks undermining the much-needed transition to more resilient and sustainable energy systems."

More than 5.5 million people across the globe have contracted the coronavirus, with over 346,700 deaths, according to data compiled by Johns Hopkins University.

Click image to enlarge. Total Global Energy Investment. Source: IEA

Oil bears the brunt

A combination of falling demand, lower prices and a rise in cases of non-payment of bills means that energy revenues going to governments and industry are set to fall by well over $1 trillion in 2020, according to the report.

Oil accounts for most of this decline as, for the first time, global consumer spending on oil is set to fall below the amount spent on electricity, the report said.

Almost all investment activity has faced some disruption due to lockdowns, whether because of restrictions on the movement of people or goods, or because the supply of machinery or equipment was interrupted. But the larger effects on investment spending in 2020, especially in oil, stem from declines in revenues due to lower energy demand and prices, as well as more uncertain expectations for these factors in the years ahead, the report noted.

Global investment in oil and gas is expected to fall by almost one-third in 2020. The shale industry was already under pressure, and investor confidence and access to capital has now dried up: investment in shale is anticipated to fall by 50 percent in 2020.

The power sector has been less exposed to price volatility and announced cuts by companies are much lower. IEA expects a fall of 10 percent in capital spending. In addition, sharp reductions to auto sales and construction and industrial activity are set to stall progress in improving energy efficiency.

Slowdown in energy transition

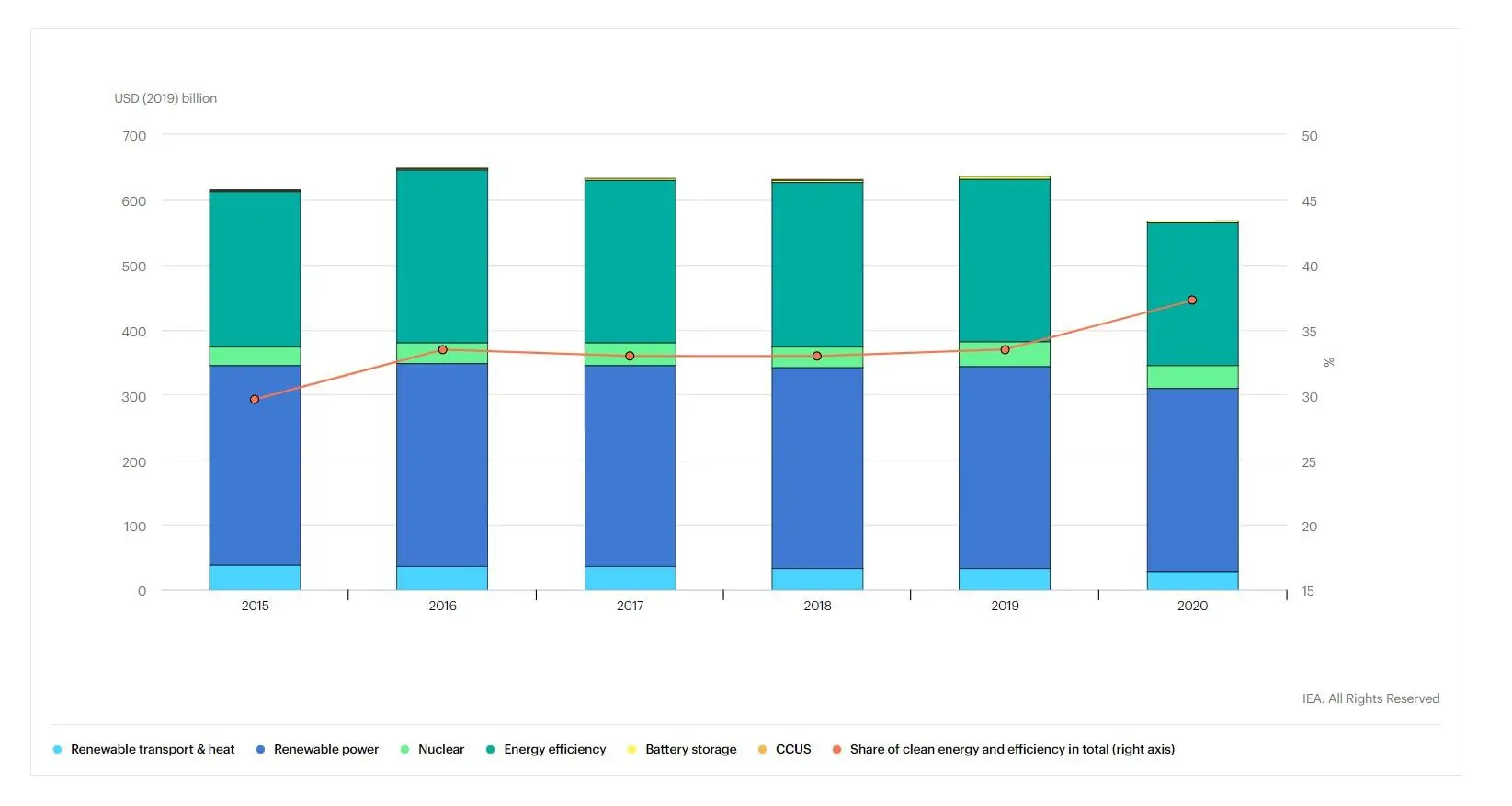

Overall, ongoing investment in renewable power projects is expected to fall by around 10 percent for the year, less than the decline in fossil fuel power. Capacity additions are set to be lower than 2019 as project completions get pushed back into 2021. Final investment decisions (FIDs) for new utility-scale wind and solar projects slowed in the first quarter of 2020, back to 2017 levels. Distributed solar investments have been more dramatically hit by lower consumer spending and lockdowns.

"Electricity grids have been a vital underpinning of the emergency response to the health crisis – and of economic and social activities that have been able to continue under lockdown," Dr Birol said. "These networks have to be resilient and smart to ward against future shocks but also to accommodate rising shares of wind and solar power. Today’s investment trends are clear warning signs for future electricity security."

Energy efficiency, another central pillar of clean energy transitions, is suffering too. Estimated investment in efficiency and end-use applications is set to fall by an estimated 10-15 percent as vehicle sales and construction activity weaken and spending on more efficient appliances and equipment is dialed back.

Click image to enlarge. Investment in clean energy, efficiency and share in total investment. Source IEA

The overall share of global energy spending that goes to clean energy technologies – including renewables, efficiency, nuclear and carbon capture, utilisation and storage – has been stuck at around one-third in recent years. In 2020, it will inch up towards 40 percent, but only because fossil fuels are taking such a heavy hit. In absolute terms, it remains far below the levels that would be required to accelerate energy transitions.

"The crisis has brought lower emissions but for all the wrong reasons. If we are to achieve a lasting reduction in global emissions, then we will need to see a rapid increase in clean energy investment," said Dr Birol.

"The response of policy makers – and the extent to which energy and sustainability concerns are integrated into their recovery strategies – will be critical. The IEA’s upcoming World Energy Outlook Special Report on Sustainable Recovery will provide clear recommendations for how governments can quickly create jobs and spur economic activity by building cleaner and more resilient energy systems that will benefit their countries for decades to come."

(Writing by Seban Scaria, editing by Anoop Menon)

#ENERGY #INVESTMENT #GLOBAL

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020