PHOTO

Regulatory plans to increase minimum capital requirements for firms will lead to consolidation in the GCC Islamic insurance industry, encompassing takaful and tawuni, where weak profitability has been a problem historically.

To strengthen the sector, the Saudi Arabian Monetary Authority, the Kingdom’s regulator, is assessing plans to increase minimum capital requirements for primary insurers to 500 million Saudi riyals, which is five times the current amount.

An increase in minimum capital requirements of this magnitude would require almost 90 per cent of insurers in the kingdom to raise new capital, consolidate through mergers and acquisitions, or exit the market entirely, S&P Global Ratings stated in one of its recent reports.

The report also noted that in other markets such as the UAE, where about 40 percent of takaful players do not comply with new solvency requirements adopted in January 2018, a significant number of companies will also need to increase their capital or consolidate.

"M&As could be one solution. But it's not the right one for everyone. Companies should assess the situation and take the call. When insurance regulators enforce regulations more strictly there is a chance that companies will not be able to continue the way they are and if they can't raise capital they may have to stop writing businesses and leave the market or consolidate,” Emir Mujkic, Director and lead analyst at S&P Global Ratings, told Zawya.

“The responsibility is certainly with insurance companies to meet the capital requirements and provide some sort of action plan with regulators, which they need to agree on,” he added.

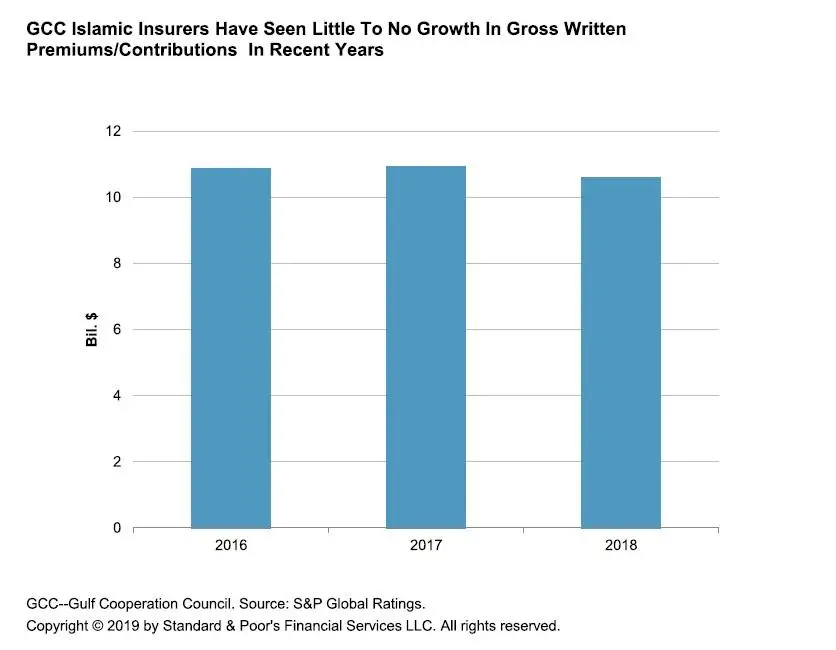

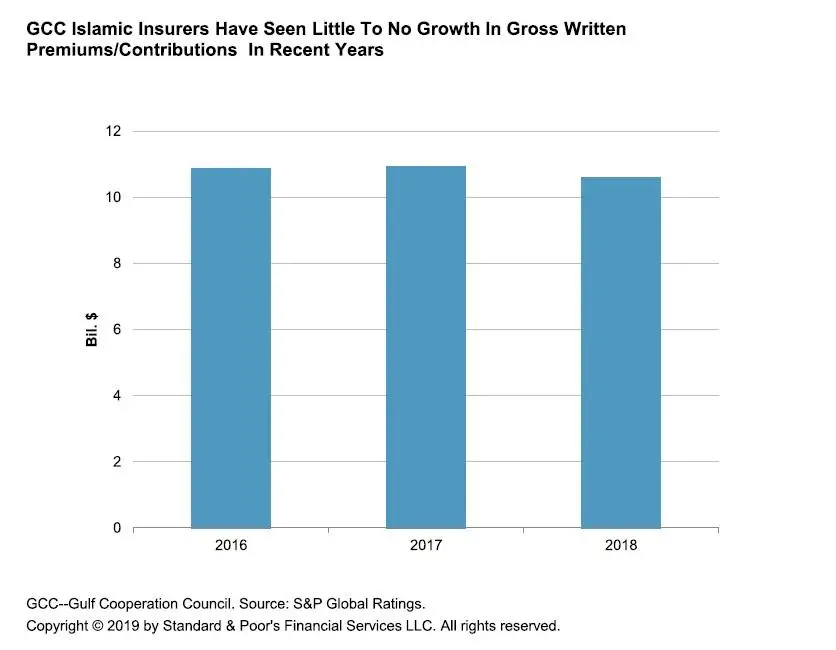

Thanks to strong premium growth in Saudi Arabia and other GCC markets following years of flat growth and declining profitability, Islamic insurers in the region recorded a 9.5 per cent increase in gross written premiums and contributions in the first quarter of 2019.

Additionally, there was a 13.4 percent increase in profits, mainly from better investment returns. Despite these material improvements, the report went on to say, "We note that more than one-third of insurers in the sector continue to report underwriting losses."

"Reasons could be multifold. Losses due to bad performance over the years have in recent years eroded capital buffers and resulted in solvency issues and temporary, or even permanent, license suspensions for a number of insurers, particularly in Saudi Arabia. Also, in some cases very fast growth could put a stress on the capital,” Mujkic explained.

Weak Profitability

Net income for Islamic insurers in the Gulf has significantly declined in recent years, according to S&P Global data. In 2018, the sector generated a net profit of about $281 million, compared with $383 million in 2017, and $674 million in 2016.

The weak results in the Saudi Arabian market, which contributes about 85 percent of total gross written premiums of all Islamic insurers in the GCC, have been the main source of earnings volatility in the sector in recent years, the report said.

According to Mujkic, higher competition has also spurred the decline in profitability: “What we see in the UAE is that there are too many insurance companies, almost 62, out of which 12 are takaful, operating in a relatively small insurance market. [In] Saudi Arabia, it’s only 31, but the premium size is relatively similar. So, that means more companies operate in the market. There is more competition. If there is more competition, it’s good for customers but bad for the profitability of insurance companies.”

However, the market received a boost in first-quarter 2019, compared with the same quarter in 2018, with gross written premiums and contributions rising about 9.5 percent to $3.5 billion, and a 13.4 percent rise in net profit to about $77 million.

Premium income in Saudi Arabia increased by 8.8 percent, mainly due to a rise in medical business following the introduction of mandatory cover for dependents of Saudi nationals, while takaful companies in other GCC markets expanded at an even faster rate of about 14 percent, supported by growth across several lines of business.

(Writing by Seban Scaria;, editing by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019