PHOTO

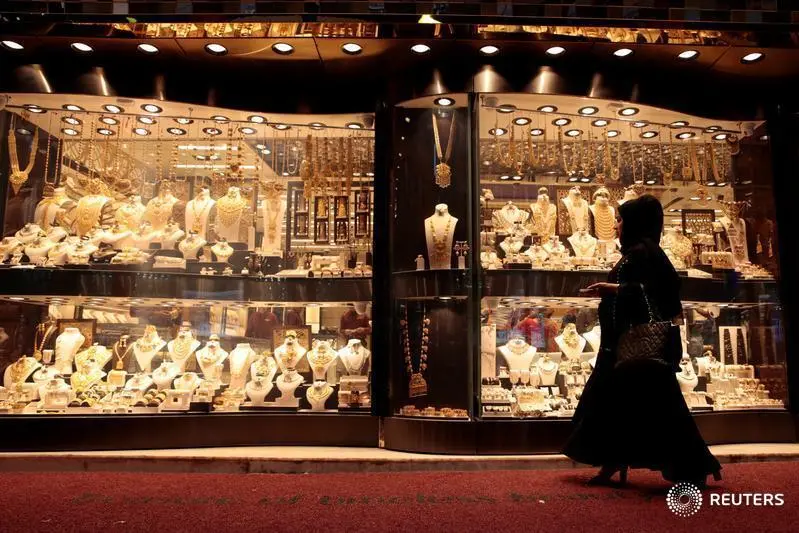

Most jewellery retailers in the UAE who saw brisk sales last week as Indian customers returned to the stores to buy gold during the auspicious Diwali festival, expect the positive trend to continue through the year and the next.

The Diwali festival--particularly the first day of the festival, known as Dhanteras--is an auspicious occasion to buy gold. This year there was a lot of pent-up demand for the precious metal among expatriates in the country, following last year's subdued celebrations due to the COVID-19 curbs.

Sales this season was also boosted by the UAE easing restrictions on international travel. The reopening of skies brought in tourists keen to attend the Expo 2020 and marquee sporting events, like the cricket world cup.

"It is certain that the incremental sales can be attributed to increased tourist influx and more countries opening up their air spaces. Source markets such as India improving its travel sentiments have helped boost the retail sales to a great extent," Tawhid Abdullah, the chairman of a trade body, Dubai Gold & Jewellery Group, told Zawya.

Industry players are optimistic about the trend for the rest of the year and beyond. "We are extremely positive in our outlook; we believe that the city as a whole is prepared to welcome millions of tourists and visitors to UAE in relation to EXPO and other newly added attractions. We are hoping for a great year ahead from the last quarter of 2021 through 2022," said Abdullah.

Ramesh Kalyanaraman, Executive Director, of Kalyan Jewellers, a large chain operating in India and the Middle East, said: "The wedding season is also just around the corner, and for these reasons, we are positive about the market sentiments going forward.”

Globally too the ongoing economic recovery has strengthened demand for gold jewellery, according to the World Gold Council. Third quarter 2021 saw demand rebound 33 percent year-on-year to 443 tonnes. Data from the industry body showed that Indians bought 194.3 tonnes of gold in 2019’s October-December festival period versus 186.2 tonnes during the same period in 2020, as sales was affected by the pandemic.

Favourable pricing

A softening of gold prices over the festival period also helped invigorate sentiment. On November 2, 22 carat gold, mostly used in jewellery, traded at 6,576 dirhams ($1,790) per ounce in Dubai, down from May high of nearly 7,000 dirhams an ounce.

According to Abdullah, the favorable pricing was a factor in increase in sales."Jewellery buyers took advantage of the price drop at the right moment and prepared for festivities," he said.

According to Kalyanaraman, softer gold rates do attract certain customer segments, but "in most cases, jewellery is looked at as a desired and accepted lifestyle purchase, which in all likelihood offers the benefit of liquidity and value appreciation at a later date."

In the days following the worst of the pandemic, "we have noticed a visible shift in consumer demographics, with younger audiences also looking at purchasing gold jewellery--which drive desirability as well as incremental value," he said.

(Reporting by Brinda Darasha; editing by Seban Scaria)

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2021