PHOTO

The UAE capital’s hotel market has posted a strong performance in the third quarter of 2019, thanks to Abu Dhabi government’s efforts to boost tourism.

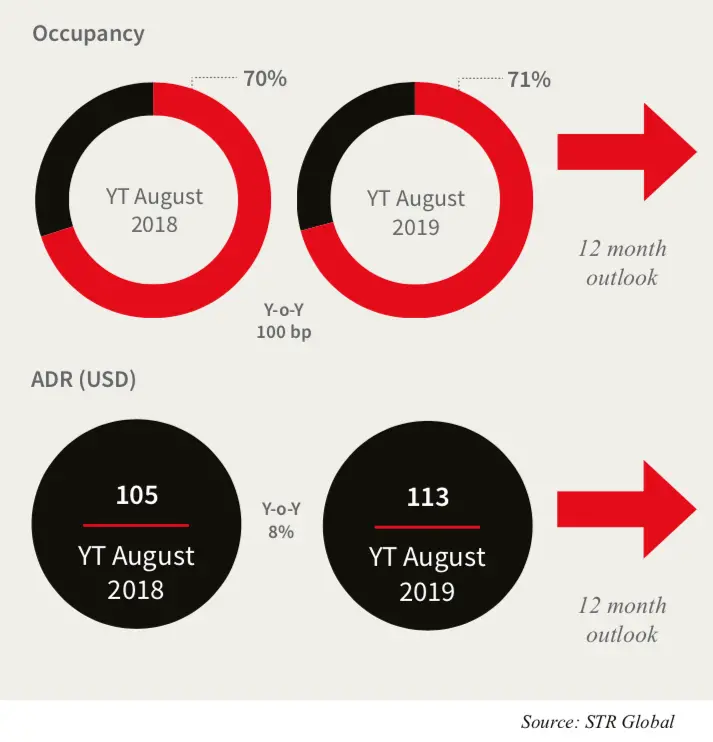

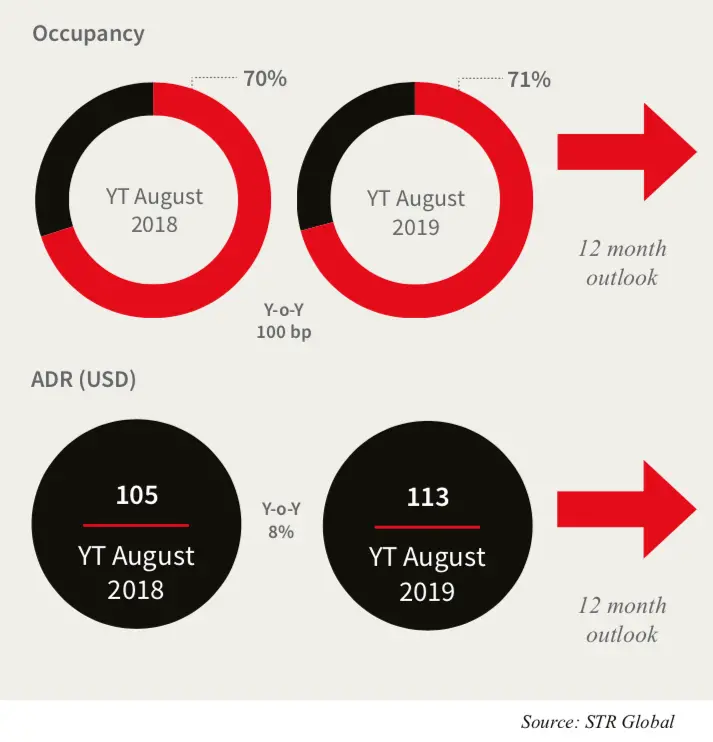

Occupancy levels in Abu Dhabi increased by 100 basis points, registering 71 per cent in the year until August 2019 and Average Daily Rates (ADRs) increased by eight per cent from the same period last year to reach $113. As a result, revenues per available room (RevPar) in Abu Dhabi during Q3 increased by nine percent over the same period at $80, property consulting firm Jones Lang LaSalle (JLL) in its latest UAE Market report.

Government initiatives aimed to promote tourism within Abu Dhabi has boosted visitor numbers along with overall investment in the tourism sector through a series of high-profile events, conferences and activations during the past quarter, said property consulting firm Jones Lang LaSalle (JLL) in its latest UAE Market report.

“The introduction of new events and initiatives, combined with an emphasis on key global markets and a drive to generate additional business from within the UAE is strengthening Abu Dhabi’s tourism strategy,” said Peter Stebbings, Head of JLL operations in Abu Dhabi.

The UFC-themed Abu Dhabi Showdown Week, which offered a range of entertainment events focused on health and fitness, drove global awareness and international visitation. Abu Dhabi also saw a large increase in Chinese visitors, partly due to the annual MeetChina conference.

JLL expects the hotel sector to continue to perform strongly in Abu Dhabi over the last quarter, particularly with the upcoming annual Formula 1 Etihad Airways Abu Dhabi Grand Prix.

In Abu Dhabi, apartment rents declined two per cent quarter-on-quarter and 10 per cent year-on-year, while villa rents stabilised at the same levels seen in the previous quarter as most villa developments maintained healthy occupancy rates.

Despite the freehold law allowing expatriates to buy land and property within investment zones, JLL expects sale prices to reduce slightly further within prime villa developments over the next 12 months.

In the commercial space, Abu Dhabi witnessed a decline of six per cent y-o-y. While the rate of decline is slowing, the market remains in favour of tenants, with landlords offering strong incentives and displaying flexibility in lease terms in order to retain existing tenants, the report noted.

Average retail rents have declined by 10 to 20 per cent y-o-y in Abu Dhabi but have remained stable on a quarterly basis. Rents and vacancies are expected to experience further pressure over the remainder of 2019 and could soften further on the back of the significant new supply due to enter the market during 2020, said the report.

Dubai hotel, residential market

Compared to Abu Dhabi, the situation is slightly different in Dubai.

The residential sector in Dubai remained relatively stable over third quarter while further declines in performance were recorded in the office, retail and hotel markets, it added

Despite multiple initiatives to support the hotel market by increasing the attractiveness of the city as a tourist destination, the Dubai hotel market recorded a softening of performance during Q3 2019, with ADR’s recording a 13 per cent decline compared to last year.

JLL’s report indicates the hotel market in Dubai can expect strong visitor arrival growth and international interest during Expo 2020, which starts in a year’s time, prompting a recovery in hotel market performance.

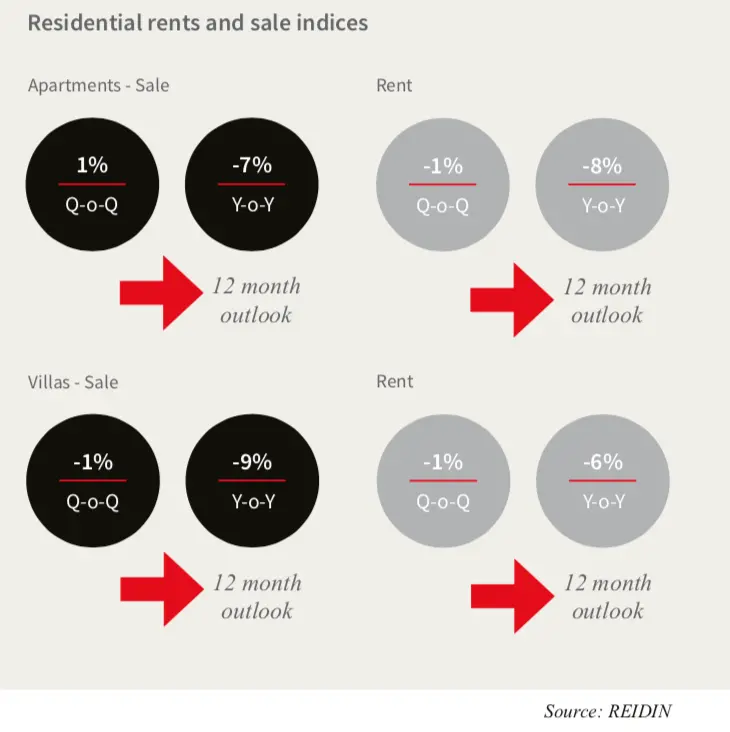

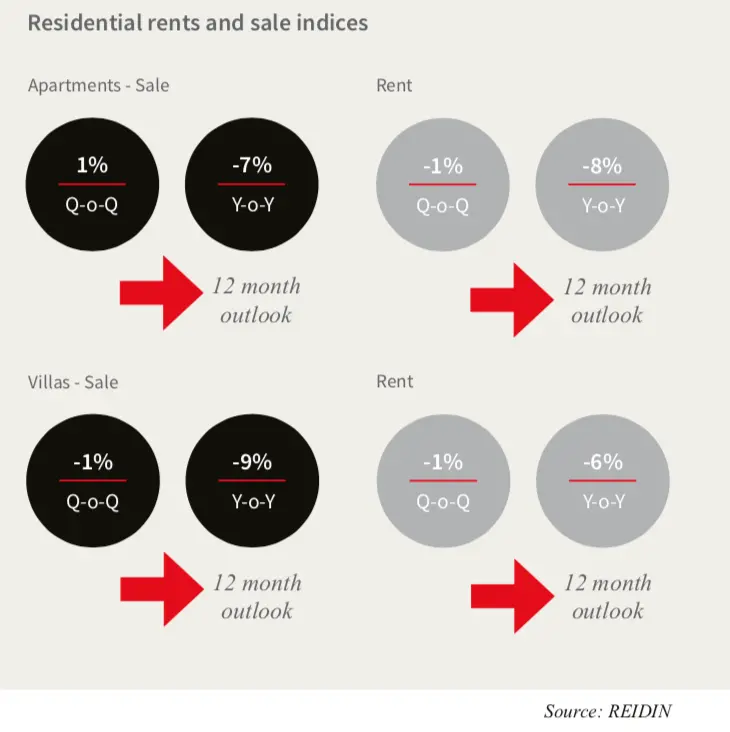

On the other hand, Dubai’s residential market approached stability during Q3, registering marginal declines of just one per cent in both apartment and villa rents and sale prices. Though apartment sale prices increased by one per cent over the quarter, JLL expects prices and rentals will remain largely unchanged in the Dubai residential market over the next 12 months.

Retail rents in Dubai remained stable over the quarter but softened across all mall categories compared to last year. Market-wide vacancies are estimated to have increased to 19 per cent in Q3 2019 from 16 per cent this time last year.

Given the level of upcoming supply, coupled with evolving consumer tastes and the rapid proliferation of disruptive technologies, JLL expects rents to remain under pressure over the next year.

(Writing by Atique Naqvi, editing by Seban Scaria seban.scaria@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019