PHOTO

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

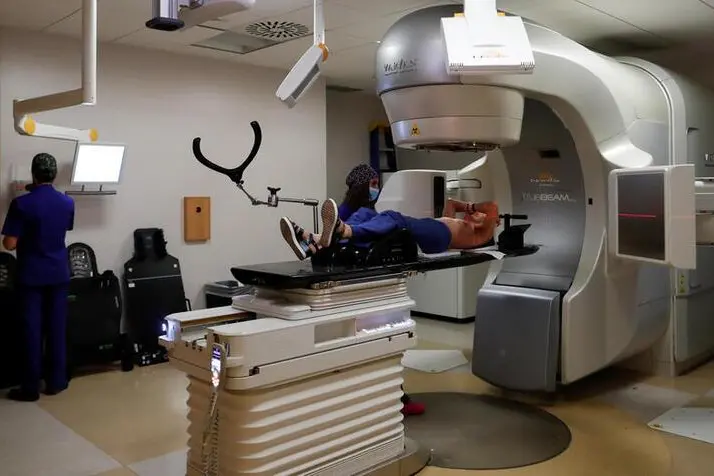

NEW YORK - Siemens decided about a decade ago it would leave radiation therapy to concentrate on diagnostics. Now Siemens Healthineers, the group spun off from the German conglomerate in 2018, is getting back in, buying Varian Medical Systems for $16.4 billion in cash. Blending diagnostics and treatment is a natural combination. But the price is a stretch.

Bundling diagnostics with radiotherapy to provide a "one-stop shop" for cancer treatment makes some sense. The radiotherapy business is growing quickly – the acquirer thinks up to 10% annually for the next decade. The trouble is Healthineers is using both cost and revenue synergies to justify its offer, and even then the price seems excessive. Healthineers thinks the combination should yield about 300 million euros($353 million) of extra pre-tax profit by 2025. Only a portion of that comes via cost savings.

Even in aggregate, it hardly covers the premium. Taxed and put on a multiple of 10, it is worth less than $3 billion, roughly the premium Healthineers is paying based on Friday’s close. The stock is trading near the top of its five-year range, too, and based on the 30-day average closing price, the premium trumps combined synergies by nearly $2 billion.

That means Healthineers is depending on the acquired business growing at a faster clip than the market anticipates – that’s conceivable, because the faster the world becomes older and richer, the more the cancer treatment market grows. A financing wheeze might help further. This is a big acquisition for Healthineers, at nearly a third of its market capitalization. But it’s small for parent Siemens, which owns 85% of the firm. So Siemens will lend to Healthineers to pay for the deal. Healthineers plans to later finance up to half via offering new equity, in which the parent won’t participate, and the debt will eventually be passed onto Healthineers.

But this is fiddling around the edges. Assuming the favorable assumption it finds the promised synergies by 2022, the deal yields an after-tax return of around 5%, using Refinitiv estimates. That’s far higher than the rate Siemens already lends to Healthineers, which is less than 1%. Meanwhile Varian’s current cost of capital is closer to 9%, according to Morningstar. Eventually once the Siemens gravy train goes away, the rich deal may not look so appealing.

CONTEXT NEWS

- Siemens Healthineers said on Aug. 2 it had agreed to buy Varian Medical Systems for $16.4 billion. The German group, which was spun off from Siemens in 2018 is paying a 24% premium to the American radiation therapy group, based on the company’s closing stock price on July 31.

- Siemens is effectively providing a bridge loan of 15.2 billion euros to Healthineers. That company aims to replace 50% of this through a rights issue this year. Siemens said it will raise the money by issuing bonds which will be passed on to Healthineers. Siemens will not participate in the rights issue, after which its stake in Healthineers will fall from 85% to 72%.

(The author is a Reuters Breakingviews columnist. The opinions expressed are his own.)

(Editing By Lauren Silva Laughlin and Sharon Lam) ((robert.cyran@thomsonreuters.com; Reuters Messaging: robert.cyran.thomsonreuters.com@reuters.net))