Global equity markets closed on a positive note during the week as sign of constructive development on the US-China trade front coupled with upbeat earnings announcement by a slew of US IT companies fuelled optimism. Market gains were however capped by the uncertainty over Brexit.

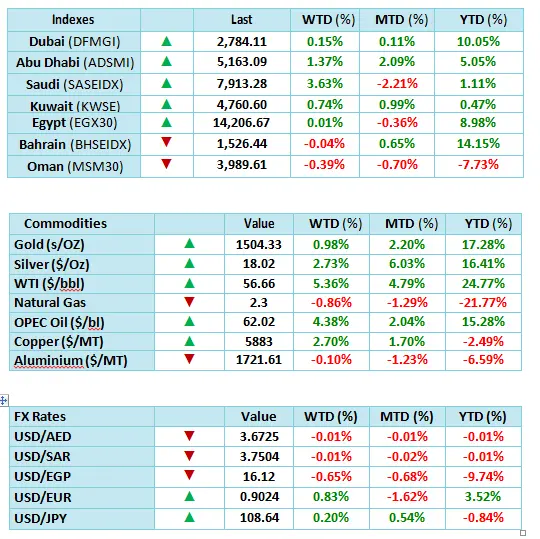

The market movement suggests that the IMF’s last week projections of synchronized slowdown did little to dent the optimism, indicating that investors are looking for immediate trigger in forms of ease in trade tension and easing policy rates. Brent crude oil prices were up by 4.38% during the week, mainly on the back of falling stockpile and ease in trade tension.

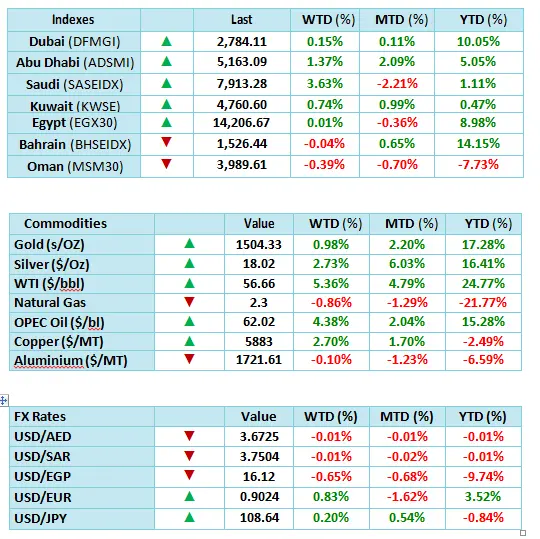

For the regional markets, the performance during the week was positive with 5 out of the 8 indexes closing in green, while 3 closed in red. Saudi Arabia was the best performing index regionally with gains of 3.63%, followed by Abu Dhabi with gains of 1.37%.

Going forward, investors will turn their focus on the upcoming US Fed meeting to get cues on the direction of interest rate trajectory, while earnings announcement will continue to influence trading activities. For the regional markets, the positive global sentiment along with strengthening of oil prices should support trading activity.

About Allied Investment Partners PJSC

Established in 2007, Allied Investment Partners PJSC is licensed by Central Bank of the UAE and Securities and Commodities Authority, and is a leading investment firm providing various services like Asset Management, Alternative Investments, Wealth Management, Securities and Custody Services, Corporate Finance and Investment Banking Advisory.

For more information, please visit http://aipuae.com/

For media enquiries, please contact Matrix Public Relations

Krishika Mahesh: Krishika@matrixdubai.com

Or call: 04 34 30 888

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.