PHOTO

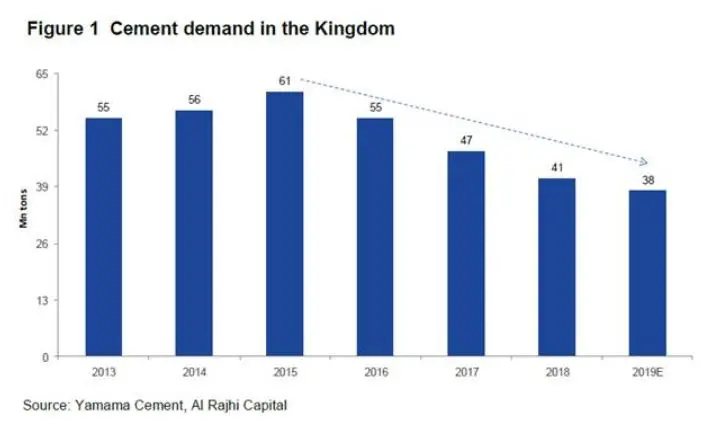

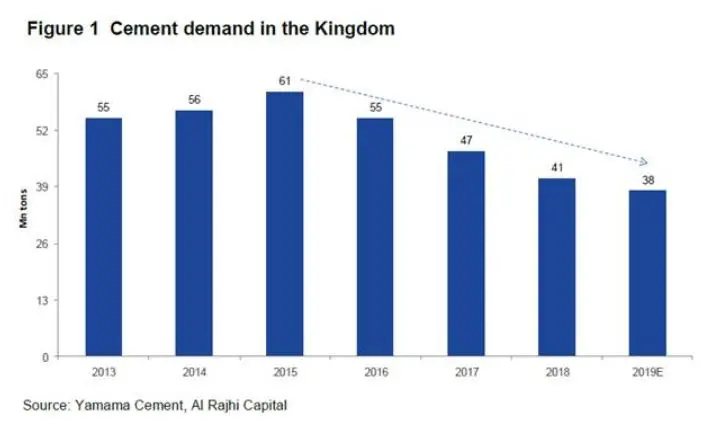

Demand for cement in Saudi Arabia is expected to drop sharply in the coming quarters, while sales prices will remain firm, according to a new research note by Al Rajhi Capital.

The firm said in a note seen by Zawya that it expects cement demand to fall significantly within the next two quarters "due to seasonality factors", such as Ramadan, Eid and the forthcoming summer period.

“However, we believe the current sales prices (will) remain firm as producers are now focused more on pricing rather than volume,” the note added.

The Saudi cement sector’s aggregated earnings for the first quarter (Q1) of the year jumped by almost 68 percent year-on-year, according to EFG Hermes, with firms in its coverage universe mostly beating EFG Hermes’ estimates.

Sameer Kattiparambil, an analyst at EFG Hermes, told Zawya by email that the earnings of Saudi Arabian cement companies were backed by improved prices.

Cement prices posted a strong recovery during the quarter to 200 million Saudi riyals ($53.3 million), which was 21 percent higher year-on-year and 24 percent higher than in the previous quarter, as “cement companies started targeting profitability rather than market share,” he added.

Saudi’s Yanbu Cement posted an 88.1 percent increase in Q1 2019 net profit and a 20.54 percent increase in revenue. (Read more here).

Saudi's Eastern Province Cement reported a 170.59 percent increase in Q1 2019 net profit and a 30.22 percent increase in revenue. (Read more here).

“Sales volume continues its negative trend in 1Q19 as sales volumes in Saudi Arabia were -8% Y-o-Y, as construction activity is yet to see a pick up,” EFG Hermes’ Kattiparambil said.

He added that inventory levels have seen a marginal dip during the quarter, as “export activities ramped up”, with total exports from Saudi Arabia standing at 2.5 million tonnes, a 66 percent jump quarter-on-quarter.

According to Al Rajhi Capital’s note, the Saudi government’s announced mega projects (including Neom, Qiddiya, Red Sea Tourism and social housing) are likely to create an incremental demand, but only in the long-term.

(Reporting by Gerard Aoun; Editing by Michael Fahy)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019