PHOTO

Cairo: The second edition of the Business Barometer: Egypt CEO Survey by the global publishing, research and consultancy firm Oxford Business Group (OBG), undertaken in partnership with Tatweer Misr, was launched on July 3 at Conrad Cairo Hotel.

Taking place under the banner “Key Findings on OBG Business Barometer: Egypt CEO Survey”, the event provided a platform for the Group’s team to share its findings with an audience of dignitaries, VIPs, representatives from the public and private sectors, and members of the media.

Ahmed Shalaby, Tatweer Misr’s CEO and managing director, gave a keynote speech on several topical issues, ranging from investor sentiment to the business community’s expectations, after which Souhir Mzali, OBG’s regional editor for Africa, presented the Group’s findings.

As part of its survey, OBG asked 136 C-suite executives from across Egypt’s industries a wide-ranging series of questions on a face-to-face basis aimed at gauging business sentiment. The results are now available to view in full on OBG’s Editors’ Blog at: https://oxfordbusinessgroup.com/blog/souhir-mzali/obg-business-barometer/how-do-egypt%E2%80%99s-ceos-view-currency-flotation-one-year.

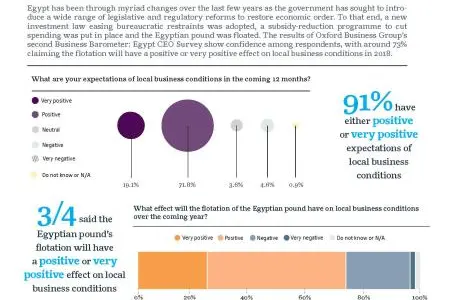

OBG found the vast majority of respondents to be optimistic about the outlook for the coming months. From those interviewed, 91% described their expectations for local business conditions in the next 12 months as either positive or very positive, up from 79% in OBG’s first survey on Egypt, which was published in early 2017.

Almost three-quarters (73%) of respondents were also upbeat about the impact they felt the decision to float the Egyptian pound in November 2016 would have on the business landscape in the near term.

A similar share (70%) of business leaders were equally bullish in their forecasts for GDP growth, telling OBG that they expected the local economy to expand by between 3% and 5% in 2018, slightly below the 5.2% projection made by the IMF.

There were also signs that reforms aimed at enhancing Egypt’s business climate are taking effect, with 70% of respondents describing the current tax environment as either competitive or very competitive on a global scale.

While confidence is high among business leaders, regional unrest clearly remains a major concern. Almost two-thirds (65%) viewed increased instability in neighbouring countries as the top external risk to growth in the short to medium term, well ahead of rising oil prices (17.2%).

OBG also asked business leaders about the skills they felt were in highest demand in the workplace – a key issue, given the high level of youth unemployment, which the IMF put at 33.1% in 2017. Just over half (54%) of respondents cited leadership as the skillset they felt was most in need among employees, followed by research and development (12.7%), and business administration (9%).

Commenting on the results in her blog, Souhir Mzali, OBG’s regional editor for Africa, said the results of the latest survey suggested that the broader drive to improve public finances, reduce the size of the state and enhance the business environment was now delivering results.

“Egypt had been through myriad changes since 2014 as the government has sought to introduce a wide range of legislative and regulatory reforms to restore economic order,” she said. “Overall, efforts to put the economy back on a surer footing seem to be finally paying off, and confidence among the business community appears to be returning in full force.”

Mzali noted, however, that while Egypt’s reforms had positioned it for ongoing economic expansion, a number of pressing challenges still needed addressing, most notably the country’s high unemployment levels, which would require longer-term attention in the form of “sustained job creation”.

Mzali’s in-depth evaluation of the survey’s results can be found on OBG’s Editor’s Blog,

titled ‘Next Frontier’. All four of OBG’s regional managing editors use the platform to share their expert analysis of the latest developments taking place across the sectors of the 30+ high-growth markets covered by the company’s research.

Ahmed Shalaby said the survey’s results showed that CEOs had recognized the part that ambitious reforms were playing in helping Egypt to reignite investor interest and begin addressing the difficulties it faced.

“There is no doubt that the past few years have presented the Egyptian economy with a multitude of dynamic challenges”. “However, with the presence of our reform program that is currently and efficiently being applied, the country’s economic growth has been recovering steadily and has started to boom once again, especially in the real estate sector, which has witnessed a steep growth due to an expected increase in the foreign and local demand”, Shalaby said.

The OBG Business Barometer: CEO Surveys feature in the Group’s extensive portfolio of research tools. The full results of the survey on Egypt will be made available online and in print. Similar studies are also under way in the other markets in which OBG operates.

About OBG Business Barometer

OBG Business Barometer: Egypt CEO Survey Copyright (c). All rights reserved.

This survey has been designed to assess business sentiment amongst business leaders (Chief Executives or equivalent) and their outlook for the next 12 months. Unlike many surveys, the OBG Business Barometer is conducted by OBG staff on a face-to-face basis, across the full range of industries, company sizes and functional specialties. The results are anonymous.

OBG Business Barometer is based on data from companies with revenue within the following parameters, among others:

• 77% of companies surveyed were private

• 51% of companies surveyed were international

• 27% of companies surveyed were local

• 16% of companies surveyed were regional

The data generated allows for analysis of sentiment within an individual country, as well as regionally and globally. Additionally, comparisons can be drawn between both individual countries and regionally. The results are presented statistically within infographics and discussed in articles written by OBG managing editors.

OBG provides this survey, infographics and accompanying analysis from sources believed to be reliable, for information purposes only.

OBG accepts no responsibility for any loss, financial or otherwise, sustained by any person or organisation using it. For further information on the content of the survey, please contact Souhir Mzali, OBG’s regional editor for Africa, at: smzali@oxfordbusinessgroup.com.

Should you wish to reproduce any element of this survey, infographics and accompanying analysis please contact mdeblois@oxfordbusinessgroup.com.

Any unauthorized reproduction will be considered an infringement of the Copyright. For further details about OBG and how to subscribe to our widely acclaimed business intelligence publication please visit www.oxfordbusinessgroup.com.

About Oxford Business Group

Oxford Business Group is a global research and consultancy company with a presence in over 30 countries, from Africa, the Middle East and Asia to The Americas. A distinctive and respected provider of on-the-ground intelligence on many of the world’s fastest growing markets, OBG has offices in London, Berlin, Dubai and Istanbul, and a network of local bureaus across the countries in which we operate.

Through its range of products, OBG offers comprehensive and accurate analysis of macroeconomic and sectoral developments, including banking, capital markets, tourism, energy, transport, industry and ICT. OBG provides business intelligence to its subscribers through multiple platforms: Economic News and Views, OBG Business Barometer - CEO Survey, Roundtables and conferences, Global Platform - exclusive video interviews, The Report publications and its Consultancy division.

Click here to subscribe to Oxford Business Group’s latest content: http://www.oxfordbusinessgroup.com/country-reports

About Tatweer Misr

Established in 2014, Tatweer Misr is a leading Egyptian real estate development shareholding company. It involves a vertically-integrated business model with various development fields, including residential units varying from private villas to apartments, leisure facilities as their one-of-a-kind mountain park. In addition to a diversity of supporting infrastructure such as a college, schools, business parks, hotels and utilities. Currently, they have three projects in various stages of development and planning including their award winning flagship project “IL Monte Galala” built on around 545 acres; “Fouka Bay” in the North Coast built on around 250 acres and; their latest project “Bloomfields”; a mixed use first homes project located in Mostakbal City on an area of 325 acres and their Entrepreneurial College built on 90 acres located in the same area. For more information visit: www.taweermisr.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.