- In line with the diversification of the economy, FinTech Bay was set up in 2018 as the leading FinTech hub in MENA.

- Flexible office spaces including co-working are still at a nascent stage in the region. The current flexible office space landscape is largely dominated by domestic players or niche operators.

- As companies try to reduce their operational expenses and offer a better and collaborative working environment, the potential of flexible office spaces as a differentiator is immense.

- Clear co-relation between flexible office spaces and employee satisfaction.

Bahrain : Savills, the Middle East’s leading real estate services provider, has released its latest report analysing the office, co-working market in Bahrain. The report focuses on the rise of flexible office space, which is gaining momentum across major cities in the world, and how this trend is applicable to Bahrain.

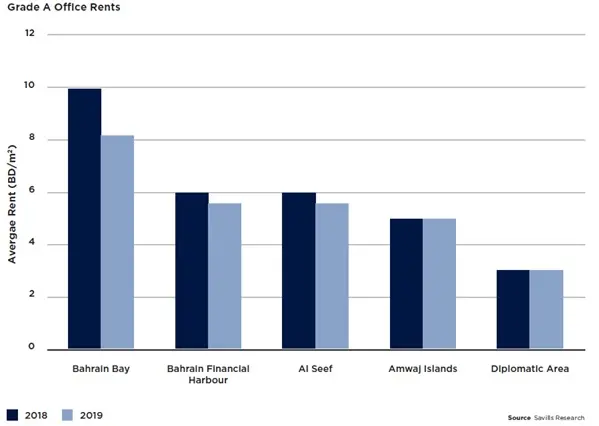

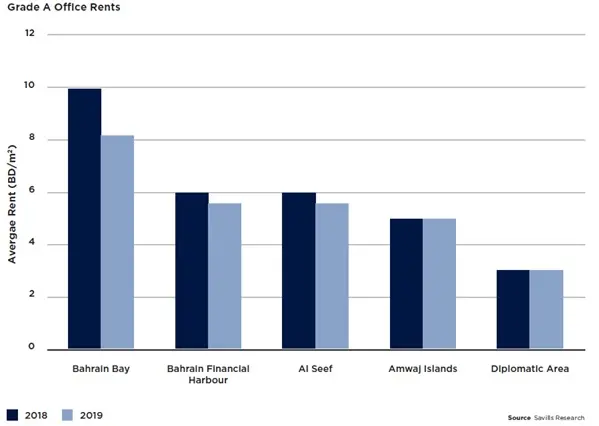

According to Savills, the office market in Bahrain has remained largely subdued over the past few years. The impact of economic slowdown is well reflected in the case of Bahrain’s real estate. Rental decline was observed in the key office markets such as Bahrain Financial Harbour and Seef where the average rents dropped by 8% y-o-y. A sustained supply addition and less active occupier demand has resulted in a tenant’s market. This has prompted some existing landlords and developers to offer generous incentives to retain and attract existing and new tenants respectively. Consequently, companies are ramping up their efforts to accommodate employee needs, including a more flexible and collaborative work environment.

Hashim Kadhem, Associate Director – Head of Professional Services at Savills Bahrain said:

“The commercial office market in Bahrain remains characterised by a supply-demand imbalance. The market continued to soften during Q2 2019, with office rents dropping by 5 to 8% YoY across the board. It is however showing positive signs of recovery with the rental rates sustaining in some area and rate of decline YoY subsiding in others. The majority of enquiry levels and transactions were for small and medium sized office space. In fact, there’s limited demand for large office plates except in the case of large-scale companies establishing their base in Bahrain. Hence, it became imperative for developers and landlords to look at global trends and adapt their local service offering.”

Flexible office spaces including co-working, though still at a nascent stage in the region, is now considered a disruptor of the office real estate landscape. The current flexible office space landscape is largely dominated by domestic players or niche operators. It occupies a relatively smaller share of the completed office stock across established markets. According to Savills estimates, in London - which is the biggest co-working market in the world - co-working spaces accounted for 7.6% of total office stock in Central London at the end of 2018. In Bahrain, there’s a strong entrepreneurial culture. Indeed, the start-up scene is expanding at a rapid pace and there’s an incredible support network and ecosystem for start-up companies which have grown by 46.2% over the past three years. There are currently 119 innovative start-ups within the growing StartUp Bahrain ecosystem, as well as 34 accelerators, incubators, co-working spaces, and government entities to support. In addition to this, Bahraini-based “Al Waha” closed $100 million fund of funds to invest in technology start-ups.

“The key drivers to flexible and co-working spaces are the growing young and educated population, the strong entrepreneurial culture, the progressive and supportive government policies, and the relative low cost of operations compared to traditional office spaces. It also led to improved employee satisfaction when compared to the conventional office worker”, said Hashim Kadhem.

Kadhem continued: “a one-size-fits-all approach may not work. There are still potential risks and challenges when it comes to leasing and operating flexible space. Depending on business requirements, security and privacy may take precedence in certain business sectors which may not find flexible spaces as the ideal office format. However, we believe that the traditional office format will continue to be challenged and will evolve to provide a holistic working environment. Developers and landlords that identify and adapt to this trend will be able to reap long term dividends.”

-Ends-

About Savills

Savills is a global real estate services provider listed on the London Stock Exchange. Savills operates from over 600 owned and associate offices, employing more than 35,000 people in over 60 countries throughout the Americas, the UK, Europe, Asia Pacific, Africa and the Middle East, offering a broad range of specialist advisory, management and transactional services to clients all over the world

For media enquiries, please contact:

TOH Public Relations

Raghad Elassi, +971 4 382 8900 / savills@tohpr.com

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.