PHOTO

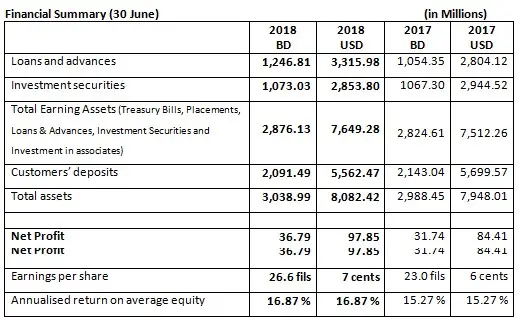

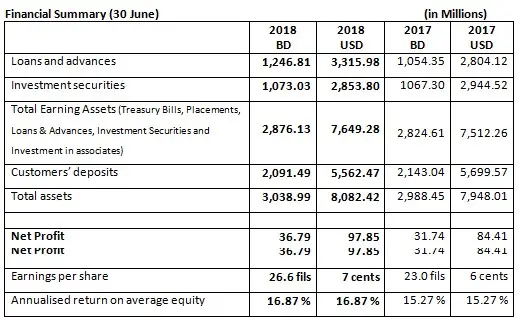

Manama:- National Bank of Bahrain (NBB) continues to record robust financial results reporting a 15.9% rise in Net Profit to BD 36.79 million (US$ 97.85 million) compared to BD 31.74 million (US$ 84.41 million) for the corresponding period of 2017. These results were achieved due to strong improvement in net interest income linked to growth in loans and advances and improved net interest margin on the back of better asset liability management. Provisions were also significantly lower than the corresponding period for 2017, further contributing to the overall rise in net profits. For the second quarter of 2018, the Bank recorded a Net Profit of BD 17.05 million (US$ 45.35 million) compared to BD 17.00 million (US$ 45.21 million) for the corresponding period of the previous year.

Other Financial Highlights for first half of 2018:

- Operating Profit of BD 38.06 million (US$ 101.22 million), growth of 9.5 % y-o-y [excluding certain one-off income of BD 3.26 million (US$ 8.67 million) in the previous year].

- Net Interest Income increases 17.6% y-o-y to BD 41.09 million (US$ 109.28million).

- Other Income up 16.0 % (excluding certain one-off income in the previous year) y-o-y to BD 17.88 million (US$ 47.55 million) resulting from stronger general income in business and a higher share of profit from the Bank’s investment in associates.

- Total Operating Costs of BD 20.91 million (US$ 55.61 million) compared to BD 15.61 million (US$ 41.52 million) reflecting the Bank’s planned and ongoing investment in people and technology in line with its new business strategy.

- Net impairment loss significantly lower at BD 1.27 million (US$ 3.38 million) compared to BD 6.27 million (US$ 16.68 million) y-o-y.

- Total Earning Assets of BD 2,876.13 million (US$ 7,649.28 million) compared to BD 2,824.61 million (US$ 7,512.26 million).

- Loans & Advances up 18.3% to BD 1,246.81 million (BD US$ 3,315.98 million).

- Customer Deposits of BD 2,091.49 million (US$ 5,562.47 million) compared to BD 2,143.04 million (US$ 5,699.57 million).

- Earnings per share (EPS) of 26.6 fils, compared to 23.0 fils y-o-y.

Commenting on the Bank’s performance, Mr. Farouk Yousuf Khalil Almoayyed, Chairman of NBB, said, “On behalf of the Board, I’m delighted to report NBB’s continued growth and enhanced performance for the second quarter of 2018. With a strong 15.9 % rise in profitability, our results underscore the success the Bank is enjoying in the implementation of its strategy and efforts to further build market leadership. This includes ongoing investments in people and technology for the effective expansion of the business and greater penetration of the local economy. During the quarter, the Bank also continues to invest in and drive plans to digitise, ensuring we are at the forefront of new in-demand products and services, and taking steps to activate and better leverage our regional presence. We look forward to accelerating growth in Bahrain and across our operations through the increasingly diverse nature of our business and capabilities.”

Mr. Jean-Christophe Durand, Chief Executive Officer of NBB, added, “We are pleased to report another strong quarter of financial performance at NBB. The ongoing diversification of our business and strengthened participation in the local economy has seen healthy growth in revenues and profitability. For the 2nd quarter, we reported a solid rise of 14.3 % in Operating Profit (excluding one-off Income in the corresponding quarter of the previous year) backed by stronger general income in business and a higher share of profit from the Bank’s investment in associates. At the same time, we also saw growth resulting from enhancements to our product and service capabilities and the increase in the facilities we are extending to customers.. We were also pleased to have launched our new business online banking platform during the quarter. In line with the digitisation of the Bank, we are bringing our business customers online helping them to enhance efficiency and better manage growth, especially SMEs. As we move ahead into the second half of the year, we will continue working hard to effectively serve our customers and create even greater value for Bahrain’s economy and our shareholders through further diversification and other innovations across the Bank and the way we operate.”

-Ends-

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.