Amman, Jordan: International General Insurance Holdings Ltd. (“IGI” or the “Company”) (NASDAQ: IGIC) today reported condensed and unaudited financial results for the fourth quarter and full year 2020.

Highlights for the fourth quarter and full year 2020 include:

- See Note (1) in the “Notes to the Condensed Consolidated Financial Statements (Unaudited)” below.

- See “Supplementary Financial Information” below.

- See Note (3) in the “Notes to the Condensed Consolidated Financial Statements (Unaudited)” below.

- See the section titled “Non-IFRS Financial Measures” below.

IGI Chairman and CEO Mr. Wasef Jabsheh said, “2020 has been a successful year for IGI on many levels. Our strong financial performance, achieved during a year of significant distraction and disruption as well as during our first year as a public company trading in the U.S., clearly demonstrates the agility, discipline and focus of our teams and our ability to execute and deliver on our strategy.”

“We broadened our footprint by entering new territories and lines of business and increased our market share, with gross premiums up more than 33% in 2020 compared to 2019, while maintaining underwriting profitability at a combined ratio below 90%. We expect to continue on this path in 2021, although likely at a more measured pace, and with the same careful approach to risk selection and portfolio balance.”

“With the first quarter of 2021 almost completed, the indications on price momentum remain very positive, and we are continuing to see exciting opportunities to build and diversify our business. We will continue to be cautious in managing our net exposures to minimize our overall risk profile so that we maintain our long-term track record of generating strong value for our shareholders.”

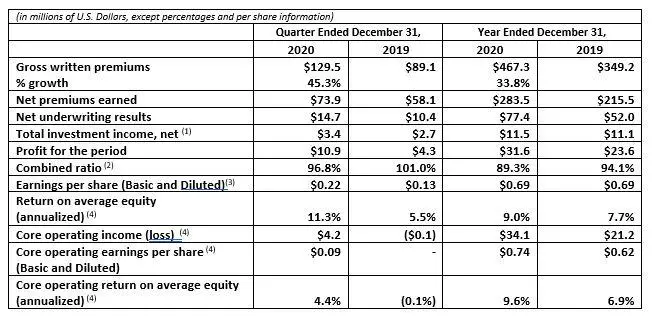

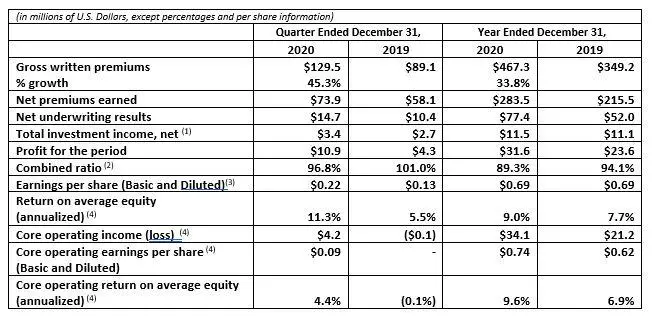

Results for the Quarters and Years ended December 31, 2020 and 2019

Net profit for the quarter ended December 31, 2020 was $10.9 million, up from a net profit of $4.3 million for the quarter ended December 31, 2019. Net profit for the year ended December 31, 2020 increased significantly to $31.6 million compared to a net profit of $23.6 million for the prior year.

Core operating income, a non-IFRS measure defined below, was $4.2 million for the fourth quarter of 2020 compared to a core operating loss of $0.1 million for the comparable quarter in 2019. Consequently, core operating return on average equity (annualized) was 4.4% for the quarter ended December 31, 2020, compared to (0.1%) in the same period of 2019.

The increase in core operating income to $34.1 million for the year ended December 31, 2020 compared to $21.1 million for the year ended December 31, 2019, was primarily the result of a higher level of underwriting income during 2020. While total equity increased by 26.4% due to the capital injection from the Business Combination with Tiberius Acquisition Corp. (“Tiberius”) as well as growth in retained earnings during the year, core operating return on average equity also increased to 9.6% for the year ended December 31, 2020 compared to 6.9% for the same period in 2019.

Underwriting Results

Gross written premiums were $129.5 million for the quarter ended December 31, 2020, an increase of 45.3% compared to $89.1 million for the quarter ended December 31, 2019. For the year ended December 31, 2020, gross written premiums were $467.3 million, up 33.8% compared to $349.2 million for the year ended December 31, 2019. The increase in gross written premiums was the result of new business generated across virtually all lines, as well as improved renewal pricing. While market conditions remained positive, the Company also continued to further refine its existing portfolio, achieving improved terms and conditions.

The claims and claims expense ratio was 59.8% for the quarter ended December 31, 2020, an improvement of 2.7 points over the corresponding quarter in 2019. This included current accident year net catastrophe losses of $6.3 million or 8.5 points for the quarter ended December 31, 2020, compared to $8.3 million or 14.3 points for the quarter ended December 31, 2019. Prior year development on loss reserves was unfavorable amounting to $5.4 million or 7.3 points for the quarter ended December 31, 2020 driven by deterioration in prior year loss reserves in both the Long-tail and Short-tail segments which were impacted by foreign exchange, specifically the strengthening of the Pound Sterling, the Company’s major transactional currency, against the U.S. Dollar. This compares to favorable development of $1.7 million or 3.0 points for the quarter ended December 31, 2019. Catastrophe losses during the fourth quarter of 2020 were driven primarily by Hurricane Laura, a Category 4 storm which caused significant damage in the mid-western U.S., and is included in the Short-tail Segment.

The claims and claims expense ratio was 53.5% for the year ended December 31, 2020, an improvement of 1.3 points compared to the year ended December 31, 2019. This included current accident year net catastrophe losses of $13.5 million or 4.8 points for the year ended December 31, 2020, compared to $16.2 million or 7.5 points for the year ended December 31, 2019. Catastrophe losses for the year ended December 31, 2020 were driven primarily by the storms that damaged cranes at the Jawaharlal Nehru port in Mumbai, India and property damage and business interruption losses resulting from Hurricane Laura, both of which are included in the Short-tail Segment. Favorable development on loss reserves from prior accident years for the year ended December 31, 2020 was $6.1 million or 2.2 points, reduced by the impact of foreign exchange, specifically the strengthening of the Pound Sterling, the Company’s major transactional currency, against the U.S. Dollar. This compares to favorable development of $6.3 million or 2.9 points for the year ended December 31, 2019, which was also impacted by strengthening of the Pound Sterling.

Net written premiums for the year ended December 31, 2020 in the Short-tail Segment were $154.8 million, an increase of $40.6 million compared to $114.2 million in the comparable period in 2019, primarily the result of increases in most Short-tail lines as well growth of the new U.S. Excess & Surplus business. The net underwriting result for this segment improved to $44.4 million for the full year 2020, compared to $35.4 million in the full year 2019, supported by 35.5% growth in net written premiums which was partially offset by a $ 12.7 million increase in net claims and claims adjustment expenses driven by higher incurred losses recorded in the Ports & Terminals, Energy, and Property lines in the Short-tail segment.

Investment Results

Total investment income was $4.5 million during the fourth quarter of 2020, compared to $2.9 million in the fourth quarter of 2019. Total investment income, net (which excludes realized and unrealized gains and losses, expected credit losses on investments, and the share of loss from associates) was $3.4 million and $2.7 million for the quarters ended December 31, 2020 and 2019, respectively. This resulted in an annualized investment yield of 1.8% for the fourth quarter of 2020, compared to 1.9% for the corresponding period in 2019.

For the full year 2020, total investment income was $8.5 million, compared to $13.0 million for the full year 2019. Total investment income, net was $11.5 million and $11.1 million for the full years 2020 and 2019, respectively. This resulted in an investment yield of 1.7% for the full year 2020, compared to 2.0% for the full year 2019.

Cash, cash equivalents and term deposits totaled $305.6 million at December 31, 2020, representing 39.4% of the total investments and cash portfolio, compared to $312.2 million at December 31, 2019, when it represented 51.6%. The total investment and cash portfolio is comprised of cash, cash equivalents and term deposits (cash portfolio), investments, investment in associates, and investment properties.

Other

Gain on foreign exchange for the quarter ended December 31, 2020 was $6.2 million compared to $2.5 million for the fourth quarter of 2019. The gain in the fourth quarter of 2020 was primarily driven by strengthening of the Pound Sterling, Euro and Australian Dollar against the U.S. Dollar from September 30, 2020 to December 31, 2020, coupled with greater exposure to Pound Sterling-denominated cash and insurance receivable balances, supported by increased business in the Specialty Long-tail Segment when compared to the corresponding period of 2019.

Gain on foreign exchange for the year ended December 31, 2020 was $2.5 million compared to $5.7 million for the full year 2019. The gain in 2020 was primarily driven by strengthening of the Pound Sterling, Euro and Australian Dollar against the U.S. Dollar from December 31, 2019 to December 31, 2020, coupled with greater exposure to Pound Sterling-denominated cash and insurance receivable balances, supported by increased business in the Specialty Long-tail Segment.

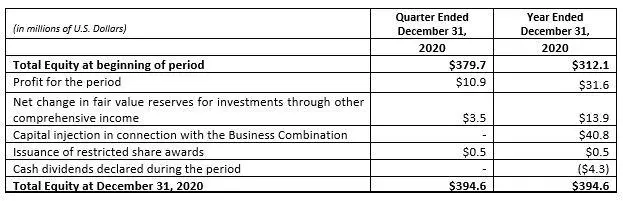

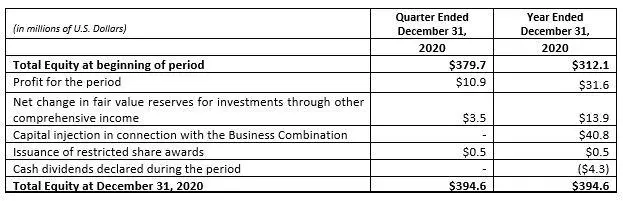

Total Equity

Total equity at December 31, 2020 was $394.6 million, representing an increase of 26.4% compared to $312.1 million at December 31, 2019. The movement in Total Equity during the quarter and year ended December 31, 2020 is illustrated below:

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.