PHOTO

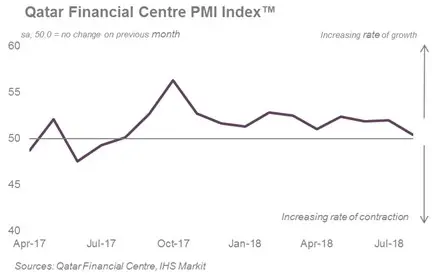

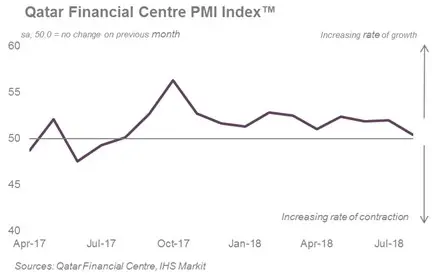

Qatar Financial Centre PMITM

- Business sentiment remains strong amid solid new order growth and marked job creation

- Supplier delivery times improve to survey-record extent

- Input costs faced by firms fall in August

Doha, Qatar: – Continuing the sequence recorded since August last year, business conditions across Qatar's non-oil and gas private sector improved once again according to the latest QFC Qatar PMI data. Despite the rate of expansion easing to a one-year low, growth of new business remained robust overall whilst job creation accelerated to a survey-record high amid elevated sentiment across the sector.

The survey, compiled for Qatar Financial Centre by IHS Markit, has been conducted since April 2017 and provides an early indication of operating conditions in Qatar. The headline figure derived from the survey is the Purchasing Managers' Index™ (PMI™).

Readings above 50.0 signal an improvement in business conditions on the previous month, while readings below 50.0 show a deterioration.

The headline seasonally adjusted Qatar Financial Centre PMI – a composite gauge designed to give a single-figure snapshot of operating conditions in the non-oil and gas private sector – softened to 50.4 in August, from 52.0 in July, partly reflecting a slight fall in output. The figure remained in positive territory, however, and stretched the current phase of expansion to 13 months.

August's survey data signalled a further improvement in new order inflows. Although the rate of growth eased, it remained solid overall. Anecdotal evidence suggested that the latest increase was linked to promotional activity and new product launches.

In response to increasing new orders and solid business confidence, firms upped their payroll count at a survey-record pace. The rate of job creation was marked overall, with the latest increase extending the current phase of growth to four months.

Prices pressures faced by businesses fell in the latest survey. In fact, the drop in input prices was the fastest since the survey's inception in April 2017. Survey data suggested that easing capacity pressures at suppliers were partly linked to the fall in input prices. Meanwhile, delivery times improved at a marked rate.

Partly reflecting falling cost burdens and promotional activity, selling prices set by Qatari private sector businesses dropped to a survey-record extent.

Despite softening to a three-month low in August, positive sentiment towards future growth prospects among Qatari non-oil and gas private sector firms remained strong overall. Many panel respondents reported optimism towards economic stability and new product launches.

Comment

“Qatar’s economic recovery continued in August, with the latest data extending the current run of expansion to 13 successive months. Whilst the headline PMI figure eased since July, there was a myriad of positive news uncovered by the latest survey. Job creation hit a survey-record high as firms sought to increase payroll numbers to meet growth inflows of new business. Furthermore, overall cost burdens faced by local businesses fell as supplier performance improved to a marked degree. Finally, client demand continued to expand, signalling that the softening in the sector’s rate of growth may prove short-lived.”

Sheikha Alanoud bint Hamad Al-Thani, Managing Director, Business Development, QFC Authority

-Ends-

The next Qatar PMI Report will be published on 3 October 2018 at 12:00 Doha (09:00 UTC)

ABOUT THE QATAR FINANCIAL CENTRE

The Qatar Financial Centre (QFC) is an onshore business and financial centre located in Doha, providing an excellent platform for firms to do business in Qatar and the region. The QFC offers its own legal, regulatory, tax and business environment, which allows up to 100% foreign ownership, 100% repatriation of profits, and charges a competitive rate of 10% corporate tax on locally sourced profits.

The QFC welcomes a broad range of financial and non-financial services firms.

For more information about the permitted activities and the benefits of setting up in the QFC, please visit www.qfc.qa

@QFCAuthority | #QFCMeansBusiness@QFCAuthority | #QFCMeansBusiness

MEDIA CONTACTS

QFC: Hala Kassab | T. +974 3300 0216 | E. h.kassab@qfc.qa

BLJ Worldwide: Shrief Fadl | +974 6685 1251| E. shrieff@bljworldwide.com

ENQUIRIES ABOUT THE REPORT

QFC: qatarpmi@qfc.qa

ABOUT IHS MARKIT

IHS Markit (Nasdaq: INFO) is a world leader in critical information, analytics and solutions for the major industries and markets that drive economies worldwide. The company delivers next-generation information, analytics and solutions to customers in business, finance and government, improving their operational efficiency and providing deep insights that lead to well-informed, confident decisions. IHS Markit has more than 50,000 business and government customers, including 80 percent of the Fortune Global 500 and the world’s leading financial institutions.

IHS Markit is a registered trademark of IHS Markit Ltd and/or its affiliates.

ABOUT PMI

Purchasing Managers’ Index™ (PMI™) surveys are now available for over 40 countries and for key regions including the Eurozone. They are the most closely watched business surveys in the world, favored by central banks, financial markets and business decision makers for their ability to provide up-to-date, accurate and often unique monthly indicators of economic trends.

To learn more go to https://ihsmarkit.com/products/pmi.html.

CONTACT

IHS Markit: Joanna Vickers |T. +44-207-260-2234 | E. joanna.vickers@ihsmarkit.com

© Press Release 2018Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.