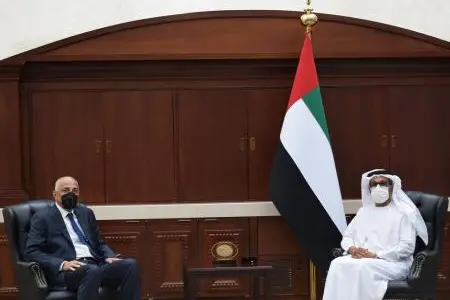

PHOTO

Abu Dhabi, United Arab Emirates: His Excellency Mohammed Saif Al Suwaidi, Director General of Abu Dhabi Fund for Development (ADFD), received a delegation from the Central Bank of Egypt led by the Governor His Excellency Tarek Hassan Amer. During the meeting, both parties discussed bilateral relations, economic cooperation as well as the significant role the UAE plays in leading efforts that help to drive sustainable economic development in Egypt. Attended the meeting by His Excellency Khalifa Abdulla Al Qubaisi, Deputy Director General of ADFD, and Mr. Rashed Al Kaabi, Director of the Investment Department at the Fund.

His Excellency Mohammed Saif Al Suwaidi welcomed the Governor of the Central Bank of Egypt and applauded the strong relationship between both countries in several fields. He emphasized that the Egyptian delegation's visit to ADFD is a great opportunity for dialogue and discussion on mechanisms to boost future cooperation and potential economic opportunities deemed as a national priority by the Egyptian government.

H.E Mohammed Saif Al Suwaidi stated that the Fund has had a strategic partnership with the Egyptian government for over 50 years and has supported economic development in Egypt, helping the country to achieve its development goals. The Director General of the Fund also reiterated ADFD’s vision to continue its developmental role by analyzing investment opportunities at the Central Bank and utilizing the Fund’s available investment tools in order to support the Egyptian government in its pursuit of its future aspirations.

The Governor of the Central Bank of Egypt commended the immense efforts by the UAE, represented by the Abu Dhabi Fund for Development, to help the Egyptian government achieve financial and economic stability, thanks to ADFD's support that is being utilized to fund development projects in key growth sectors.

H.E Tarek Amer also showcased reform programs and legislative measures taken by the Egyptian government that significantly contributed to creating an attractive investment environment, enabling the national economy to achieve positive results over the past years.

Since it commenced its activities in Egypt in 1974, the Abu Dhabi Fund for Development has funded more than 75 strategic projects in the country with a total value of approximately AED 3.3 billion in projects spanning several vital sectors. Moreover, the Fund owns an 84.3% stake in the Abu Dhabi Tourism Investment Company (ADTIC) in Egypt, which aims to support the tourism sector and improve tourist services in a key sector that supports economic growth in the country.

-Ends-

About Abu Dhabi Fund for Development (ADFD)

Abu Dhabi Fund for Development (ADFD) is a leading national entity for economic development aid owned by the Abu Dhabi government. Established in 1971, it aims to help emerging countries by providing concessionary loans to finance sustainable development projects as well as administering long-term investments and direct contributions. In addition to managing development grants offered by the Abu Dhabi government, ADFD has adopted a policy of supporting the national economy. Since its inception, ADFD has marked developmental milestones in 97 developing countries. Spanning the last 50 years, the Fund's development projects and investments, valued at more than AED150 billion, have helped the international community achieve sustainable economic growth as well as drive the implementation of the United Nations’ Sustainable Development Goals (SDGs).

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.