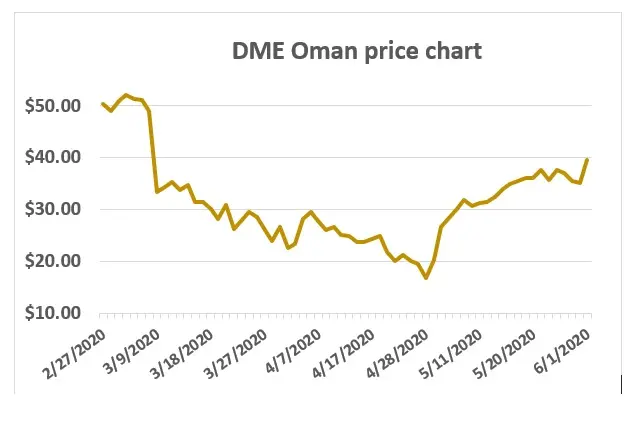

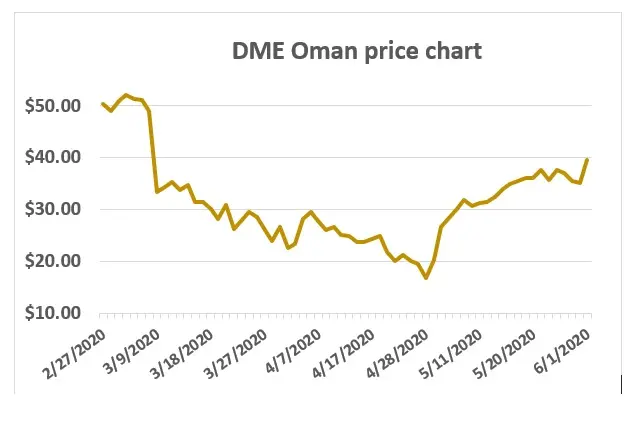

Dubai, UAE : Benchmark Oman crude oil trading on the Dubai Mercantile Exchange traded above $40 per barrel Monday for the first time in almost three months, making it the first internationally traded crude oil futures contract to break the $40/b mark since the oil price recovery started early May.

Front-month August DME Oman traded at a high of $40.09/b, up $0.30/b from Friday’s settlement price of $39.79/b. Oman last traded above $40/b on March 6 of this year.

The DME Marker Price for Monday was set earlier in the day at $39.62/b. The Marker Price is used by Middle East producers Saudi Arabia, Kuwait, Bahrain, Oman and Dubai in calculating the monthly Official Selling Price (OSP).

Middle East prices have recovered faster than those in Europe, with DME Oman trading at around $2/b over the Brent North Sea benchmark on Monday.

-Ends-

About Dubai Mercantile Exchange (DME):

DME is the premier international energy futures and commodities exchange in the Middle East. It aims to provide oil producers, traders and consumers engaged in the East of Suez markets with transparent pricing of crude oil.

Launched in 2007, DME has rapidly grown into a globally relevant exchange. Its flagship Oman Crude Oil Futures Contract (DME Oman) contract is now firmly established as the most credible crude oil benchmark relevant to the rapidly growing East of Suez market. Reflecting the economics of the Asian region like no other contract, and the largest physically delivered crude oil futures contract in the world, DME Oman is the world’s third crude oil benchmark and the sole benchmark for Oman and Dubai exported crude oil.

DME is a fully electronic exchange, with regulatory permissions allowing access from more than 20 jurisdictions, including the major financial centers of Asia, Europe and the United States. The Exchange is located within the Dubai International Financial Center (DIFC), a financial free zone designed to promote financial services within the UAE. The DME is regulated by the Dubai Financial Services Authority and all trades executed on the DME are cleared through and guaranteed by CME Clearing.

DME is a joint venture between Dubai Holding, Oman Investment Fund and CME Group. Global financial institutions and energy trading firms including Goldman Sachs, JPMorgan, Morgan Stanley, Shell, Vitol and Concord Energy also hold equity stakes in the DME. www.dubaimerc.com

For more information, please contact:

DME

Mayssam Hamadeh

Head of Marketing

+971 506523754 (mobile)

mayssam.hamadeh@dubaimerc.com

TRACCS (PR agency)

Walid Majzoub

+9714 3672530

walid.majzoub@traccs.net

TRACCS 24/7 Media Hotline: +97150 9448389

© Press Release 2020

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.