PHOTO

Reviving demand requires immediate measures and incentives from the government

Byblos Bank Headquarters: Byblos Bank issued today the results of the Byblos Bank Real Estate Demand Index for the first quarter of 2018.

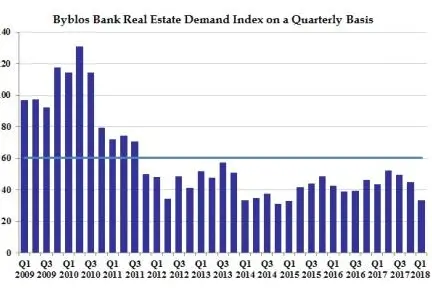

The results show that the Index posted a monthly average of 33.2 points in the first quarter of 2018, constituting a decline of 26.1% from 44.9 points in the fourth quarter of 2017 and a decrease of 23.7% from 43.5 points in the first quarter of 2017. The first-quarter results constitute their lowest level since the second quarter of 2015 and their third lowest level in 43 quarterly readings.

Further, the Index’s average monthly score in the first quarter of 2018 came 74.7% lower from the peak of 131 points registered in the second quarter of 2010, and remains 70% below the annual peak of 109.8 points posted in 2010. Also, it is 45% lower than the Index's monthly trend average score of 60.3 points since the Index’s inception in July 2007.

Commenting on the results, Mr. Nassib Ghobril, Chief Economist and Head of the Economic Research and Analysis Department at the Byblos Bank Group, said: "Demand for housing in Lebanon declined sharply in the first quarter of 2018 due to the suspension of interest-rate subsidies on housing loans at the beginning of the year.”

Mr. Ghobril pointed out that ''Banque du Liban, in cooperation commercial banks, has subsidized interest rates on housing loans since 2009 through various measures and mechanisms.'' He added “the subsidies were supposed to be temporary in order to give the executive branch time to develop a housing policy. But the successive governments took these measures for granted, as they assumed that the subsidies would continue indefinitely. Therefore, after citizens benefited for nearly nine years from these measures, the available funds to subsidize interest rates on mortgages dried up. This, in turn, reduced local demand and negatively affected citizens' decision to buy a house in the first three months of the year.'' He noted: ''it remains the sole responsibility of the executive branch to develop a housing policy that would provide citizens access to affordable housing, with the banking sector standing ready to support a properly developed housing policy.”

Mr. Ghobril indicated ''most Lebanese found themselves priced out of the market without any subsidy support, which significantly impacted their decisions to buy or build a house.'' He said that ''the suspension of the subsidy program will weigh on the willingness of prospective buyers to acquire a residential unit, given that buying a house constitutes one of the most important investment decisions for the Lebanese, and the value of a house is usually the single most important non-financial asset for Lebanese residents." In fact, the answers of respondents to the Index's survey questions in the first quarter reflected this trend, as only 3.8% of Lebanese residents had plans to either buy or build a residential property in the coming six months compared to 5.1% in fourth quarter of 2017. In parallel, 6.8% of residents in Lebanon, on average, had plans to buy or build a residential unit in the country between July 2007 and March 2018, with this share peaking at nearly 15% in the second quarter of 2010.

Further, Mr. Ghobril considered that ''the intentions of the Lebanese to buy or build a house need a conducive environment in order to translate into actual sales, which, in turn, requires immediate measures and incentives from the government.'' In this context, Mr. Ghobril reiterated the need for the government to revive demand through two immediate measures. First, the government should inject USD 500 million into the banking system in 2018 in order to revive the mortgage subsidies. Second, the government should reduce from 6% to 3% the registration fee on all purchased residential units, not just on apartments whose price is USD 250,000 or less as stipulated in the government’s budget for 2018. He noted that buyers of apartments that are priced at USD 250,000 or less were already exempt from registration fees if they qualified for loans through the Public Corporation for Housing, which was the case for the vast majority of mortgages that commercial banks approved in 2017.”

The results of the Index show that demand for housing was the highest in the North in the first quarter of 2018, as 6% of its residents had plans to build or buy a house in the coming six months, compared to 9.8% in the fourth quarter of 2017. Beirut followed with 4.6% of its residents planning to build or buy a residential unit in the coming six months, unchanged from the preceding quarter; while 3.4% of residents in the South had plans to buy or build a house, down from 4.5% in the previous quarter. In addition, 3.2% of residents in Mount Lebanon intended to buy or build a house, down from 4.3% in the preceding quarter, while 1.7% of residents in the Bekaa had plans to build or buy a residential unit, down from 2.1% in the fourth quarter of 2017. In parallel, real estate demand decreased among all income brackets in the first quarter of 2018.

The Byblos Bank Real Estate Demand Index is a measure of local demand for residential units and houses in Lebanon. The Index is compiled, implemented and analyzed in line with international best practices and according to criteria from leading indices worldwide. The Index is based on a face-to-face monthly survey of a nationally representative sample of 1,200 males and females living throughout Lebanon, who reflect the demographic, regional, religious, professional and income distribution of Lebanon. The surveyed persons are asked about their plans to buy or build a house in the coming six months. The Byblos Bank Economic Research and Analysis Department has been calculating the Index on a monthly basis since July 2007, with November 2009 as its base month. The survey has a margin of error of ±2.83%, a confidence level of 95% and a response distribution of 50%. The monthly field survey is conducted by Statistics Lebanon Ltd, a market research and opinion-polling firm.

© Press Release 2018