PHOTO

- UAE’s leading Fintechs and regulators call for further collaboration at inaugural Fintech Surge

- Customer-centric financial options at the forefront for the MENA region

Dubai, UAE: The transformative potential of multi-industry Blockchain technologies and fintech was in the spotlight as the 4th Future Blockchain Summit and inaugural edition of Fintech Surge got under way as part of GITEX Global, the world’s largest technology showcase of the year, at Dubai World Trade Centre.

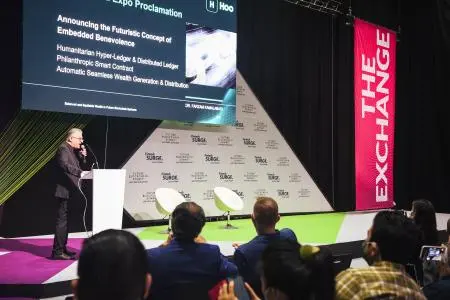

Dr Farzam Kamalabadi, president of the Future Trends Group and Executive Chairman of Hyper Optimum Organisation (HOO), a Blockchain assets service platform, emphasised the need to evolve the sector in an ethical way in his address.

Dr Kamalabadi discussed his own ambition to create a framework and system that would offer potential for multi-dimensional growth while onboarding non-crypto communities. He said: “Through a methodology of what I call vortex creation, the swap of shares and hubs and extraction coins, we can create clusters and grow into conglomerate creation, bringing in many more projects and increasing traders.

“Through multi-linear and multi-dimensional growth, organisations can multiply quickly, and help others to progress in the correct way. The industry currently has a mix of correct and incorrect ways of operating; it is full of successes and many more failures. We want to reduce those failures and increase the successes by sound methodology and wealth generation that contributes to society, spreading the wealth generation to more than a few institutions.”

The future outlook for open banking in the region was also discussed in a panel session that brought together the UAE-founded Fintech Galaxy, a global platform that fuels innovation in financial services, and the UAE’s Securities and Commodities Authority.

Mirna Sleiman, founder and CEO of Fintech Galaxy, said: “Our vision has always been to bring the whole region onto one platform, and we want to bring the local ecosystem up to par with global mindset.”

Pooja Singh, CFA International Organisations Expert at Securities and Commodities Authority, added: “As regulators we have to understand that our job is to ensure that the market develops and today, there’s no other way then through technology.

“We don’t always know what the industry is doing, yet we have to regulate these changes. Working and developing these challenges means we can learn how APIs interplay with the institutions we regulate. We worked earlier this year with Fintech Galaxy to launch a hackathon so we could see what areas needed attention and regulation. This collaboration and many others help us learn how APIs are needed for the market and in turn help us create the regulations that are also API friendly, ensuring it works well for the wider markets and industry growth.”

In the Fintech Surge event, Walid Hassouna, CEO of EFG Hermes and Ahmed Osama Abdelkader, Chief Risk Officer of EFG Hermes, explained the journey of Egyptian fintech valU, the Middle East’s first BNPL (buy now pay later) platform. The app, which was launched in 2017 to provide customers with an alternative financing option, enjoys run rates of over 40,000 loans per month.

Hassouna said: “We started in this market when there was no other player in the region or Egypt, and now we offer BNPL solutions for more than 5,000 brands and more than 250 websites. We are the sole BNPL for Ikea and Amazon in Egypt. We are the only company that underwrites students, and we offer a solution for every stage of life, from age 18 through to 65 in categories such as education, home improvements, car loans and fashion.”

Another session discussed the changing face of crowdfunding, and its regulations. Siddiq Farid, founder of Smartcrowd, highlighted the evolving space in the region, adding: “The space is very nascent in the region. The UAE is the first country to have the crowdfunding framework in the entire region, and it is not as developed as the US for example. There are lots of similarities in restrictions on how much can be raised or invested for example. Work still needs to be done to realise the power of the crowd. Everyone should have the same opportunities as those who have a lot of money.”

Fintech Surge and Future Blockchain Summit are part of GITEX GLOBAL, the world’s most complete, experiential technology event, which runs at DWTC until 21 October, and unites international innovators in artificial intelligence, 5G, cloud, big data, cybersecurity, Blockchain, quantum computing, fintech and immersive marketing across six events – GITEX GLOBAL, Ai Everything, GITEX Future Stars, the Future Blockchain Summit, Fintech Surge and Marketing Mania.

-Ends-

About Dubai World Trade Centre:

With a vision to make Dubai the world’s leading destination for all major exhibitions, conferences and events, DWTC has evolved from being the regional forerunner of the fast-growing MICE industry into a multi-dimensional business catalyst, focusing on Venues, Events and Real Estate Management. Complementary to the primary service offerings are a range of value-added services from media/advertising, engineering and technical consultation and wedding planning, security services and an award-winning hospitality portfolio.

For more information, please contact:

James Dartnell (English)

Manager – PR & Media Relations

+971 4 308 6354

james.dartnell@dwtc.com

Sura AlYaziji (Arabic)

Manager – PR & Media Relations

+97 150 380 3852

Sura.AlYaziji@dwtc.com

Or, reach out to Future Blockchain Summit and Fintech Surge 2021’s official PR agency, Action Global Communications, via: fbs@actionprgroup.com

© Press Release 2021

Disclaimer: The contents of this press release was provided from an external third party provider. This website is not responsible for, and does not control, such external content. This content is provided on an “as is” and “as available” basis and has not been edited in any way. Neither this website nor our affiliates guarantee the accuracy of or endorse the views or opinions expressed in this press release.

The press release is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Neither this website nor our affiliates shall be liable for any errors or inaccuracies in the content, or for any actions taken by you in reliance thereon. You expressly agree that your use of the information within this article is at your sole risk.

To the fullest extent permitted by applicable law, this website, its parent company, its subsidiaries, its affiliates and the respective shareholders, directors, officers, employees, agents, advertisers, content providers and licensors will not be liable (jointly or severally) to you for any direct, indirect, consequential, special, incidental, punitive or exemplary damages, including without limitation, lost profits, lost savings and lost revenues, whether in negligence, tort, contract or any other theory of liability, even if the parties have been advised of the possibility or could have foreseen any such damages.