PHOTO

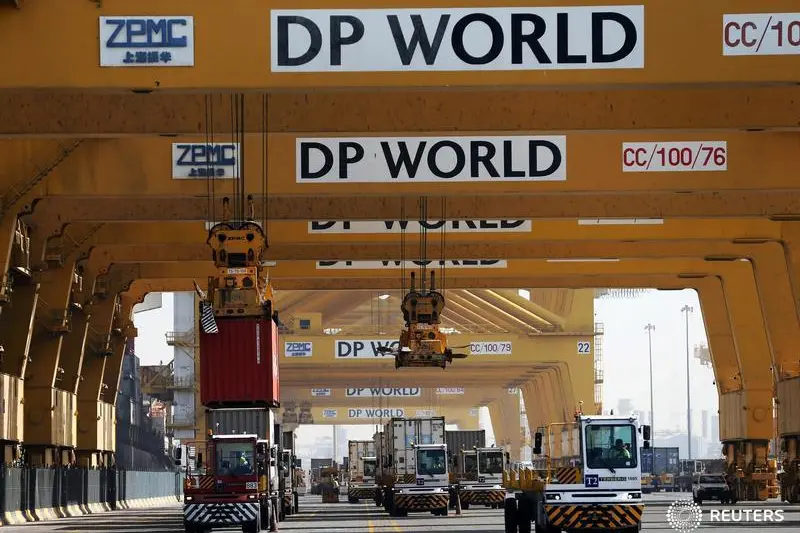

DUBAI- Nasdaq Dubai today welcomed the listing of a US$1 billion Sukuk and a $300 million conventional bond issued by global trade enabler DP World.

DP World is the largest UAE debt issuer by value on the region’s international exchange, with Sukuk and conventional bond listings now totaling $8.09 billion.

The $300 million conventional bond that listed today was a tap issuance on a $1 billion bond that DP World issued in September 2018.

DP World operates a geographically diverse network of trade enabling businesses including ports and terminals, industrial parks, logistics and economic zones, maritime services and marinas. DP World’s latest $1 billion Sukuk underlines Dubai’s role as one of the largest global centres for Sukuk listings by value, with a current total of $62.35 billion.

© Copyright Emirates News Agency (WAM) 2019.