PHOTO

Shares in Saudi Arabia’s United Electronics Company (Extra) edged lower this week despite the company on Sunday reporting a 9 percent increase in fourth quarter (Q4) net profit for last year.

Q4 2018 estimated net profit after zakat and tax stood at 62.9 million Saudi riyals ($16.8 million), compared to 57.7 million Saudi riyals a year ago, broadly in line with estimates by Al Rajhi Capital.

Al Rajhi Capital said in a note sent to the media that the stock price has gained close to 11 percent over the past three months and is trading near Al Rajhi’s target price and consequently they remain “Neutral” on the stock.

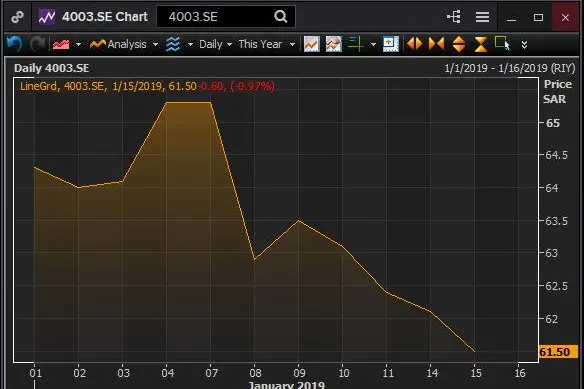

The Riyadh-based financial firm's target price for Extra is at 60 Saudi riyals. At the end of the trading session on Tuesday, Extra's stock was trading at 61.5 Saudi riyals.

Shares in Extra dropped 0.97 percent on Tuesday, have dropped 3.91 percent since the start of 2019 and have fallen more than 2 percent since the start of this week. Saudi Arabia’s index gained 0.93 percent on Tuesday and has now gained 6.66 percent so far this year.

“For 2019, we remain cautious due to shrinkage in the overall market amid economic uncertainty,” Al Rajhi Capital said in a note sent to the media.

“However, starting from 2020 we expect Extra’s growth to recover underpinned by expansion in the instalment program “Tasheel” (expected to reach SAR500mn book value) and elevated digital sales (Extrastores.com, Noon.com) which will drive higher LFL (like for like) sales,” Al Rajhi’s note added.

Tasheel installment is a financing program designed to help finance products from Extra stores.

Q4 estimated revenue amounted to 1.62 billion Saudi riyals, compared to 1.61 billion Saudi riyals for the same period last year.

“The company has gained notable market share from shift of the market towards organised players, as the market share increased by 21 percent to stand at 16.5 percent (13.6 percent in 2017),” Al Rajhi Capital’s note said.

“We believe that the company is well positioned to continue gaining market share on the back of Saudization and higher penetration into e-commerce sales channel,” the note added.

According to data from Eikon, three analysts have a 'buy' rating on the stock, three analysts have a ‘hold’ rating and one analyst has a 'sell' rating.

Elsewhere in the region, Dubai’s index fell 1.45 percent on Tuesday, Abu Dhabi’s index edged 0.32 percent lower, Qatar’s index gained 0.86 percent, Oman’s index fell 0.67 percent, while Kuwait’s premier market index added 3.87 percent, Bahrain’s index edged 0.27 percent lower and Egypt’s blue-chip index EGX30 added 0.84 percent.

(Reporting by Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@refinitiv.com)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019