PHOTO

The Saudi economy shrank by 1 percent year-on-year in Q1. Though a recovery is likely later this year, supported by the lifting of lockdown restrictions, this will be held back by the imposition of fiscal austerity, including the tripling of the VAT rate that takes effect from today.

"This negative growth originated mainly from the contraction in the oil sector by 4.6 percent, while the non-oil sector recorded a positive growth rate of 1.6 percent," the General Authority for Statistics said.

However, the economic indicators for the second quarter point to a sharp downturn.

The kingdom's move to reduce oil production will act as a major drag on the economy. Moreover, the lockdown led to a slump in non-oil activity.

According to Capital Economics, lockdown will result in weak domestic demand. Non-oil imports fell 28.4 percent Y-o-Y in April. ATM withdrawals and point of sale transactions, proxies for consumer spending, plunged by more than 30 percent Y-o-Y in April and May. And, as construction activity dried up, local deliveries of cement and clinker fell by more than 25 percent Y-o-Y over the same period.

"The government ended the country’s lockdown earlier this month and there are signs that economic activity has started to recover. Nonetheless, we expect the recovery to be relatively slow-going as fiscal austerity measures bite," Jason Tuvey, Senior Emerging Markets Economist at Capital Economics said in a note.

On May 11th, the kingdom announced that The Cost of Living Allowance will be suspended from June and the VAT rate will triple from 5 percent to 15 percent, effective 1st July. Increasing the VAT will cause inflation to jump from 1.1 percent year-on-year in May to 5.5-6. percent year-on-year in July weighing heavily on household incomes.

Saudi Minister of Finance, Mohammad Al Jadaan, said the measures were imposed to protect the kingdom’s economy and overcome the unprecedented global COVID-19 pandemic crisis and its financial and economic repercussions with the least possible damage.

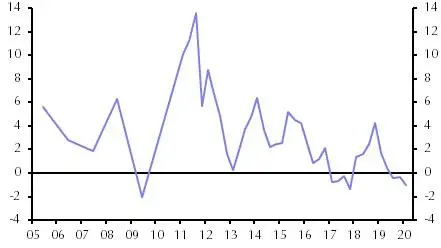

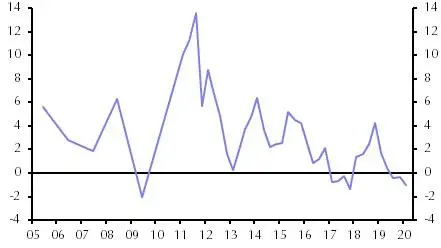

Saudi GDP over the years. Source: Capital Economics

The new VAT regime would affect consumption and lifestyle patterns and that would in turn reflect the economic performance of the country.

Nicholas Soverall, Head of Indirect Tax at KPMG in Saudi Arabia, said: "Due to the high rate, I would expect a significant drop in spending after VAT is implemented. Again, it will be much likely [similar] to what was experienced in early 2018, but for a much more sustained period. It will also result in a decrease in net disposable income of consumers and immediate inflationary effect."

Businesses are expected to experience a major impact both commercially and administratively and should ensure readiness for effective transition by focusing on whether they can accommodate multiple rates and trace and account transactions before and after the VAT change.

"Businesses could face challenges such as accounting for VAT in different scenarios such as rebates, discounts, advances, etc. Contracts, where the pricing or VAT rate is fixed, raise a concern especially when the delivery takes place post-July 1 as it may have a direct impact on profits," Soverall said in a webinar.

(Reporting by Seban Scaria; editing by Anoop Menon)

#SAUDI #VAT #ECONOMY #TAXATION

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2020