PHOTO

The global Islamic finance industry will continue to expand slowly in 2019-2020. However, inclusive standardization, fintech and a focus on the industry's social role could help spur growth in the next few years.

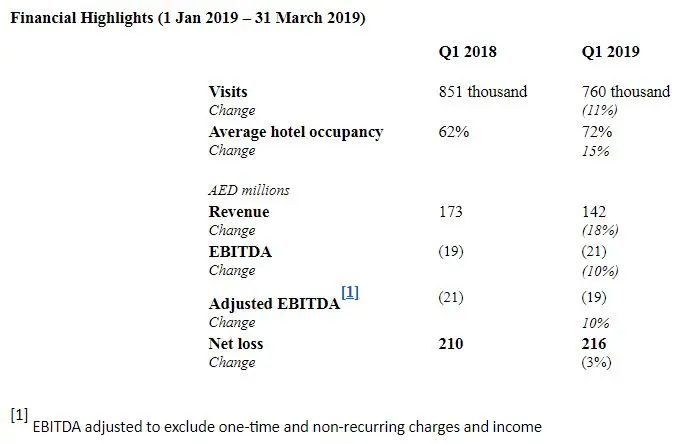

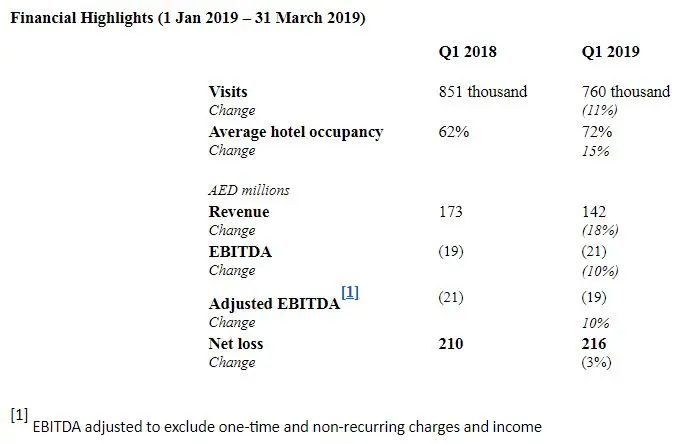

A new report from S&P Global Ratings estimates the Islamic finance industry to show only about 5 percent growth in 2019-2020, owing to tepid economic conditions in certain core markets.

"Fintech could stimulate growth by making transactions quicker, more secure, and easier to implement. We believe the social role of Islamic finance could unlock new growth opportunities as core markets implement the U.N. Sustainable Development Goals, and issuers and investors become more sensitive to environmental, social and governance (ESG) issues," said Mohamed Damak, S&P Global Ratings Head of Islamic Finance.

Factors holding back growth

In 2019, the market is not expected to fare much better owing to volatility in key parameters such as oil prices and geopolitical risks.

The growth of banking assets has also slowed down in almost all core Islamic finance markets. Turkey and Iran lead the decline under a trend that is expected to continue in the next 12-24 months. Malaysia, Indonesia, and the GCC countries were among the few sources of industry growth.

As the economic cycle might turn at some stage, a low-single-digit growth rate over the next two years is a fair assumption, S&P Global Ratings said.

The Islamic finance industry expanded by about 2 percent in 2018 compared with 10 percent in 2017 with strong support from the sukuk market.

In 2017, most of the growth stemmed from jumbo sukuk issuances in some Gulf Cooperation Council (GCC) countries, but this was followed by an about 5 percent reduction in issuances in 2018.

Potential accelerators such as inclusive standardization, fintech disruption and ESG opportunities are expected to provide new growth prospects for the industry.

Inclusive standardisation

S&P Global Ratings defines inclusive standardisation as the standardisation of Shariah interpretation and legal documentation that accommodates the requirements of the stakeholders.

For issuers, inclusive standardization would mean less complexity and time needed to put together their sukuk and tap the market. Ideally, an issuer would be able to take a set of standard legal documents, plug-in its underlying asset, and go to the market. The process should be equivalent from a time, effort, and price perspective to issuing a conventional bond, the report said.

For investors, inclusive standardization means the capacity to understand the risks related to their instruments and avoid situations where they lose money because they, or any other stakeholders, have interpreted the legal provisions of sukuk contracts in a specific way.

For Shariah scholars, inclusive standardization means factoring the requirements of the market and creating some room for innovation.

"We believe that regulators, sukuk issuers, and investors should also have their say, and a more inclusive consultative process can help the market move forward more quickly. This process would ultimately lead to the standardization of the full spectrum of sukuk--from fixed-income to equity-like instruments," read the report.

Fintech disruption

Fintech is expected to help unlock new growth opportunities through the faster execution and better traceability of transactions.

S&P Global Ratings has identified four aspects of fintech - speed and tracebility of transactions, accessibility of Islamic Finance services and improved governance - that could help the industry.

Ease and speed of transactions holds true for payment services and money transfers. Islamic finance industry players can benefit from the possibilities fintech and other innovations offer to enhance their services and attractiveness.

Using blockchain could help reduce the industry's exposure to risks related to transaction security or identity theft. It could also disrupt the way sukuk are issued and managed. Blockchain could resolve challenges related to sukuk issuance and management.

Fintech could also help the industry broaden its reach and tap new customer segments currently excluded from the banking system. For example, mobile banking for clients in remote areas, or the provision of products such as crowdfunding for affordable housing or small and midsize enterprises (SMEs).

Improved governance implies that regulatory technology could help the Islamic finance industry with more robust tools to achieve compliance with regulations and Shariah requirements, assuming agreed Shariah standards are in place. It could also minimize the reputation risk related to a potential breach of Shariah requirements, and free up Sharia scholars to focus on innovation.

ESG Opportunities

Islamic finance, shares some links with ESG considerations.

For example, Islamic finance's goal to protect life aligns with sustainable finance principles, which emphasize environmental and social protection. These include either refraining from developing or financing operations that could harm the environment or the health or wellbeing of humankind.

Green sukuk is an example of instruments that can be used to finance environmentally friendly projects. Green sukuk issuance has almost equaled the 2018 total so far this year.

(Writing by Seban Scaria, editing by Daniel Luiz)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019