PHOTO

Price declines in real estate markets in Saudi Arabia, the United Arab Emirates and Qatar are likely to persist given an oversupply in the market and regional tensions, but there are country-specific reasons for optimism in each market, according to a new paper from the Institute of International Finance (IIF).

The paper states that real estate in the region "has often operated on a model that emphasises excess for the sake of excess" and as a result the market is oversaturated with huge developments that have low levels of product differentiation. It also pointed to recent figures from JLL Mena stating that supply in Dubai is set to undergo an average annual increase of 8 percent over the next two years, "far outpacing the projected 2.5 percent increase in the resident population".

JLL MENA's Q1 Dubai report states that the number of residential units in Dubai is scheduled to increase to 652,000 by the end of 2021, up from 520,000 at the end of last year.

In Saudi Arabia, the IIF paper blamed real estate market weakness on fiscal consolidation policies entered into as oil prices declined, citing the removal of housing subsidies and a "steady exodus" of foreign labour as Saudisation policies ramp up in the private sector.

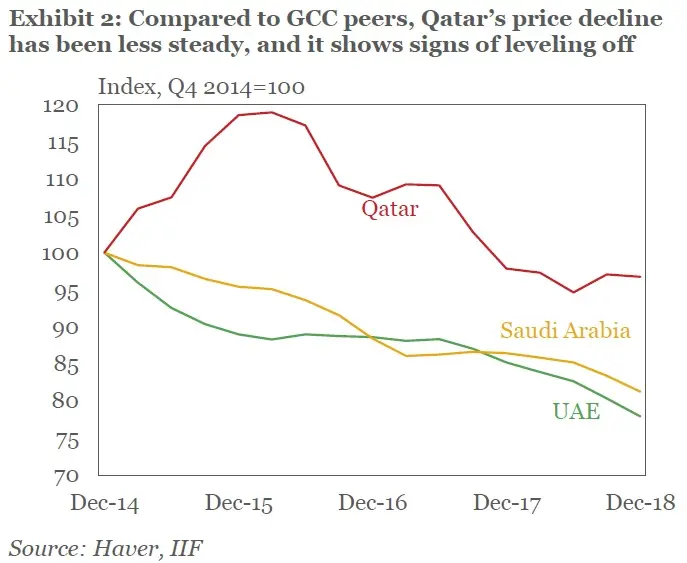

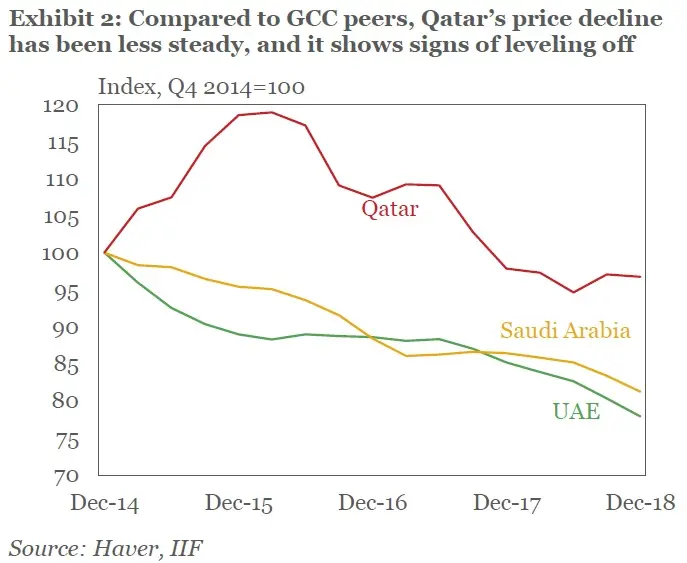

The IIF's paper also said political tensions have played a role in the region’s real estate weakness, citing the ongoing tension between Qatar and its neighbours, which began in June 2017 when Bahrain, Egypt, Saudi Arabia and the United Arab Emirates cut diplomatic and economic ties with the country, accusing it of funding terrorism. Qatar has denied the charges.

The rift not only spurred a withdrawal of Qatari investors from the Dubai property market, it also impacted Qatar. The IIF’s paper said real estate prices in Qatar continued to climb for a year after the oil price crash, and have “not declined uniformly” since, posting the occasional quarterly uptick, they witnessed the steepest decline in the four quarters following the rift.

The IIF also pointed to the impact of real estate price declines on banking, with home loans comprising around 20 percent of total consumer credit in the UAE, and a similar level in Qatar, meaning falling prices can cause non-performing loans (NPLs) to rise – “in the UAE, for example, NPLs have consistently exceeded 6 percent of total loans since 2013”.

Reasons to be cheerful

Despite this, it said there were country-specific reasons for optimism in each market. In Saudi, for instance, the government has announced a series of affordable housing programmes, while in the UAE stimulus measures have included changes to the visa regime and the cutting of some government fees.

It also said both Dubai and Qatar also have “upcoming large global events” in terms of the Expo 2020 and the 2022 World Cup, which should provide growth impetus.

“Governments across the GCC are also engaging in stimulus initiatives to expand consumer financing, facilitate trading of real estate investment trusts and liberalise ownership regulations,” the IIF’s paper said.

Anum Hasan, a senior market research analyst at real estate consultancy Valustrat, said in a telephone interview that prices in Qatar have witnessed a 27 percent decline since the start of 2016, but she added that “in some areas now they have started showing resilience”.

In a telephone interview with Zawya, she said that the government in Qatar has continued to support the real estate sector “directly or indirectly”, through injecting money into projects and into semi-government developers.

As a result, although valuations are declining, she said there had been a 15-20 percent year-on-year rise in the number of real estate transactions in the first quarter of this year.

Simon Townsend, senior director and head of strategic advisory at CBRE MENAT, argued that in Saudi Arabia, a “significant growth in commercial real estate activity coupled with the changes to the entertainment landscape will likely bring positive benefits to the residential sector”.

“In the UAE, we are beginning to see the impact of the Abu Dhabi stimulus package and may experience potential changes to ownership regulations in the short term. Of course, Expo 2020 is also expected to positively impact the entire industry as we move forward,” he added.

(Reporting by Michael Fahy; Editing by Anoop Menon)

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2019