PHOTO

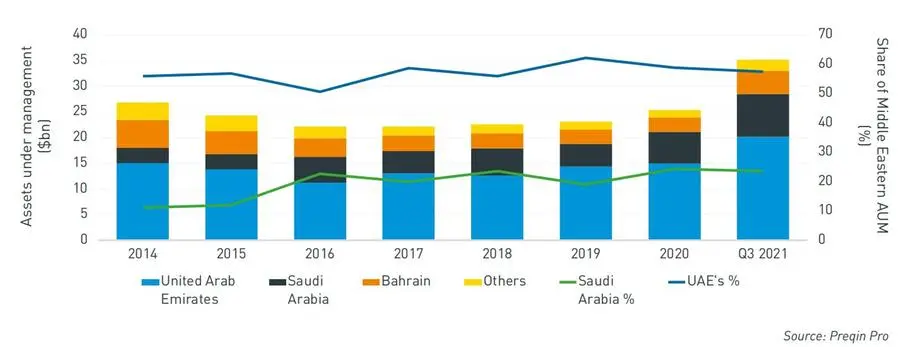

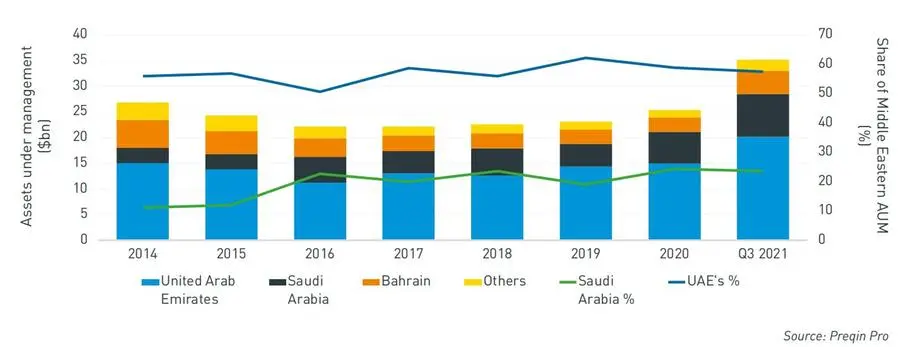

The value of assets under management (AUM) in the Middle East has rebounded after a contraction in 2015 and 2016 and is poised to increase further on the back of rising energy prices, a new report said.

Since the end of 2019, AUM in the region has been consistently on an uptrend, rising by 52 percent, according to Preqin, a privately held UK-based investment data company. As of the third quarter in 2021, the region’s AUM reached $35 billion, exceeding the $25 billion recorded in 2020.

“We expect this to increase further, given the dramatic rise in oil and gas prices,” Preqin said in its report out Wednesday.

Among the key markets in the region, the UAE and Saudi Arabia continue to account for the largest share of AUM. However, Saudi Arabia has been increasing its share of Middle East-based AUM, which has jumped from 11 percent in 2014 to 24 percent as of the third quarter last year.

Higher oil and gas prices have been a boon for the region’s AUM, with the recent price increases driving private capital’s improved fortunes in the Middle East. According to Peqin, the current period of increased revenues from commodity exports into private industry and government coffers could create opportunities to speed up economic diversification efforts.

However, the trend could change in the long term due to a greater push for lower reliance on imported hydrocarbons.

“The ongoing conflict in Ukraine alongside the continued post-pandemic economic resurgence is pushing commodity prices higher, creating short-term opportunities,” Peqin’s report stated.

“But in the long term, Europe’s government are looking to reduce reliance on imported hydrocarbons. Efforts to increase energy independence and step away from imported hydrocarbons have major implications for the Middle East.”

Middle East-based private capital assets under management by location, 2014 – Q3 2021

Source: Preqin

(Reporting by Cleofe Maceda; editing by Seban Scaria)