PHOTO

Oil prices

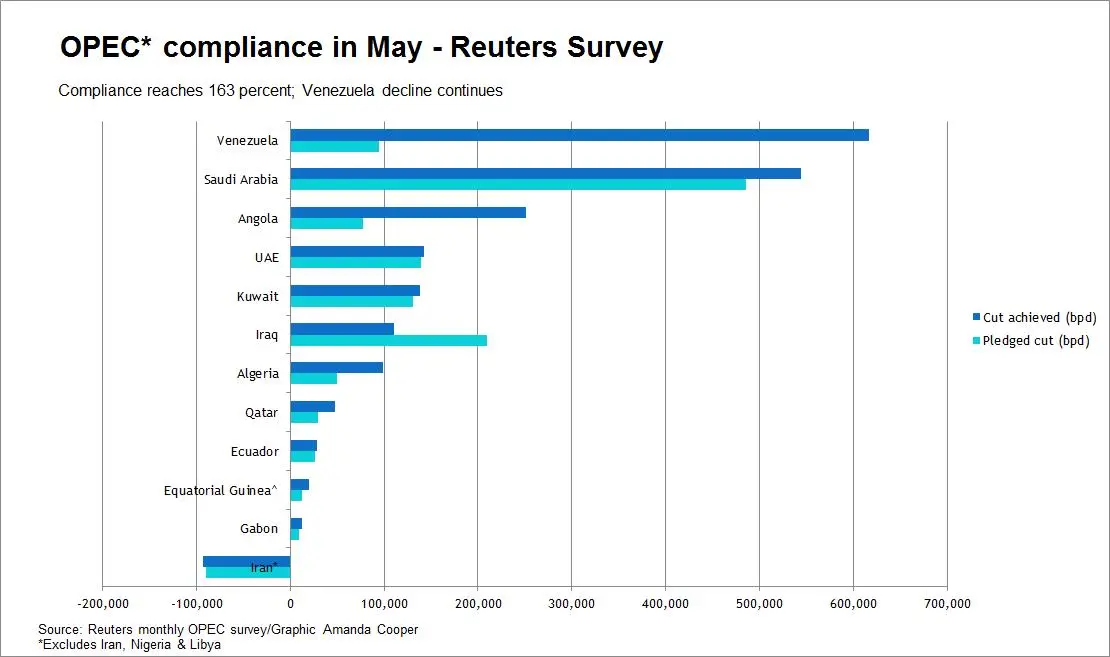

Oil prices rose sharply on Friday after OPEC decided on only modest increases in crude production.

U.S. crude rose 5.77 percent to $69.32 per barrel and Brent was last at $75.61, up 3.5 percent on the day.

“There was a lot of anticipation in the market that there was going to be a lot of new oil coming to market, and that isn’t going to happen, at least for now,” John Kilduff, a partner at Again Capital, told Reuters.

OPEC agreed with Russia and other oil-producing allies over the weekend to raise oil output from July.

Gain a deeper understanding of financial markets through Thomson Reuters Eikon.

Global markets

Investors were worried last week about the possibility of a trade war between the United States and China, which sent equities lower, but global markets regained some ground on Friday.

MSCI's gauge of stocks across the globe gained 0.49 percent for the day, but for the week fell 1 percent in its biggest weekly drop in three months.

The pan-European FTSEurofirst 300 index rose 1.18 percent.

“The market’s saying we’re a little nervous about a trade war but we really don’t think there will be one,” Gail Dudack, chief investment strategist at Dudack Research Group, told Reuters. “Nothing major has happened today so the market is rebounding having discounted a lot of trade fears already.”

On Wall Street, the Dow Jones Industrial Average rose 119.19 points, or 0.49 percent, to 24,580.89 snapping an eight-day losing streak. The S&P 500 gained 5.12 points, or 0.19 percent, to 2,754.88, and the Nasdaq Composite dropped 20.14 points, or 0.26 percent, to 7,692.82.

Middle East markets

Middle East stock markets were mixed on Thursday with Saudi Arabia’s market rising after index provider MSCI announced it would add the kingdom's stock market to its emerging markets benchmark. The decision is expected to attract massive foreign inflows from funds.

Saudi Arabia's index gained 0.5 percent, helped by shares in insurance firms and financial institutions.

In Dubai, the index rose 0.2 percent as property and banking shares gained. Dubai's largest listed developer Emaar Properties rose 1.2 percent and rival DAMAC Properties ended the day 1.3 percent higher.

Abu Dhabi's index closed the day 0.3 percent lower, weighed down by telecom and financial shares.

Qatar’s index rose 0.5 percent as blue chip Industries Qatar gained 1.8 percent and lender Masraf Al Rayan added 1.9 percent.

Egypt’s index gained 1.3 percent, Bahrain’s index added 0.6 percent while Kuwait’s index lost 0.2 percent and Oman’s index gained 0.4 percent.

Currencies

The dollar index, which tracks the dollar against six major currencies, fell 0.22 percent. The euro was up 0.5 percent to $1.1659.

Precious metals

Gold prices rose on a weaker dollar. Spot gold gained 0.2 percent at $1,268.76 per ounce by 1734 GMT.

U.S. gold futures for August delivery settled up 20 cents, 0.02 percent, at $1,270.70 per ounce.

In other news

Morocco’s High Planning Commission said on Friday that annual consumer price inflation slowed slightly to 2.6 percent in May from 2.7 percent in April.

(Writing Gerard Aoun; Editing by Shane McGinley)

(gerard.aoun@thomsonreuters.com)

A new version of the Trading Middle East newsletter is being launched on June 27, 2018. To keep receiving the newsletter after this date, please subscribe using this link.

Our Standards: The Thomson Reuters Trust Principles

Disclaimer: This article is provided for informational purposes only. The content does not provide tax, legal or investment advice or opinion regarding the suitability, value or profitability of any particular security, portfolio or investment strategy. Read our full disclaimer policy here.

© ZAWYA 2018