PHOTO

The Middle East and Africa (MEA) region holds significant potential to become a global hub for carbon capture and storage (CCS), according to a new industry analysis.

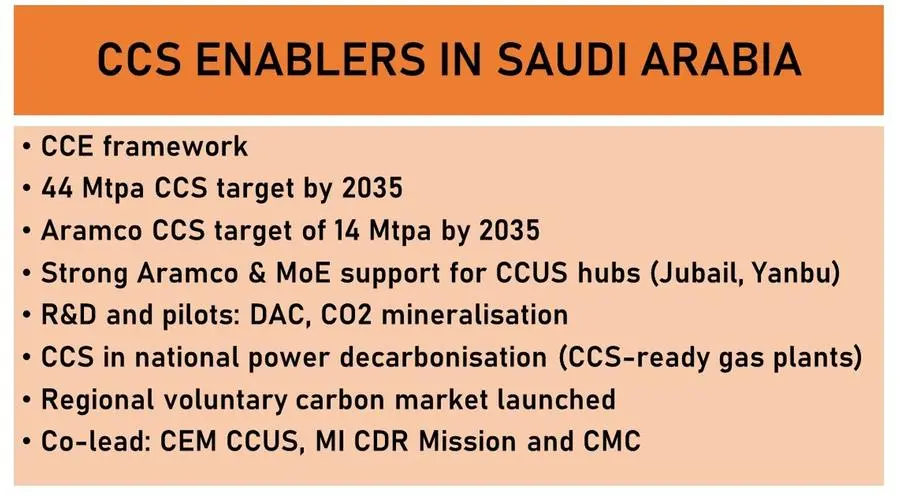

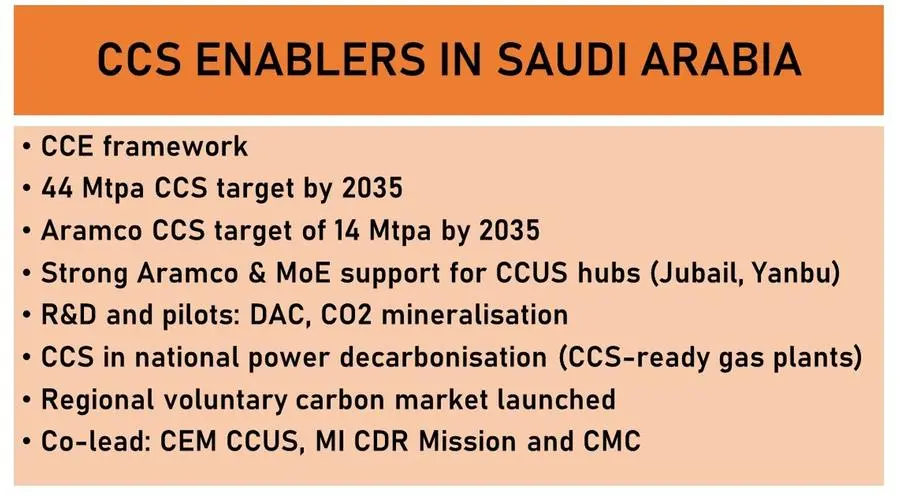

Countries including Saudi Arabia, the UAE, Nigeria, Mozambique, Egypt, and South Africa possess vast and underutilised geological storage capacity, positioning them to lead in CCS deployment, Global CCS Institute said in its ‘Global Status of CCS 2025’ report.

As global demand for low-carbon products and carbon credits rises, MEA nations could leverage CCS to maintain export competitiveness, particularly in sectors affected by carbon border adjustment mechanisms such as the EU’s CBAM, the report noted.

Technological innovation is also advancing in the MEA region - Kenya’s Octavia Carbon is piloting direct air capture (DAC) integrated with geothermal energy, while Saudi Arabia’s NEOM project is exploring mineralised concrete using CarbonCure technology.

Private sector involvement is also expanding, with national oil companies, industrial players, and start-ups showing growing interest in CCS as a climate and business solution. Cross-border partnerships with Europe and Asia, including CO2 import and low-carbon hydrogen investment, are also emerging.

However, a key challenge for the region is lack of comprehensive legal and regulatory frameworks for CO2 storage, transport, and liability.

“While progress is being made, particularly in the UAE and Oman, many jurisdictions still lack clarity on permitting, access rights, and long-term stewardship,” the report noted.

High cost of capital, limited public finance and weak carbon pricing signals are also barriers to scaling projects beyond the pilot stage.

“Scaling CCS from pilot to commercial scale will require de-risking investments through public-private partnerships (PPP), concessional finance, and clearer revenue models,” the report said.

For CCS to move beyond the demonstration phase to a broader deployment, the region required robust monitoring, reporting, and verification (MRV) systems, transparent carbon credit standards, and stronger governance in voluntary carbon markets.

Institutional clarity, streamlined approvals, and regional autonomy are seen as critical to avoiding bureaucratic delays. Despite these hurdles, the report concludes that with policy support, infrastructure expansion, and innovation, the MEA region is well-positioned to become a global leader in CCS.

(Writing by SA Kader; Editing by Anoop Menon) (anoop.menon@lseg.com)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.