PHOTO

The Gulf Cooperation Council (GCC) countries are poised to generate additional revenue streams in the short to medium term by prioritising the development of their green hydrogen sectors, Claude Mourey, Director of Hydrogen and New Energies - EMEA - Wood Mackenzie, told Zawya Projects.

She said that this strategic move aims to strengthen their position against the economic and political ramifications of tightening global climate policies in the long run.

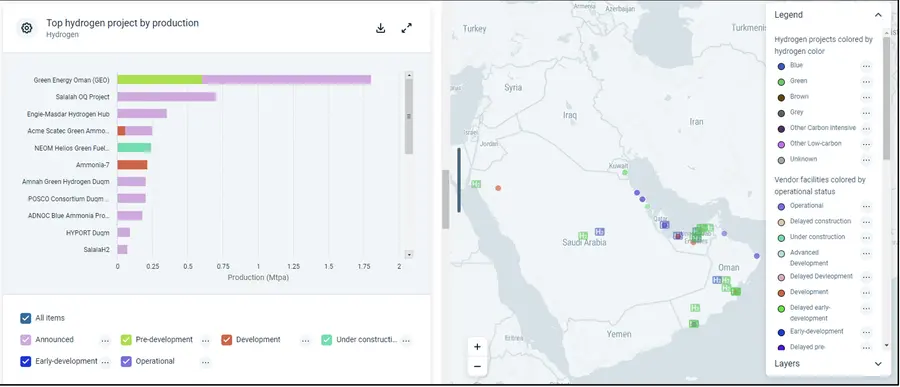

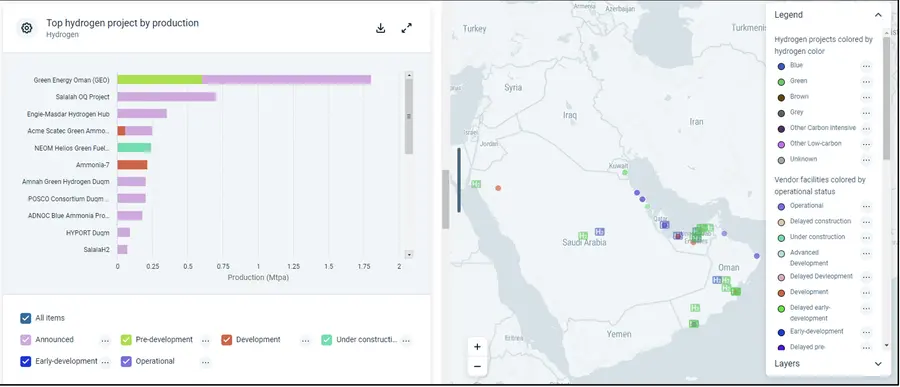

The mega NEOM hydrogen project currently places Saudi Arabia at the forefront of the green hydrogen industry. However, Oman's focus on green hydrogen is expected to pay off post-2030 with a significant production capacity ramp-up.

In addition to capitalising on global opportunities, developing a robust hydrogen supply chain will be crucial to the GCC's success since most projects are geared toward export markets.

"The GCC benefits from existing infrastructure from ports and methanol and ammonia plants, which provide an excellent platform," Mourey stated.

Below are the excerpts from the interview.

How would you characterise the state of development in the GCC regarding green hydrogen?

The GCC region has displayed its capability to move ahead with green hydrogen projects and attract foreign investments, despite a limited regulatory framework or incentives such as the ones formulated in the US (IRA) or Europe (Repower EU).

The attractiveness of GCC countries for green hydrogen projects stems from strong political will and the fact that these countries, located between the two main demand markets of the EU and Asia, are endowed with substantial renewable energy potential.

Land availability and port infrastructures with Special Economic Zones (SEZ) add to these natural assets. Access to water for the electrolysis process is a potential limitation, but the additional energy for water desalination is marginal compared to the overall cost of hydrogen production. Research and development on direct electrolysis from seawater will surely progress in the following decades in parallel to project developments.

Oman, the UAE and Saudi Arabia have led the way in green hydrogen by setting up hydrogen alliances (like Hy-Fly in Oman), MoUs and government-to-government engagements.

Recent milestones include: the first green hydrogen bidding round of the region, successfully orchestrated by Hydrom in Oman, the signature of a strategic collaboration agreement between John Cockerill Hydrogen, Strata manufacturing and ADNOC to manufacture electrolysers in the UAE and NEOM's multibillion-dollar green hydrogen project taking a final investment decision.

A common characteristic of the development path of the green hydrogen projects in the GCC is that the 20–100-megawatt (MW) scale stage is absent, as most projects aim to target the export market with GW scale projects. This is similar to Australia's ambition but quite different from Europe, where the average project size is just below 200 MWe, primarily aimed at local decarbonisation of industries such as refining, ammonia and the maritime sector.

Our LENS Hydrogen platform provides a good overview of the future production capacity per country. While the NEOM project will allow Saudi Arabia to take the lead in the short term, Oman's focus on green hydrogen is expected to pay off post-2030 with a significant production capacity ramp-up.

How well-equipped is the GCC in terms of supply chain infrastructure to export green hydrogen to distant markets?

Developing the hydrogen supply chain is a cornerstone to the success of the GCC, given that bulk of projects are export-oriented. The GCC benefits from existing infrastructure in terms of ports and methanol and ammonia plants. Countries like the UAE and Oman are well-positioned to extend their existing infrastructure to become green fuel bunkering hubs.

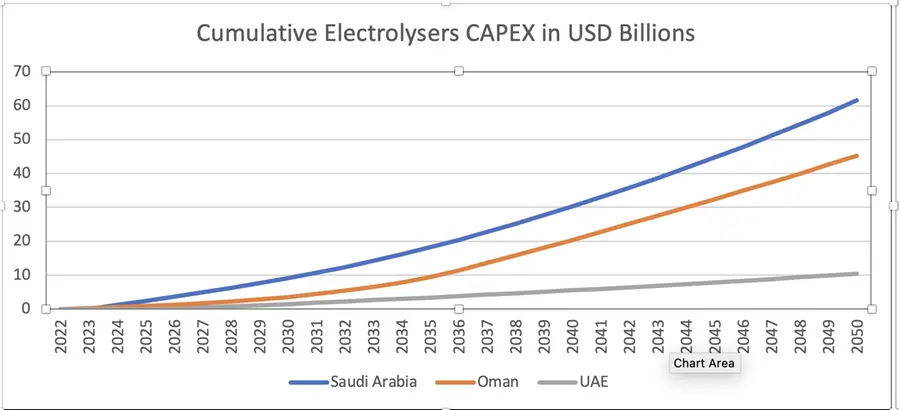

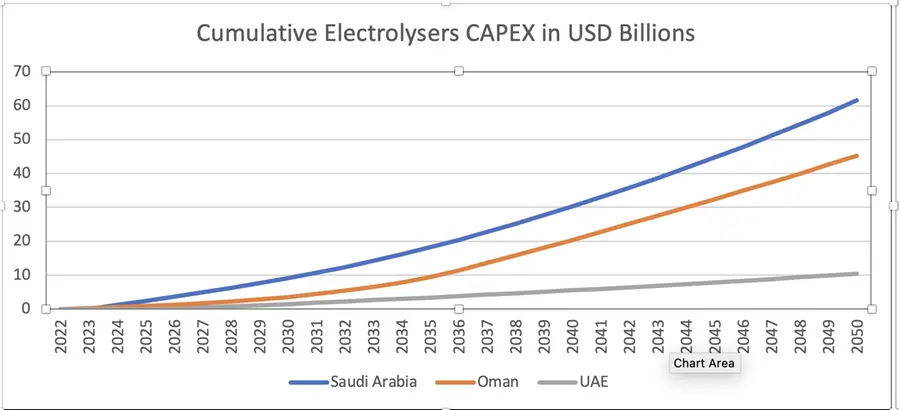

Looking holistically at the green hydrogen supply chain is complex, and having a robust masterplan is required to ensure all the pieces fall at the right place at the right time. Through the strategic collaboration agreement to manufacture electrolysers locally, the UAE is securing a strategic element of the green hydrogen supply chain, which is another example of how the GCC countries are looking to materialise their green hydrogen plans.

What challenges do GCC countries face in launching and scaling green hydrogen projects?

The challenges are similar to other regions, such as securing offtake agreements, getting finance and developing the infrastructure. However, three elements stand out:

Lack of carbon price/support incentives such as in the US or EU to develop local market demand: Addressing local demand allows project stakeholders to gain experience/the development of the supply chain and therefore support the de-risking of the scale-up.

Export-oriented projects: Giga-scale projects are necessary to reduce unit costs to ensure future competitiveness with the local supply of targeted markets, but they require large CAPEX investments for which financiers are asking to see signed offtake agreements. Managing the price risk in a market that has not fully materialised yet is not easy.

The difficulty in securing large offtake agreements: This is getting tougher due to the competition of blue hydrogen projects benefiting from the 45Q in the US. Blue hydrogen projects have the advantage of not relying on the cost-down curve of electrolysers technology and, therefore, can ramp up faster, but will be reliant on the effectiveness of CO2 capture and storage technologies.

Do you expect collaboration on regulations and infrastructure among the GCC countries?

Collaboration on regulation would make a lot of sense. Common standards and certification schemes would allow the region to gain overall influence on a global scale.

Combined with shared infrastructure such as pipelines and storage, either for GCC intra-trade to support individual countries' decarbonisation efforts or to deliver to key export markets, such as Europe, would undoubtedly boost the region's overall competitiveness by reducing costs and allowing for more supply flexibility.

What are your views on how green hydrogen will be priced in the GCC? Is there competition brewing between the GCC countries?

Forecasting the price for a product whose market materialisation is still distant is quite difficult. In the short term, it will boil down to the willingness to pay by a handful off-takers who are required to decarbonise by law and have the capacity to pass to their end customers the extra costs while contributing to their decarbonisation objectives.

With scale and technology evolution, production costs of green hydrogen will align with the hydrocarbon-sourced one, which in turn are likely to be increasingly hit by some kind of energy transition-related carbon tax.

For all these reasons, the price of green hydrogen will most likely be set by regions outside the GCC. Key demand markets such as Europe and Asia, driven by decarbonisation targets policies, supportive mechanisms such as contracts for differences and regulations such as the Carbon Border Adjustment Mechanism (CBAM), will play a fundamental role in setting the market price of green hydrogen.

However, one could also imagine a local price of hydrogen below the international market price to support the competitiveness of their exporting industries (for example, steel/aluminium/ammonia etc.) to markets that will have set carbon intensity threshold related tax (for example, CBAM).

Saudi Arabia, the UAE and Oman have ambitious low-carbon hydrogen plans. In October 2021, Saudi Arabia's energy minister announced the goal of becoming the world's largest hydrogen producer. A formalised hydrogen strategy has yet to be released, but blue and green hydrogen are being considered.

The UAE has just announced the validation of its national hydrogen strategy, but details are not available outside key objectives of producing 1.4 Mtpa of hydrogen by 2031 out of two "hydrogen oases" with the aim to produce 15 Mtpa by 2050 with three more.

Decarbonising local demand is an essential element in developing a hydrogen ecosystem aimed at driving economic growth and job creation. The UAE hydrogen roadmap plans to capture 25 percent of the global low-carbon hydrogen trade. Oman's commitment to be a key player in green hydrogen is reflected by its target to produce at least one million tons of renewable hydrogen annually by 2030, up to 3.75 million tonnes by 2040, and up to 8.5 million tonnes by 2050.

Wood Mackenzie base case Energy Transition Outlook forecasts a global demand of 15Mtpa of low carbon hydrogen by 2030 (including all end-use derivatives such as ammonia and methanol), which means that the targets set by the GCC front-runner countries might look ambitious but realistic taken into account their development stage.

The first mover advantage in securing commercial trade routes with demand centres, technology partnerships and developing the required export infrastructure will likely pay off in the following decades as these three dimensions echo the Middle East's competitive advantage from a track record perspective.

Do you foresee green hydrogen reducing GCC countries' heavy reliance on hydrocarbons?

In our base case Energy Transition Outlook, we foresee the share of fossil fuels going from 80 percent today to 66 percent of the total primary energy demand by 2050. This means that the world will continue to be dependent on hydrocarbons. As advantaged producers (i.e., Middle East producers are on the lower end of the global supply curve), volumes supplied by the GCC countries are not likely to reduce.

Gulf states with sufficient oil and gas reserves will continue to enjoy significant oil and gas revenues, a share of which they can dedicate to ensure they remain on the winning side of the energy transition opportunities.

To summarise, by developing their green hydrogen sectors, GCC countries will create additional sources of revenues in the short to medium term while edging their position against the economic and political ramifications of tightening global climate policies in the long run.

(Reporting by P Deol; Editing by Anoop Menon)