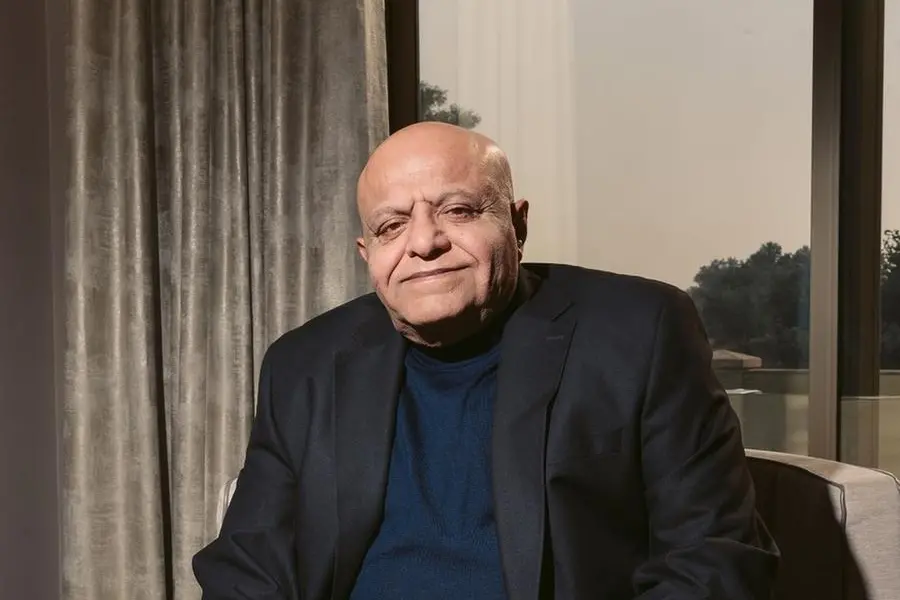

PHOTO

Dubai-based Kamdar Developments is exploring opportunities in the GCC real estate market, particularly Saudi Arabia, as it continues to prioritise high-end residential projects.

“We closely monitor progress in Saudi Arabia, particularly with the enormous potential of Vision 2030 and the Kingdom’s gigaprojects,” Founder and Chairman Yousuf Kamdar told Zawya Projects.

He added that the private developer is open to forming joint ventures and partnerships with Saudi companies.

Construction is progressing as planned on the 105 Residences project in Jumeirah Village Circle (JVC), with completion expected in the first quarter of 2027, Kamdar said.

Interview excerpts:

What market factors compelled you to launch 105 Residences in Jumeirah Village Circle (JVC)?

As a business, we have been investing in the UAE for 40 years. We have seen the incredible rise of Dubai, particularly driven by visionary leadership and welcoming policies that attract businesses and investment.

Demand to live and work in Dubai has only risen in recent years, with safety and quality of life driving an influx of new residents.

In line with our ambitions for the company, we want to strategically acquire assets in locations that show good market fundamentals. As a whole, Dubai ticks virtually every box.

Looking at JVC specifically, it is a good location with a growing community, with attractive options for residents. There is an increasing number of dining, shopping, entertainment, leisure, and lifestyle destinations emerging, which is driving both investors and end-users to seek well-constructed and well-managed properties.

Who is the project’s architect? What is its USP in terms of design?

The project’s design and architecture were done by Arec. The main USP of the project can be summarised as “attainable luxury” – a place that has all the finish quality of a premium property at an affordable price point. We have carefully considered what people require – from wellness and fitness areas to relaxation zones and functional amenities.

What process did you follow to appoint Luxedesign as the contractor? When do you intend to deliver/hand over the project?

Luxedesign (LDV) is managing all stages of construction along with Arec. Fundamentally, we believe in delivering projects on time. It’s an important part of building long-term trust. 105 Residences is currently on track and targeting a first quarter of 2027 delivery and handover.

When did you acquire the land for the project? Are you now seeing an increase in land prices in JVC?

Firstly, there has been an uplift in the underlying value of the project. We acquired ownership of the land in 2023 and have carefully planned its development.

What is the total cost of the project? How do you intend to fund the project?

105 Residences is fully funded by us. We do not require third-party investment to complete the project.

What will be the sustainable elements of the project?

Sustainability is a very important aspect of our projects. Eco-friendly materials that meet green building standards and energy-efficient HVAC systems tie in with Nakheel’s (master developer) framework for JVC. Wherever possible, we will also work with local suppliers, knowing that transport and logistics incur a carbon cost. The design and positioning of the building have also been considered to maximise natural light balanced with solar reflective materials that lower heat absorption – in effect, reducing interior lighting and cooling costs.

Have you seen tender prices rise due to the UAE’s booming real estate sector?

Tender prices have increased across the board. Specifically, costs for suppliers and contractors for in-demand elements, such as MEP and the provision of structural materials, have risen. We try to mitigate this by leveraging long-term relationships and utilising decades worth of market knowledge.

Are you seeing an increase in construction costs in Dubai? Are you concerned about it?

There has been an increase in construction costs, as well as volatility in pricing, due to regional and international supply chain disruptions.

There are various aspects to managing this, including locking in fixed pricing for materials, shifting elements of projects forward or backward dependent on requirements, sensible budgeting and forecasting that includes contingency pricing, cost tracking to quickly identify any potential areas of overspending before it becomes an issue, and streamlined construction processes that minimise construction waste.

From our perspective, our projects across JVC, Meydan, Jumeirah Golf Estates and Dubai Hills continue at full speed.

What are the biggest challenges you see in the coming years and how are you planning to overcome them?

The biggest concern at present is the escalation of hostilities in the region, which could impact the supply chain. There’s also been some discussion of a market price correction – but our take on this is quite simple: is Dubai a popular place to live, and do we see that changing any time soon? The answer is a resounding yes: Dubai is the most popular place to live in the entire Middle East, and no, its popularity isn’t going to diminish now or in the next hundred years. So, even if there are small cyclical dips, the overall trajectory and potential for capital appreciation in Dubai is upwards.

How extensive is your project portfolio in the UAE?

We are currently developing our flagship 105 Residences and multiple villa developments in Meydan, Jumeirah Golf Estates, and Dubai Hills. This includes a combination of public and private projects; therefore, we cannot disclose the overall development value of the portfolio. In addition to the UAE, the business continues to operate across the Middle East, Europe, and Africa, managing our existing property portfolio and a pipeline of developments.

How much land bank do you own in the UAE?

We have a substantial land bank in the UAE. We have long-held ambitions to diversify the portfolio to other emirates – we are actively evaluating opportunities across Abu Dhabi, Sharjah and Ras Al Khaimah as part of our expansion strategy.

Are there plans to enter other markets in the Middle East?

Currently, our focus remains on the UAE; however, other GCC markets are also of interest to us. Given our focus on the luxury development segment, we closely monitor progress in Saudi Arabia, particularly with the enormous potential of Vision 2030 and the Kingdom’s gigaprojects. We remain open to joint ventures and partnerships with local Saudi businesses seeking an agile developer.

What is your outlook on the real estate market in the UAE, particularly Dubai’s off-plan market, for 2025 and 2026?

For the most part, we will see continued momentum driven by investment. The population in the UAE continues to grow, driving demand for real estate. Overall, pricing trends are difficult to neatly categorise into one box, as the market is more nuanced. However, developments that are well-located, offer excellent amenities, and have accessible price points will be popular – we certainly see 105 Residences meeting these criteria.

(Reporting by P Deol; Editing by Anoop Menon)

Subscribe to our Projects' PULSE newsletter that brings you trustworthy news, updates and insights on project activities, developments, and partnerships across sectors in the Middle East and Africa.