PHOTO

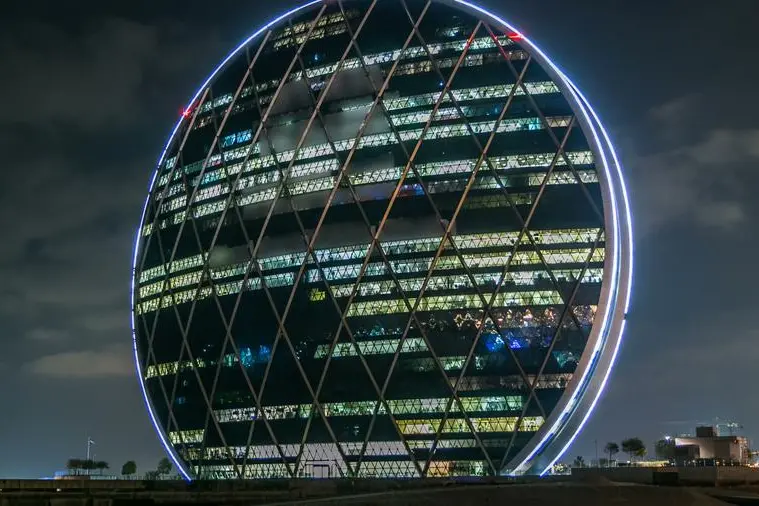

The UAE’s Aldar Properties PJSC has priced its $1 billion USD denominated hybrid notes offering at 5.875%, narrowed from initial price thoughts (IPTs) in the 6.375% area on robust investor demand.

The issuance carries a 5.95% yield and a re-offer price of 99.574.

Books peaked to $3 billion (excluding JLM interest), before settling at $2.9 billion.

The notes are direct, unsecured, and subordinated obligations, ranking ahead only of share capital and deeply subordinated instruments.

The issuance will be listed on the Global Exchange Market of Euronext Dublin, followed by the Abu Dhabi Securities Exchange (ADX).

(Writing by Brinda Darasha; editing by Bindu Rai)