PHOTO

With China being the world’s largest bilateral creditor, it has a critical role in addressing post-COVID debt distress challenges in emerging economies, especially in the Global South.

It is also the biggest lender in 68 countries (of which 57 are BRI partners) eligible for the Debt Service Suspension Initiative (DSSI), which was started by the G20 to help countries concentrate their resources on fighting COVID-19 and safeguarding lives and livelihoods.

Besides DSSI, China has participated in various multilateral debt relief initiatives over the past years.

To better understand the evolving role of China in overseas sovereign debt, a recent academic study, co-authored by Dr Christoph Nedopil Wang, Associate Professor of Practice and Director at the Green Finance & Development Centre, FISF Fudan University in Shanghai, looked at 19 Chinese sovereign overseas development funds that were established between 2007 and 2017.

In an exclusive interview with Zawya Projects, Dr Wang dwelled on BRI investment cooperation funds and their potential for financing sustainable development while touching upon the lack of transparency of most funds on environmental policies and practices.

Dr Wang, who is also a visiting faculty at Singapore Management University, discussed new investment opportunities in energy transition and climate resilience while flagging the need to carefully evaluate risk exposure in a global economy of interrelated risks. He highlighted that regulatory authorities in China are encouraging financial institutions to adopt international environmental standards, but developers continue to engage in fossil fuels due to perceived lower risks.

Here are the excerpts:

What are the various types of Chinese sovereign-backed overseas development funds?

In an academic study published in March 2023, we have identified and analysed 19 funds established between 2007 and 2017 with an announced capital of between $500 million and $54.5 billion. Included among the funds officially set up by China are the Silk Road Fund, China-ASEAN Investment Cooperation Fund, China-Africa Development Fund, China-Latin America and the Caribbean Cooperation Fund, and China-Kazakhstan Capacity Cooperation Fund.

Can you give an overview of some of these funds and their approach to sustainable development?

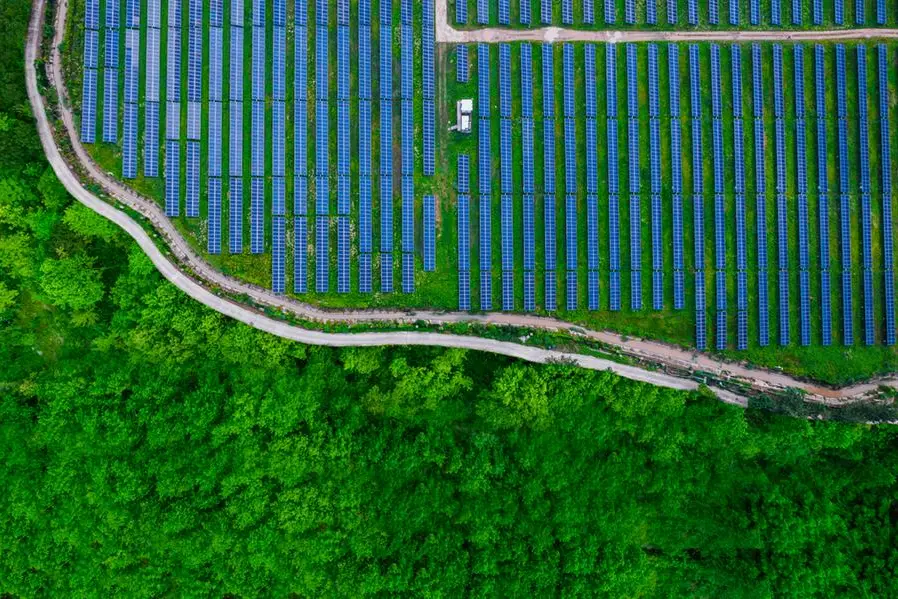

Chinese state-backed development funds have a crucial role in financing sustainable development, for example, in renewable energy investments or in recapitalising BRI countries’ incumbent energy companies, which is necessary to support these companies’ financial profiles.

BRI investment cooperation funds provide financing support for project investment and construction, equity investment and acquisition, and mergers and acquisitions. These funds play a unique role in promoting the development of green projects along the Belt and Road. They have allowed enterprises to invest and build projects overseas, especially in specific regions of the BRI. These funds have the advantage of long-term and large-capital financing as equity investors and developmental financiers in potentially higher-risk projects.

In the context of China’s promise to green overseas cooperation, do you discern any shift in China’s overseas energy investments from fossil fuels and its rationalisation?

In 2021, China’s official policy moved from a ‘host country principle’ to an international best practice principle through guidelines issued by various ministries and regulators.

This means Chinese companies engaging in overseas projects are encouraged to apply international environmental standards when developing and implementing projects in countries with insufficient environmental governance.

Similarly, the Chinese Banking and Insurance Regulatory Commission (CBIRC) issued guidelines encouraging Chinese financial institutions to apply international environmental standards when engaging in overseas projects in less developed countries.

How is the shift to international best practice principles playing out on the ground?

The change from the ‘host country principle’ to international best practice has continued since 2010. However, Chinese developers and financial institutions are still engaging in fossil fuel-related projects, particularly the exploration and transmission of fossil fuels, due to the relatively low-risk profile of these projects.

How would you place Chinese development funds in terms of transparency on sustainability criteria?

Chinese development funds often adopt the environmental standards of their most important funder, such as the China Development Bank. Some funds, such as the China-ASEAN Investment Cooperation Fund, have developed and published their sustainable policies.

In a study published in May 2023, supported by Chinese government institutions, we recommended funds to improve the integration of ESG standards and transparency and expand non-financial disclosure to better align with the Paris Agreement objectives.

Overall, in our comprehensive analysis of publicly available data on these funds, we find that most funds need more transparency about their environmental policies and practices, safeguards are often absent, project pipelines are often undisclosed, and sustainability performance is rarely assessed.

With global recession looming and low-income countries hit by the long-drawn Ukraine war and COVID-19, what will be the scale of risk for Chinese lenders?

New investment opportunities in energy transition and climate resilience provide important investment opportunities. But, like all lenders, Chinese lenders must carefully evaluate their risk exposures in domestic and international markets. The complexity of interrelated risks is a growing concern for the global economy, with inflationary pressures in some countries and high unemployment in others. Climate risks and corruption are further undermining investor appetite. Investors will seek strong policy support to ensure that investments are bankable.

How much debt to China has accumulated in low and middle-income countries?

China held about $104 billion of official bilateral debt in the 68 DSSI countries for which data are available in 2021. This is about $6 billion less than in 2020. In 2023, $10.8 billion of debt service (18 percent of the total debt service) from these countries will be paid to China, which compares to $8 billion to bondholders.

(Reporting by Syed Ameen Kader; Editing by Anoop Menon)