PHOTO

- Al-Sager ranked among the top 10 CEOs in the GCC Banking Sector

- The award honors the most successful and innovative CEOs of GCC listed companies

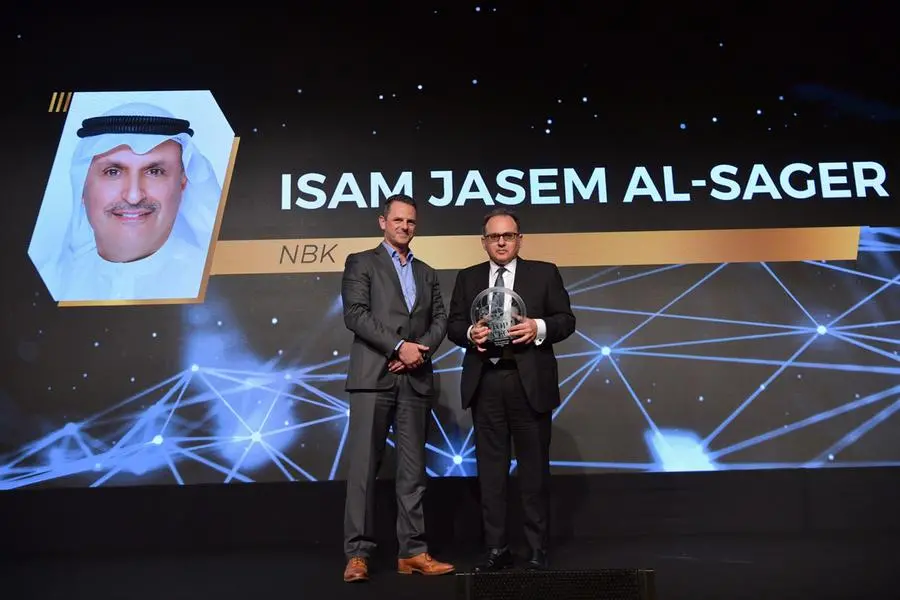

Mr. Isam Jasem A. Al-Sager, Vice Chairman and Group Chief Executive Officer of the National Bank of Kuwait, was named the Top CEO in the Banking industry in Kuwait and among the top 10 CEOs of the GCC Banking Sector. The “Top CEO” Awards Ceremony 2022 honored the most successful and innovative CEOs of listed companies on the seven GCC stock markets.

The award was announced on the sidelines of the "Top CEOs Conference and Awards", which returned in its sixth edition in the UAE on May 17-18, 2022. The prestigious event was attended by senior entrepreneurs and industry leaders in the Arab region, including CEOs and senior government officials, as well as regional and international experts.

GCC-listed companies are evaluated based on their financial performance, size, and adherence to corporate governance standards in accordance with Dubai based Hawkamah Institute’s guidelines.

Al-Sager was named “Top CEO” in the Kuwaiti banking sector and among the top 10 CEOs in the GCC banking sector, based on certain factors including growth, profitability, and corporate governance. Moreover, Hawkamah Institute has provided corporate governance guidelines developed by the Top CEO in partnership with INSEAD Business School and KPMG audited the Top CEO ranking for the 2022 awards.

The event was a celebration of the Top 10 CEOs in ten different sectors in the GCC, who effectively achieved significant growth and profitability for their companies and demonstrated their commitment to corporate governance last year. The conference organizers amplified that the GCC companies successfully managed to achieve significant growth in the aftermath of the global financial crises, and that would not have been possible without the key role played by the innovative and resilient CEOs.

Extensive Banking Expertise

Mr. Al-Sager enjoys extensive professional expertise with over 45 years in banking experience. He played a major role in turning NBK into a leading regional institution with a wide international presence.

He is the Vice Chairman and Group CEO. He is also Chairman or member of various management Committees. Mr. Al-Sager is the Chairman of the Board of NBK (International) PLC and serves on the Board of Directors of Watani Wealth Management (KSA). Mr Al-Sager is a Board member of MasterCard. He was the Chairman of National Bank of Kuwait – Egypt until May 2019 and a Board member of Turkish Bank, Watani Holding, NBK Trustees (Jersey) Limited.

Mr. Al-Sager holds a Bachelor of Science Degree in Business Administration from California State Polytechnic University, USA.

For more information on the Top CEO Awards 2022 organized by Trends - The International Media on Arab Affairs (published by Mediaquest) and in partnership with INSEAD, please visit their website:

-Ended-

About NBK:

The National Bank of Kuwait was established in 1952 as the first national bank and the first joint stock company in Kuwait and the Arab Gulf region. The National Bank of Kuwait achieved profits of $1.2 billion (KD 362.2 million) in 2021, while the Bank’s total assets reached $109.9 billion (KD 33.3 billion) by the end of 2021, and total shareholders’ equity reached $11.0 billion (3.3 billion Kuwaiti dinars).

The National Bank of Kuwait is the largest financial institution in Kuwait and has actual predominance in the commercial banking sector. NBK maintained the highest credit ratings among all banks in the region, according to the agreement of the well-known global ratings agencies: Moody's, Standard & Poor's and Fitch. NBK is also distinguished in terms of its local and global network, which extends to include branches and associate and affiliated companies in China, Geneva, London, Paris, New York, and Singapore, in addition to its regional presence in Lebanon, Egypt, Bahrain, Saudi Arabia, Iraq, and the UAE.

NBK Long-Term Rating

- Moody's Credit Rating: A1

- Fitch Ratings: A+

- Standard & Poor's Rating: A