PHOTO

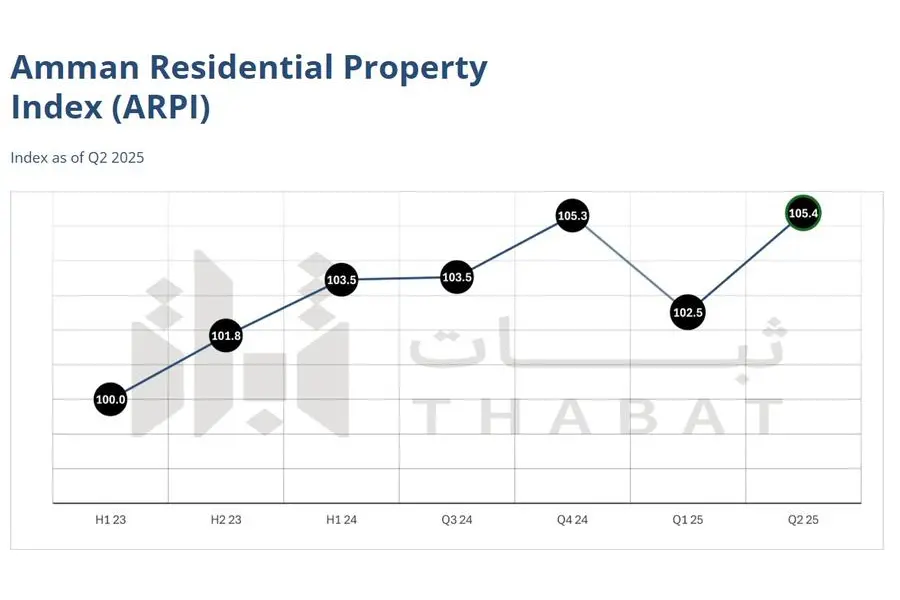

Amman, Jordan – Thabat, a Jordanian private shareholder company owned by seven of the region’s leading banks, has officially launched the Amman Residential Property Index (ARPI), the first of its kind in Jordan to measure and track the performance of Amman’s residential real estate market. This innovative index is designed to serve as a national reference point for banks, developers, policymakers, and prospective homebuyers, promoting transparency and informed decision-making across the sector.

Internationally Benchmarked Methodology

The ARPI represents a major step forward in strengthening Jordan’s economic infrastructure by introducing a tool that aligns with internationally recognised best practices. It is built on a hedonic property index framework consistent with the Handbook on Residential Property Prices Indices (RPPIs), 2013 edition by Eurostat, ensuring methodological robustness and comparability with global standards. The construction of the index accounts for detailed property characteristics such as age, size, location, neighbourhood, and floor level. This sophisticated approach ensures that the ARPI reflects true market value movements rather than simple averages, providing a more precise and reliable measure of housing price trends.

Applications Across the Market

Beyond serving as a trusted reference, the ARPI has broad and practical applications:

- Banks and Regulators: A benchmark for lending, risk assessment, and portfolio management.

- Developers and Investors: A data-driven tool to guide development planning and capital allocation.

- Households and Homebuyers: A transparent, evidence-based resource to support informed decisions in a historically opaque market.

Data Integrity and Transparency

The index is updated quarterly and is publicly accessible at www.arpindex.com, ensuring broad usability and reach. Importantly, the ARPI incorporates anonymous transaction-level data supplied by member banks that provides actual property sales data. This validation is essential for the index, as it ensures that the statistical model is grounded in genuine market activity rather than asking prices or estimates. By basing the index on verified transactions, ARPI enhances its accuracy, reliability, and trustworthiness as a benchmark.

A detailed methodology white paper has also been published, underscoring Thabat’s commitment to fairness, transparency, and market education.

Performance and Global Standing

Performance-wise, the ARPI has demonstrated strong predictive accuracy, matching—and in some cases outperforming—other well-recognised international hedonic house price indices. This reliability positions the ARPI not only as a national benchmark but also as a credible reference point for international institutions comparing regional markets.

Leadership Commentary

Commenting on the index, Haethum Buttikhi, Chairman of Thabat, said, “I believe that by grounding this index in verified transactions, we are offering a resource that will foster trust, improve transparency, and help move Jordan’s property market forward. Our hope is that ARPI not only elevates Jordan’s reputation internationally but also serves as a catalyst for progress in the way our economy measures, understands, and plans for the future.”

Chris Orrell, CEO of Bright Levant and General Manager of Thabat, added, “The Amman Residential Property Index is an important step toward supporting Jordan’s economic development. It offers a practical way to strengthen transparency and build greater trust, providing a useful foundation for the country’s financial and real estate sectors.”

The Amman Residential Property Index is publicly available at arpindex.com

About Thabat

Thabat is a Jordanian private shareholder company owned by seven of the region’s largest banks (Jordan Commercial Bank, Housing Bank, Capital Bank, Jordan Kuwait Bank, Invest Bank, Jordan Ahli Bank, Arab Jordan Investment Bank). Thabat's vision is to become the leading real estate investment, holding, and management company in Jordan, fostering sustainable growth and contributing to the Kingdom’s enduring economic prosperity. The company uses best-in-class asset and risk management techniques, adapted to the local market, and is managed by an independent third-party asset management company called Bright Levant, a company affiliated with Dubai Financial Services Authority (DFSA), a regulated asset manager.