PHOTO

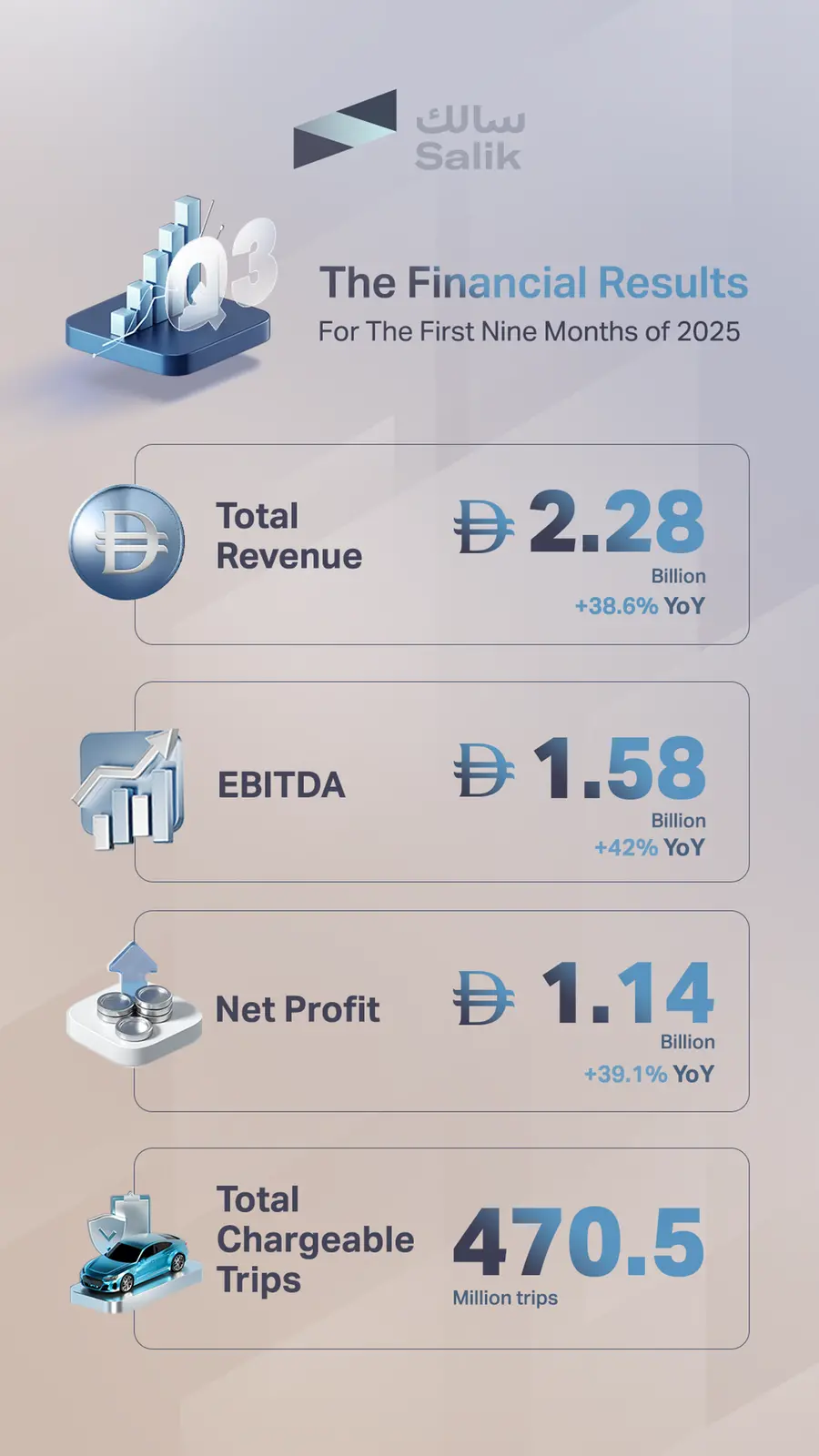

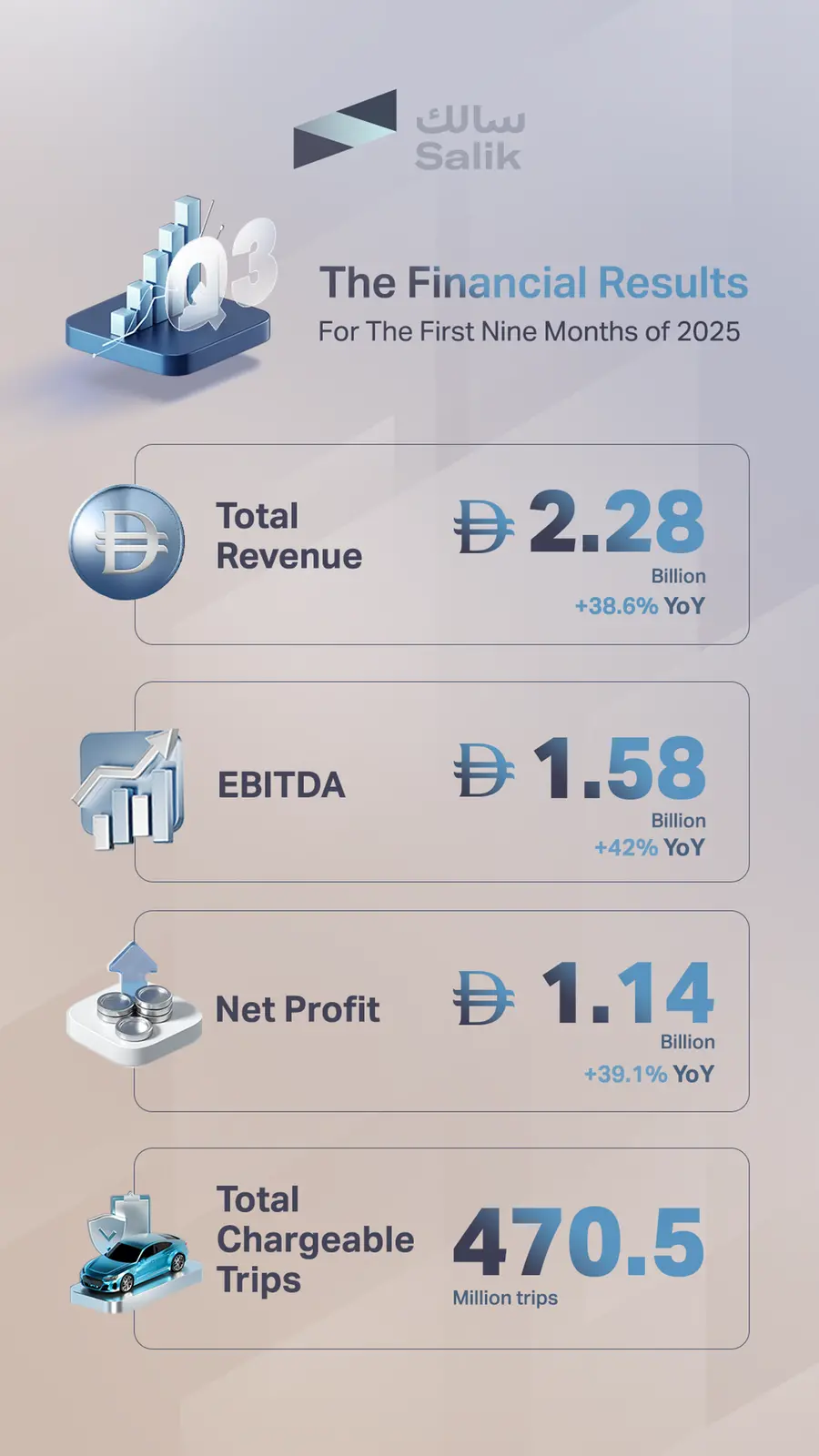

- Net Profit of AED 1.14 billion for the period, up 39.1% YoY and reflecting a 50.3% margin

- Total chargeable trips reached 470.5 million in 9M 2025

Salik Company PJSC (“Salik” or the “Company”), Dubai’s exclusive toll gate operator, today announced its financial results for the three-month and nine-month periods ended September 30, 2025 (“Q3 2025” and “9M 2025”). Total revenue for 9M 2025 increased 38.6% year-on-year (“YoY”) to AED 2,275.0 million, supported by a 36.9% YoY increase in Q3 2025. EBITDA grew 42.0% in 9M 2025 to AED 1,583.7 million, translating to a strong margin of 69.6%. Salik’s strong performance was driven by two new gates introduced in November 2024, the successful implementation of variable pricing at the end of January 2025 and a sustained positive macroeconomic backdrop. In Salik’s core tolling business, total chargeable trips reached 470.5 million in 9M 2025, of which 152.2 million were completed in Q3 2025.

His Excellency Mattar Al Tayer, Chairman of the Board of Directors of Salik, said:

“Salik’s performance during the first nine months of 2025 reflects the economic growth witnessed in Dubai and the attractive investment environment that has made the emirate a global model in business sustainability and the competitiveness of vital sectors. It also highlights the strength of our operations and the continued resilience and scalability of our business model. Salik delivered strong top-line momentum, achieving a 39% year-on-year increase in total revenue, supported by continued growth in traffic volumes and the early benefits of variable pricing implemented earlier in January, alongside significant ancillary revenue growth.

He added: This performance embodies the success of our strategy, which combines operational excellence with disciplined execution and innovation across the mobility ecosystem, as well as the success of our operational and financial plans in enhancing the efficiency of the smart mobility ecosystem, expanding the scope of its services in a way that contributes to delivering sustainable value for our shareholders while supporting Dubai's vision to build a diversified and sustainable economy."

His Excellency Mattar Al Tayer affirmed that Salik also continues to benefit from Dubai’s robust economic backdrop, supported by key factors, namely steady growth in population, tourism and real estate sector activity, and intensive and well-planned infrastructure investment, reiterating Salik’s commitment to developing its digital infrastructure and investing in smart solutions, in line with Dubai’s ambition to become a global leader in smart, sustainable mobility.

Ibrahim Sultan Al Haddad, Chief Executive Officer of Salik, commented:

“Our strong performance in the first nine months of 2025 reflects Salik’s solid growth trajectory and the continued successful execution of our strategy. Total trips increased by approximately 38% YoY and toll usage fees rose by around 42%, supported by the addition of two new gates, the positive impact of variable pricing, and underpinned by Dubai’s strong economic fundamentals, sustained population growth, and healthy tourism inflows. Our core tolling business continues to perform exceptionally well, complemented by steady progress across our strategic initiatives to diversify our revenue streams. Ancillary revenues continue to grow, driven by the success of our digital partnerships in mobility and payment solutions. Collaborations with Emaar Malls, Parkonic, and Liva Group are key contributors to this performance, strengthening Salik’s position as a leading innovator in seamless, smart and sustainable mobility. Through these partnerships, we are expanding across the mobility ecosystem and enhancing convenience and value for our users.

He added: With continued operational excellence, strong cash generation, and a solid balance sheet, we remain confident in Salik’s ability to sustain growth and create long-term value for our shareholders as we expand our footprint and continue to innovate within mobility and other services.”

Performance Review

Core Tolling Business

| Million | Q3 2025 | Q3 2024 | % YoY | Q2 2025 | % QoQ | 9M 2025 | 9M 2024 | % YoY |

| Total trips | 204.2 | 150.5 | 35.6% | 213.4 | -4.3% | 628.4 | 454.4 | 38.3% |

| Total chargeable trips | 152.2 | - | - | 160.4 | -5.1% | 470.5 | - | - |

| Peak trips (AED 6)* | 55.3 | - | - | 57.7 | -4.2% | 152.2 | - | - |

| Off-peak trips (AED 4)* | 80.9 | - | - | 86.3 | -6.3% | 274.7 | - | - |

| Past Midnight trips (AED 0)* | 16.0 | - | - | 16.4 | -2.4% | 43.6 | - | - |

Note: The implementation of variable pricing began on January 31, 2025. Q3 2025 represents the second full quarter since the implementation of variable pricing.

The total number of trips, including discounted trips, made through Salik’s toll gates grew 38.3% YoY in 9M 2025 to record 628.4 million trips, driven by a strong 35.6% YoY growth in trips in Q3 2025 reaching 204.2 million. This growth reflects the impact of the two new gates introduced, along with Dubai’s strong macroeconomic environment, sustained tourism inflows, and continued population growth.

- Total chargeable trips reached 152.2 million in Q3 2025, following the 160.4 million in Q2 2025. This reflects the usual seasonal slowdown following the summer travel period, as Q3 typically records the lowest total number of trips. It is worth noting that the Q3 2025 period represented the second full quarter since implementing the new variable pricing system.

- Toll usage fees: performance remained strong in 9M 2025, increasing 41.5% YoY to AED 2,012.1 million, including a 39.9% YoY increase in Q3 2025 to AED 655.2 million. The increase in toll fees was primarily driven by the impact of two full quarters of the new variable pricing structure introduced at the end of January 2025, alongside additional contribution from the two new gates, partially offset by the seasonal slowdown witnessed in Q3.

- Fines: revenue from fines increased 18.2% YoY to AED 206.7 million in 9M 2025, with fines growing 23.3% YoY to AED 72.4 million in Q3 2025. The number of net violations (accepted minus dismissed violations) grew by 39.9% YoY in Q3 2025, reaching 936,972 and representing 0.7% of net toll traffic, with revenue from fines contributing 9.7% to total revenue in Q3 2025.

- Tag activation fees: increased 15.4% YoY in 9M 2025 reaching AED 34.7 million, supported by a 13.8% YoY increase in Q3 2025 to AED 11.8 million. Tag activation fees contributed 1.6% of total revenue in Q3 2025.

- Total ancillary revenue: reached AED 14.5 million during 9M 2025 driven by revenues from Parking Payment Solutions partnerships with Emaar Malls and Parkonic. Furthermore, the company’s partnership with Liva Group has continued to gain momentum during 9M 2025.

Financial Performance

Solid 9M 2025 performance: total revenue +38.6% year-on-year to AED 2,275.0 million, EBITDA +42.0% year-on-year with a strong 69.6% margin, and a strong balance sheet position.

| AED million | Q3 2025 | Q3 2024 | % YoY | Q2 2025 | % QoQ | 9M 2025 | 9M 2024 | % YoY |

| Revenue | 747.7 | 546.1 | 36.9% | 775.7 | -3.6% | 2,275.0 | 1,640.9 | 38.6% |

| Toll usage fees | 655.2 | 468.4 | 39.9% | 691.3 | -5.2% | 2,012.1 | 1,422.2 | 41.5% |

| Fines | 72.4 | 58.7 | 23.3% | 65.9 | 9.9% | 206.7 | 174.8 | 18.2% |

| Tag activation fees | 11.8 | 10.3 | 13.8% | 11.5 | 2.5% | 34.7 | 30.1 | 15.4% |

| Other revenue | 8.3 | 8.6 | -3.7% | 7.1 | 17.7% | 21.4 | 13.8 | 55.3% |

| EBITDA(1) | 518.7 | 376.7 | 37.7% | 545.3 | -4.9% | 1,583.7 | 1,115.0 | 42.0% |

| EBITDA margin | 69.4% | 69.0% | 0.4% | 70.3% | -0.9% | 69.6% | 68.0% | 1.7% |

| Finance costs, net | (72.7) | (50.5) | 44.0% | (69.3) | 4.8% | (218.3) | (148.2) | 47.3% |

| Profit before tax | 409.8 | 304.7 | 34.5% | 439.8 | -6.8% | 1,256.9 | 903.3 | 39.1% |

| Net Profit for the period | 372.9 | 277.3 | 34.5% | 400.2 | -6.8% | 1,143.8 | 822.0 | 39.1% |

| Earnings per share | 0.050 | 0.037 | 34.5% | 0.053 | -6.8% | 0.153 | 0.110 | 39.1% |

(1) EBITDA is profit for the period, excluding the impact of interest, tax, depreciation and amortization expenses.

Salik generated EBITDA of AED 1,583.7 million in 9M-25, up 42.0% YoY, with Q3-25 EBITDA increasing by 37.7% YoY to reach AED 518.7 million. EBITDA margin stood at 69.6% in 9M-25, a 166 bps YoY increase compared to 68.0% in 9M-24. EBITDA margin was reported at 69.4% in Q3-25, compared to 69.0% in Q3-24, representing a 40 bps expansion YoY.

Salik’s net profit before taxes totaled AED 1,256.9 million in 9M 2025, up 39.1% YoY. Net profit before taxes reached AED 409.8 million in Q3 2025, marking a strong 34.5% YoY increase despite higher finance costs in the period.

Salik generated net profit after taxes of AED 1,143.8 million in 9M 2025, up 39.1% YoY. Net profit after taxes reached AED 372.9 million in Q3 2025, a solid 34.5% YoY increase. Net profit margin expanded by 18 bps to 50.3% in 9M 2025.

Summary of balance sheet: net debt of AED 5,336.7 million, with T12M leverage reported at 2.61x

| AED million | 30-Sep-25 | 30-Jun-25 | % QoQ | 31-Dec-24 | % YTD |

| Total assets, including: | 7,570.3 | 8,077.3 | -6.3% | 7,985.9 | -5.2% |

| Cash and cash equivalents | 425.9 | 380.3 | 12.0% | 963.7 | -55.8% |

| Short term deposit with bank (1) | 254.0 | 756.9 | -66.4% | - | 100.0% |

| Total liabilities, including: | 6,761.2 | 6,838.3 | -1.1% | 6,897.9 | -2.0% |

| Long term borrowings and related party payable liabilities(2) | 6,010.3 | 5,983.3 | 0.5% | 6,154.3 | -2.3% |

| Contract liabilities (3) | 399.1 | 398.4 | 0.2% | 382.3 | 4.4% |

| Total equity | 809.1 | 1,239.0 | -34.7% | 1,088.0 | -25.6% |

| Net debt | 5,336.7 | 4,853.0 | 10.0% | 5,198.6 | 2.7% |

| Net working capital balance (4) | (578.4) | (665.0) | -13.0% | (536.8) | 7.8% |

- Represent Fixed deposit with original maturity of 3 to 12 months. Deposits with maturity less than 3 months are classified as Cash and Cash Equivalents

- Related party payable liability includes liability in relation to the toll operation rights for the two new gates

- Contract liabilities is the sum of current and non-current balances paid in advance by customers relating to recharges and top-ups and tag activation fees

- Net working capital is the balance of inventories plus trade and other receivables plus dues from related parties plus contract assets minus trade and other payables, minus current portion of due to a related party minus current portion of contract liabilities minus current portion of lease liabilities and provision for taxation.

Salik recorded a net working capital balance of AED -578.4 million as of September 30, 2025, equating to 19.1% as a percentage of annualized revenue, compared to 21.8% recorded in H1 2025. The increase in net working capital in the trailing four quarters compared to prior quarters is primarily driven by the semi-annual installments for the toll rights fees relating to the new toll gates. As of September 30, 2025, net debt stood at AED 5,336.7 million, a 10.0% increase from AED 4,853.0 million at the end of Q2 2025. This translates to a trailing twelve-month net debt/EBITDA ratio of 2.61x in Q3 2025, compared to 2.55x at the end of Q2 2025 and well below the Company’s debt covenant of 5.0x.

Summary of cash flow: free cash flow of AED 1,471.5 million, with a margin of 64.7% in 9M 2025.

| AED million | Q3 2025 | Q3 2024 | % YoY | Q2 2025 | % QoQ | 9M 2025 | 9M 2024 | % YoY |

| Net cash flow from operating activities | 359.9 | 370.3 | -2.8% | 485.0 | -25.8% | 1,471.5 | 1,060.6 | 38.7% |

| Net cash (used in) / generated from investing activities | 509.4 | 621.0 | -18.0% | (247.0) | -306.2% | (235.1) | 793.3 | -129.6% |

| Net cash used in financing activities | (823.7) | (607.0) | 35.7% | (898.9) | -8.4% | (1,774.2) | (1,283.5) | 38.2% |

| Free cash flow(1) | 359.8 | 370.3 | -2.8% | 485.0 | -25.8% | 1,471.5 | 1,054.7 | 39.5% |

| Free cash flow margin(2) | 48.1% | 67.8% | -19.7% | 62.5% | -14.4% | 64.7% | 64.3% | 0.4% |

| ||||||||

Salik generated free cash flow of AED 1,471.5 million in 9M 2025, up 39.5% YoY and a free cash flow margin of 64.7%, a 41 bps increase compared to 64.3% in 9M 2024.

Becoming a global leader in smart and sustainable mobility solutions

Core Tolling Business

Implementation of variable pricing: As instructed by the RTA, based on the traffic studies and analysis, Salik implemented variable pricing on January 31, 2025. The variable pricing aims to enhance traffic flow across Dubai’s road networks and improve transportation efficiency across the city.

Ancillary Revenue Streams

- Salik reaffirms its confidence in expanding its ancillary revenue streams over the medium to long-term, building on the strong progress achieved in 2024 and the nine months of 2025. Key initiatives include the collaboration with Emaar Malls, the collaboration with Parkonic to integrate Salik accounts across UAE parking locations, and the continued collaboration with Liva Group to streamline vehicle insurance renewals. These partnerships reinforce Salik’s focus on innovation and enhanced user experience, while driving revenue diversification and supporting the Company’s long-term growth and sustainability.

- Introduction of seamless parking operations at Dubai Mall: this milestone marked Salik’s first barrier-free parking payment solution, in partnership with Emaar Malls Company, across the Fashion, Grand and Cinema parking zones of Dubai Mall, where operations commenced on July 1, 2024.

- Collaboration with Parkonic, one of the largest private parking operators in the UAE: the collaboration aims to enhance parking payment experiences across the UAE by integrating Salik’s advanced e-Wallet system. The five-year partnership will see Parkonic integrate Salik Accounts across all its existing and future locations in the UAE, marking Salik’s first expansion outside the Emirate of Dubai. The partnership is progressing well, with the solution now live across 90 of 177 locations.

- New LIVA motor insurance partnership: Salik partnered with LIVA (formerly RSA), a leading multi-line insurer in the GCC, to offer its customers access to market-leading insurance solutions. The partnership offers one-of-a-kind bespoke insurance solutions to drivers in the UAE, streamlining the renewal process for greater convenience and efficiency. Salik leverages its comprehensive database to provide value-added services to customers by sending timely renewal reminders to mitigate insurance coverage lapses. These notifications include a link directing customers to a LIVA landing page, where the motor insurance policy can be renewed in a few simple steps at a competitive price.

- Collaboration with Schneider Electric and Vcharge to Power Next-Generation EV Charging Network: this collaboration which was entered into at the beginning of November 2025 will enable first of its kind seamless EV charging journey for EV drivers powered by the integration of Salik’s E-Wallet system with Schneider Electric’s EV chargers, thus simplifying payment and on boarding of customers and providing further diversification to the income generated from ancillary revenue streams.

Other Achievements

- International Bridge, Tunnel & Turnpike Association (IBTTA): Salik has joined the International Bridge, Tunnel & Turnpike Association (IBTTA), as announced during the Global Tolling Summit in Lyon, France, marking Salik’s entry into the global tolling community. This move reinforces the Company’s commitment to aligning with international best practices, elevating Dubai’s role as a global hub in smart mobility driving innovation in smart mobility and expanding its strategic reach beyond the UAE.

- Continued investment in human resources: in Q3 2025 Salik expanded its full-time workforce by 13.0% YoY to 52 personnel, representing 8.3% growth as compared to year-end of 2024, with the number of nationalities represented at 12. Salik continues to progress on Emiratization, attaining a level of 30.8% in Q3 2025, with the female-to-workforce ratio at 21.2% at the end of the third quarter.

- Regional and international awards in investor relations: Salik was awarded first place as “Leading Corporate for Investor Relations – Dubai” at the Middle East Investor Relations Association (MEIRA) conference and named “Most Honored Company in Emerging EMEA - Large Corporates” by Extel. Both accolades were based on independent votes from a global community of investors and financial analysts, underscoring Salik’s growing reputation and leadership in investor relations on both regional and international levels.

- Gulf Sustainability Awards: Salik earned top recognition across the GCC at the Gulf Sustainability Awards, winning Overall Winner, Gold for Best Sustainable Business Model, and Silver for Best ESG Initiative. These accolades reinforce Salik’s position as a regional leader in sustainable mobility and ESG excellence, reflecting strong alignment with our long-term strategy and stakeholder value creation.

Business Outlook

FY25 total YoY revenue guidance remains unchanged, expected to grow 34-36%

- Revenue growth: total revenue growth in FY25 is expected to be in the range of 34-36% year-on-year, including the impact of the two new gates introduced in November 2024 and the implementation of variable pricing on January 31, 2025.

- EBITDA margin: is expected to be in the range of 68.5-69.5%.

About Salik Company PJSC

The Company was established in its current form, as a public joint stock company in June 2022 pursuant to Law No. (12) of 2022. “Salik”, which means “seamless mobility” in Arabic, is Dubai’s exclusive toll gate operator and manages the Emirate of Dubai’s automatic toll gates utilizing Radio-Frequency-Identification (RFID) and Automatic-Number-Plate-Recognition (ANPR) technologies. The Company currently operates exclusively all the toll gates located at strategic junctures, especially on Sheikh Zayed Road, which is considered the main road in Dubai. Salik listed on the Dubai Financial Market (DFM) on 29th September 2022. Under a 49-year concession agreement (ending in 2071), with the Roads and Transport Authority (RTA), Salik has the exclusive right to operate existing and any future toll gates in Dubai.

Investor Relations

Wassim El Hayek

Head of Investor Relations

Wassim.Elhayek@salik.ae

Disclaimer

No statement in this document is intended to be nor may be construed as a profit forecast. Any statements made in this document which could be classed as "forward-looking" are based upon various assumptions, including management’s examination of historical operating trends, data contained in the Company’s records, and other data available from third parties. Although the Company believes that these assumptions were reasonable when made, these assumptions are inherently subject to significant risks, uncertainties, and contingencies. Forward-looking statements are not guarantees of future performance. Risks, uncertainties, and contingencies could cause the actual results of operations, financial condition, and liquidity of the Company to differ materially from those results expressed or implied in the document by such forward-looking statements. No representation or warranty is made that any of these forward-looking statements or forecasts will come to pass or that any forecast result will be achieved. No reliance should be placed on any forward-looking statement. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this communication. Furthermore, no representation or warranty is made as to the accuracy, completeness, or reliability of the information contained in this document. The information, statements, and opinions provided herein do not constitute a public offer under any applicable legislation or an offer to sell or solicitation of an offer to buy Salik Shares. In the event of any discrepancy or error in the numbers presented in this document, the information provided in the official financial statements shall prevail. We do not accept any liability for errors or omissions in the information contained herein.