PHOTO

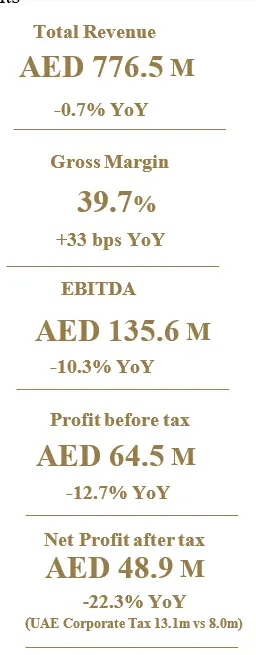

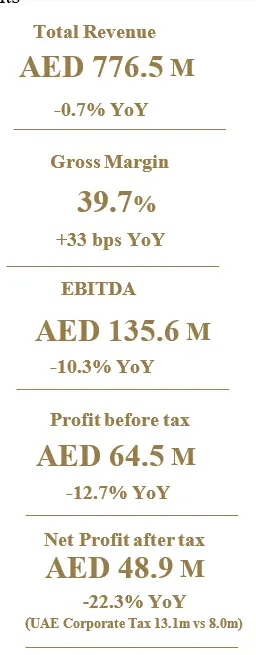

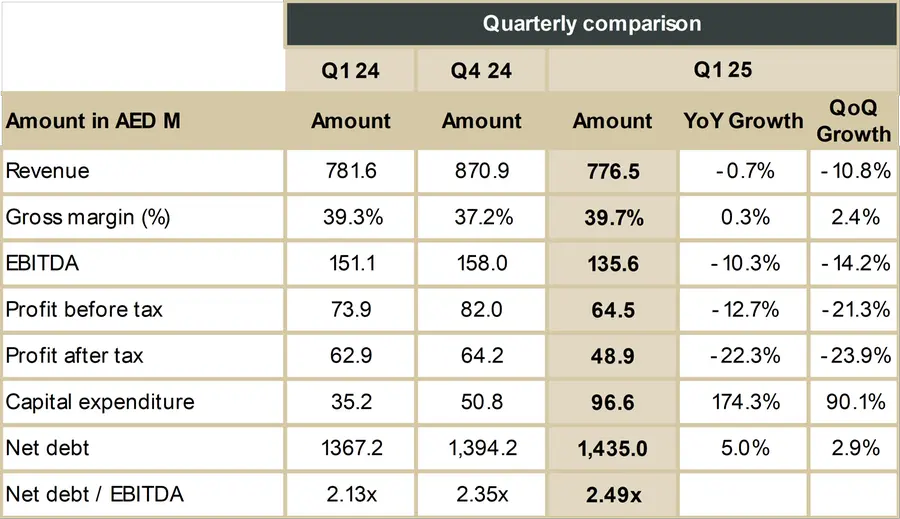

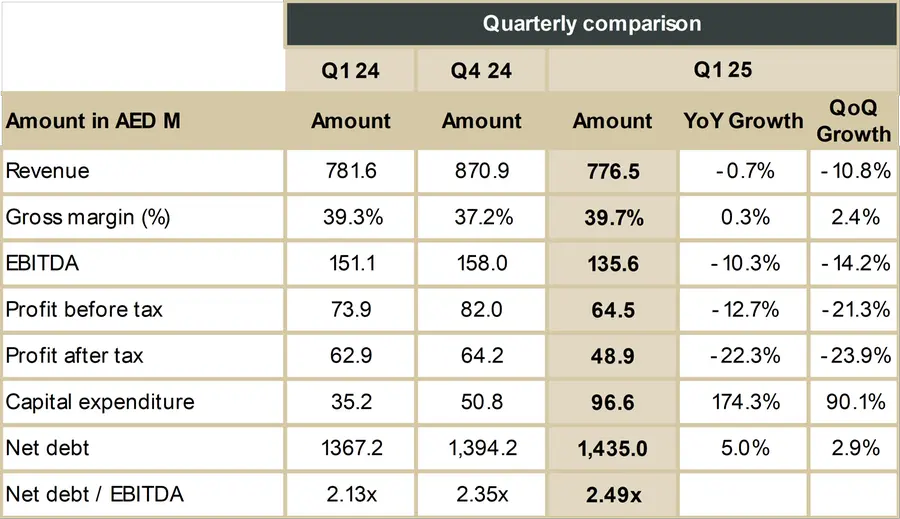

- Group revenue: Experienced a marginal decrease of 0.7% year-on-year (YoY) to AED 776.5 million in Q1 2025, primarily attributable to weaker Euro, BDT & INR vs USD. On currency rates of last year, revenue is higher by 0.7% YoY.

- Gross profit margin: Improvement by 33bps YoY to 39.7% in Q1 2025, up from 39.3% in Q1 2024.

- EBITDA performance: EBITDA decreased by 10.3% YoY in Q1 2025 to AED 135.6 million from AED 151.1 million in Q1 2024.

- Profit before tax: Decreased by 12.7% YoY to AED 64.5 million, compared to AED 73.9 million in Q1 2024. Kludi Group’s transformation initiatives has impacted profitability by AED 8.4 million. Excluding this impact, profit before tax was AED 74.4 million, marginally down by 1.4% YoY.

- Financial health: Net debt position stood at AED 1.43 billion in Q1 2025, registering an increase of AED 40.8 million from December 2024 mainly due to Capex payments.

Ras Al Khaimah, United Arab Emirates: RAK Ceramics PJSC (Ticker: RAKCEC: Abu Dhabi), one of the largest ceramics and porcelain lifestyle solutions provider in the world, today announced its financial results for the first quarter ended 31 March 2025.

Q1 2025 Financial Highlights

Our Q1 2025 performance has shown resilience in the face of macro-economic challenges. During this quarter, total revenue experienced a marginal decrease of 0.7% year-on-year (YoY) to AED 776.5 million. However, calculated on the basis of 2024 currency exchange rates, revenue has increased slightly by 0.7% YoY.

In Q1 2025, the gross profit margin increased by 33bps to 39.7% YoY, driven by enhanced operational efficiencies.

EBITDA decreased to AED 135.6 million in Q1 2025 compared to AED 151.1 million in Q1 2024, while the EBITDA margin decreased by 1.8% to 17.5% in Q1 2025 from 19.3% in Q1 2024.

Profit before tax decreased by 12.7% YoY to AED 64.5 million, compared to AED 73.9 million in Q1 2024. Kludi Group’s transformation initiatives has impacted profitability by AED 8.4 million. Excluding this impact, profit before tax was AED 74.4 million, marginally down by 1.4% YoY.

Net profit after tax decreased by 22.3% YoY to AED 48.9 million, compared to AED 62.9 million in Q1 2024. This decrease is attributable to Kludi Group’s transformation impact and the newly introduced Domestic Minimum Top- up Tax under Globe Pillar-2 rules. Effective tax rate of UAE based entities is at 13.5% up from 9% last year.

`Net debt position stood at AED 1.43 billion in Q1 2025, registering an increase of AED 40.8 million from December 2024 mainly due to capex payments.

Financial highlights

Segmental performance highlights

- Tiles revenue continued to grow in Q1, up 1.2% year-on-year to AED 448.9 million, led by strong performance in the UAE and Indian markets, with an increasing contribution from high-margin project and retail channels.

- Sanitaryware experienced a decline of 6.5% in revenue. However, gross margins improved by 444bps, driven by a favorable shift in product mix.

- Tableware division reported a decline in revenue of 4.5% to AED 85.9 million for Q1 2025, primarily impacted by a weaker Euro and slower demand in US. However, UAE and Middle East market have performed well, driven by new commercial agreement with an airline and expansion of distributors.

- Faucets revenue declined 4.4% to AED 111.7m also due to a weaker Euro, recessionary fears in Europe, and a struggling real estate sector in China.

Tiles & Sanitaryware market highlights

- UAE: Continued to register growth in revenue mainly driven by the Tiles segment, supported by robust real estate and construction activity. Enhanced operational efficiencies in UAE tile plants have driven higher gross margins.

- Saudi Arabia: Demonstrated steady growth in Q1 2025, with revenue up 4.4% to AED 69.1 million, supported by relief in levy of customs duties on exports from the UAE, allowing RAK Ceramics to regain market share lost in the wholesale segment.

- Europe: Revenue has remained resilient in local currency (LCY) resisting recessionary fears and driven by growth in the German market and the Italian market. Overall revenue fell 1.4% to AED 77.0m.

- India: India registered moderate growth with revenue growth of 2.8% in LCY, driven by expansion of the dealer’s network.

- Bangladesh: Experienced a sharp decline in business performance due to ongoing political instability, gas shortage, inflation, and currency devaluation.

Commenting on the results, Abdallah Massaad, Group CEO, RAK Ceramics said:

"In Q1 2025, we faced a highly complex macroeconomic landscape, characterized by geopolitical uncertainties, inflationary pressures, and shifting consumer demand. Despite a minor revenue decline of 0.7%, our gross profit margins improved, on the back of rolling out improvements in operational efficiency.

The UAE continues to be our strongest market with growth driven by robust real estate activity, while our KSA market continues to show encouraging signs, aided by recent customs duty relief measures. We’ve made strategic progress in manufacturing, with our new large-format tile production facility in the UAE currently in the commissioning stage. The facility will be commercially operational by the end of 2025.

The market is volatile. So, looking ahead, we remain committed to our strategic priorities centered on protecting market share, optimizing operations, and expanding production capabilities. By leveraging technology and targeted investments, we aim to enhance resilience and create long-term value for our investors and customers."

Strategic Highlights

Expansion

- In the UAE, continued investment in brand positioning and strategy has allowed us to maintain higher ASPs compared to competition.

- Investing in upgrading Tiles production facilities to produce differentiated and large format Tiles.

- Investing in UAE Sanitaryware production facility to improve efficiency and reduce carbon emissions.

Greenfield projects

- In KSA, continuing to work towards setting up a production facility.

Awards & Recognition

- Strategic participation in ISH 2025 in Frankfurt, showcasing our innovative product designs and technologies to key industry stakeholders and strengthening relationships with stakeholders.

About RAK Ceramics

RAK Ceramics is one of the largest ceramics brands in the world. Specializing in ceramic and grès porcelain wall and floor tiles, tableware, sanitaryware and faucets, the Company has the capacity to produce 118 million square meters of tiles, 5.0 million pieces of sanitaryware, 36 million pieces of porcelain tableware and 2.6 million pieces of faucets per year at its 24 state-of-the-art plants across the United Arab Emirates, India, Bangladesh and Europe.

Founded in 1989 and headquartered in the United Arab Emirates, RAK Ceramics serves clients in more than 150 countries through its network of operational hubs in Europe, Middle East and North Africa, Asia, North and South America and Australia.

RAK Ceramics is a publicly listed company on the Abu Dhabi Securities Exchange in the United Arab Emirates and as a group has an annual turnover of approximately US$1 billion.

Contact Us

If you have any questions or require further information, please do not hesitate to contact our investor relations department.

Investor Relations: RAK Ceramics PJSC

Sarang Dublish

E. ir@rakceramics.com | corporate.rakceramics.com

For media enquiries please contact:

Kekst CNC (Financial communications advisor)

Gregor Riemann

E. gregor.riemann@kekstcnc.com

Tan Siddique

E. tan.siddique@kekstcnc.com